Starting with last Monday, the divergence between the Dow Jones Industrial Average (NYSEARCA: SPY) and the Russell 2000 (NYSEARCA: IWM) became a hot topic.

All throughout the week, rates and the dollar rose along with oil.

The Dow Jones Industrial Average made a new high, but did so all alone.

The phases in many important sectors deteriorated.

The market breadth weakened enough to cause a substantial sell-off by Friday.

Let’s review the levels on key sector and index ETFs before we dig deeper:

S&P 500 (SPY) – 287.57 the very pivotal 50 DMA

Russell 2000 (IWM) – 160.95 is the 200 DMA this popped up from. But, unless it can clear back over 164.07 on a closing basis, it will be a temporary hold

Dow (DIA) – 259.50 is the underlying 50-DMA support. Best I can say right now

Nasdaq (QQQ) – Unconfirmed warning phase. So if this did indeed put in a double top, next week will close under 179.50

Regional Banks (KRE) – 58.25 support Unconfirmed bearish phase

Semiconductors (SMH) – Closed below the 50 WMA-now if it cannot get back over 104.40-look at SOXS

Transportation (IYT) – Confirmed warning phase-202 first line to clear if this is to recover

Biotechnology (IBB) – 115 support, then 112. 118 now resistance

Retail (XRT) – 47.70 the 200 DMA held thus far

The Semiconductors ETF closed under the 50-week moving average for the first time since November 2016.

Nevertheless, buyers did come in at the end of the session to lift the indices and sectors off their intraday lows.

Making money until this past week has been easy.

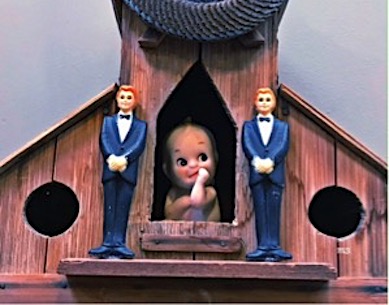

Protective corporate suits have guarded the baby in the birdhouse, making even the least experience traders look smart.

Until this week, corporate buybacks were a big part of the sustained rally.

Will they show up again?

Amazing how technical the market can be.

Not only were we prepared for the obvious sell off, the Russell 2000 found support at its 200-daily moving average.

NASDAQ found support at its 100 DMA.

The S&P 500 found support at its 50 DMA and marginally held the bullish phase.

The Dow did not even come close to testing its 50 DMA.

Furthermore, I projected that the TLTs would find support at 112. The low was 112.62.

I also wrote that the dollar has resistance at 25.45. UUP, the dollar bull ETF settled at 25.41.

I now see the overall equities picture as mixed.

Though, no doubt damage was done.

If I were that baby in the birdhouse, I would not count on those suits to protect me.

Rather, I would keep watch of the dollar and the rates.

In particular, should the dollar soften, what I have patiently waited for could finally shift.

Commodities-that historically low ratio between equities and commodities-might finally knock the suits down.

If so, the baby better grow up independently and fast!

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.