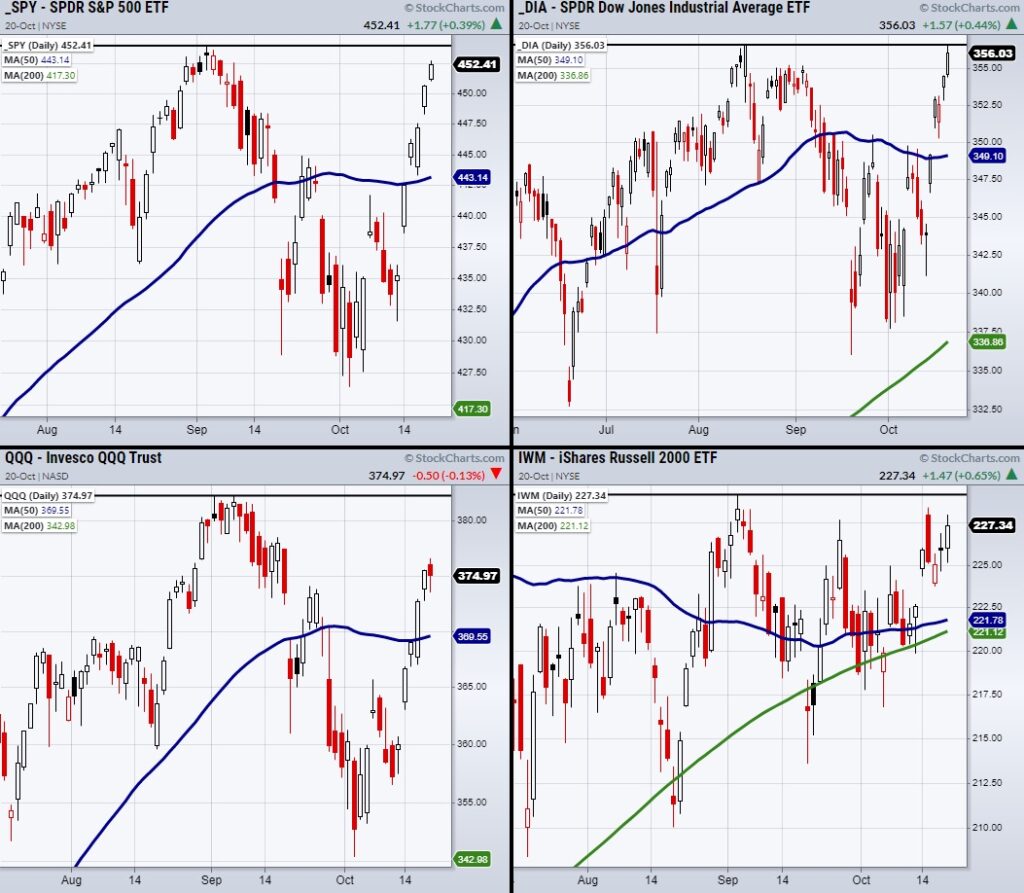

Both the S&P 500 ETF (SPY) and the Dow Jones Industrials ETF (DIA) are poised to hit new highs, while the Nasdaq 100 ETF (QQQ) and the small-cap index Russell 2000 ETF (IWM) have a bit more territory to clear.

The above chart shows pivotal areas to clear in each index (Black Line).

So far, our chances for clearing resistance look good as we have strong momentum and a stream of positive earnings reports coming from the financial and now healthcare sector.

Another thing to note is with the fast-paced rally towards highs we have not seen many digestion days.

These are trading days where sellers take profits while new buyers enter the market looking for the overall trend to continue.

Because the market has seen a large surge of buying and not so much selling, traders could be looking for profit-taking areas.

For now, it looks as though Thursday will decide if the SPY and DIA can clear the highs.

With that said, this is focused on short-term market price action.

The longer-term picture involves the looming holiday season which has raised a lot of questions from investors and companies.

So far, expectations for sales through the holidays are rather weak as companies continue to struggle to keep warehouses and stores stocked.

It is expected that this holiday season online retailers will have a 172% increase in out-of-stock messages compared to 2020 according to Adobe Analytics.

Therefore, companies are urging people to begin holiday shopping early as supplies are already waning.

This doesn’t bode well for the next earnings season.

However, investors’ focus is in the moment and so far, we have clear pivotal price levels to watch through the rest of this week’s trading.

One last thing to note is while the market has strengthened, precious metals and specifically Silver (SLV) have rallied from recent lows.

This is another interesting development as we have been watching precious metals and raw materials to gain extra strength from supply and inflation-related issues.

Watch Mish’s most recent appearance on Fox Business: Making Money with Charles Payne!

Stock Market ETFs Trading Analysis:

S&P 500 (SPY) 454.05 high to clear.

Russell 2000 (IWM) 229.84 to clear.

Dow Jones Industrial Average (DIA) 356.60 high to clear.

Nasdaq (QQQ) 369.78 support the 50-day moving average.

KRE (Regional Banks) Cleared resistance. 71.60 new support area.

SMH (Semiconductors) 264.21 support the 50-day moving average.

IYT (Transportation) 256.77 support.

IBB (Biotechnology) 160 resistance. 153.38 support.

XRT (Retail) 93.66 resistance from 50-day moving average.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.