Raven-the sarcastic, deadpan demon girl who’d rather be left alone

I found her lying in the street in NY.

Raven, a prominent member of the superhero team Teen Titans, was taught to “control her emotions” in order to suppress her inherited demonic powers.

Today, she may have lost some of that control.

The selloff in every sector except for long bonds, utilities, metals, sugar, coffee, cotton and cocoa (do you see a pattern here?) looked a bit demonic.

The worst hit of the indices was the Russell 2000 IWM, along with many of his other Family members.

Semiconductors SMH, Transportation IYT, Regional Banks KRE, Retail XRT and Biotechnology IBB, all declined by between .90 and 2.30%.

Given the number of times I have posted the weeky charts of the Modern Family, I may not be Raven, but you cannot say I have not tried to warn you!

Since I covered these charts yesterday, I just want to point out three notable features.

Biotechnology was a bright spot yesterday. Maybe because the perception is there will be no enforcement of price gouging as promised, IBB is holding onto the 200-week moving average (green line).

Semiconductors SMH , after weeks of holding above the 50-WMA (blue line), today has failed it.

Regional Banks KRE, touched down on the 200-WMA (green line). Now we will see if it can hold or not.

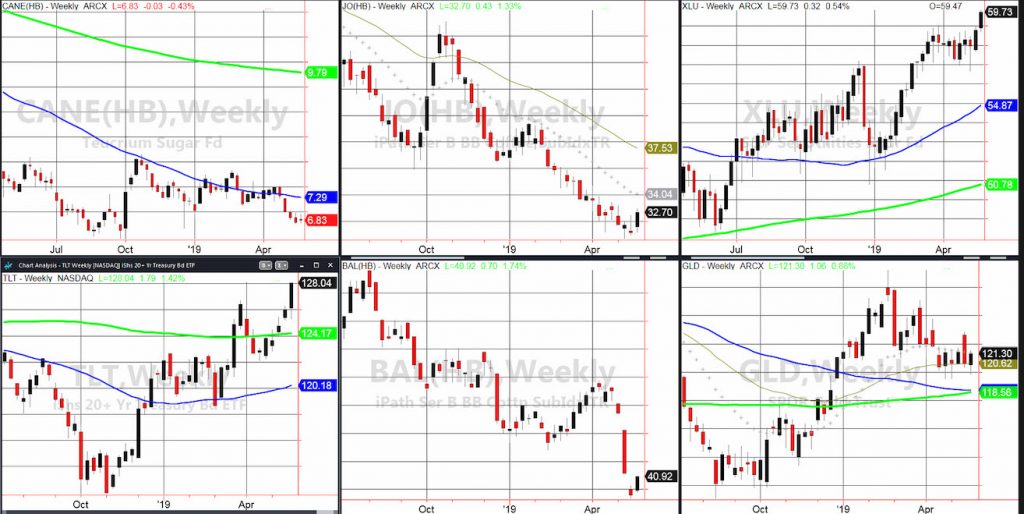

I also include the outperformers today.

Top left is the ETF for sugar. Although CANE closed unchanged, sugar futures are doing their best to bottom. Eyes here as one of the key indicators of an inflationary sea change.

Middle is the coffee JO ETF. Coffee, with some rumors that frost in Brazil could impact the beans, gained. Futures must clear 94 to really get interesting.

Far right is the Utilities ETF XLU. As I write in my book, when Uncle Ute shows up drunk at your door, pay attention. XLU made a new all-time high.

Bottom left is the 20-year long bond. Today, with the flock to bonds for safety and nothing but reports on low inflation, money flowed there.

Bottom middle is the cotton ETF BAL. Not really tradeable, I include it because it too looks like it’s trying to bottom.

Finally, bottom right is the ETF for gold GLD. Holding in a weekly bullish phase, GLD gained as well. However, it is into some weekly resistance at 121.40. Plus, the gold to silver ratio moved up, but not by nearly enough to get excited over.

Currently, not much looks particularly safe nor like a great buy.

Nonetheless, if a trend is emerging, continue to watch commodities for a buy and equities for a short.

Raven also has the power to induce calm, suppress negativity, and even make someone fall in love with her. Perhaps, she can still put those powers to use for the market.

Check out my book: Plant Your Money Tree: A Guide to Growing Your Wealth!Now on Kindle! Go here: www.marketgauge.com/plantyourmoneytree to receive a special $97 bonus for free while it lasts!

S&P 500 (SPY) – Around 277 is where the next major moving averages sit. 285 major resistance.

Russell 2000 (IWM) – The 3/25 low was 148.41. Significant? Only if it holds.

Dow Jones Industrials (DIA) – 253.40 is the 50-week MA. If that fails, besides IWM, it will be the second but not the last index to break that level.

Nasdaq (QQQ) – If this cannot get back over 179.75, then 174.40-174.60 is the test of the underlying MAs.

KRE (Regional Banks) – 51.31 the 200-WMA holding for now.

SMH (Semiconductors) – 102 the big resistance now.

IYT (Transportation) – 180 next best support with 184.15 resistance.

IBB (Biotechnology) – 103.26 the 200 WMA pivotal.

XRT (Retail) – 42.12 broke. Now resistance to clear.

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.