The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE), came in below or aligned with market expectations. This supports our prediction that rate cuts are on the horizon, likely starting in the upcoming months.

Brief Market Overview

We anticipate the economy will transition from the robust growth in 2023 to a slower pace in the latter half of 2024.

The earnings season has largely concluded, with notable updates from companies such as Salesforce and Best Buy. Salesforce reported an increase in sales cycles, a trend we are noticing across the board. Meanwhile, Best Buy experienced some increased demand, particularly in the PC market, and anticipates this trend to continue with a flattening overall.

Now let’s look at two technology market leaders:

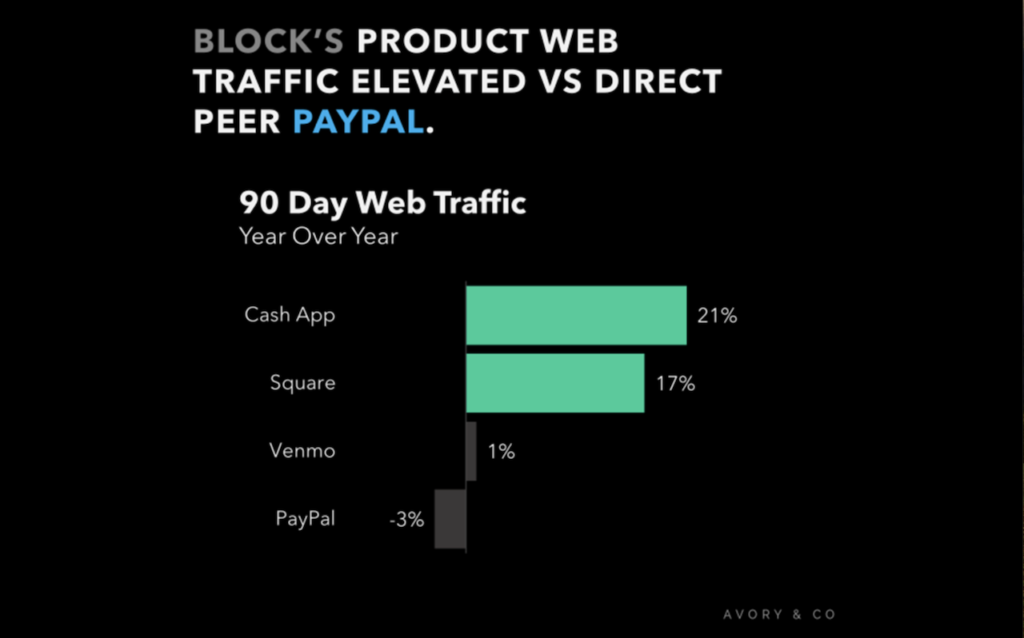

- Block Data Supportive; Web traffic up vs peer

- Meta Leads All in App Downloads; Over 150m downloads..

Data Continues to Support Block’s Competitive Advantage

Our investment strategy prioritizes short-term data to confirm long-term trends. This week, we analyzed a key indicator: 90-day web traffic for Block’s Cash App and Square compared to PayPal’s core app and Venmo. The results are very positive, suggesting continued high demand for both Block products. Encouragingly, data for AfterPay (also owned by Block) shows healthy traffic and customer satisfaction trends. Specifically, Cash App and Square web traffic have grown by 21% and 17% respectively.

Meta Continues to Be Leader in App Downloads Across Family of Apps

Expanding on web traffic data, here’s a look at app downloads across Android and Apple app stores. Meta, despite its large user base, continues to experience significant growth. Notably, Meta apps within the top 10 most downloaded apps have seen a combined increase of 150 million downloads.

Additionally, Threads, a Meta app, sits as a #3 app overall and ranks within the top 10 in total downloads. This data aligns with Mark Zuckerberg’s positive comments on Threads’ post-launch performance during the recent earnings call. Furthermore, the strength of Chinese apps is evident with TikTok, CapCut, and Temu all experiencing significant downloads. This is important as Chinese pressures continue to emerge from a political standpoint.

Twitter: @_SeanDavid

The author and/or his firm have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.