The Biotech Sector (NASDAQ:IBB) has been volatile the last few weeks, more so than the market at least with two opposing forces. On one side, sell-offs look to be election related on fears of further scrutiny on drug pricing weighing on future profits, and on the other side, a growing expectation for Mergers and Acquisitions (M&A) to heat up into year-end has seen many names see notable accumulation.

Up to this point the M&A in Biotech has been disappointing in 2016, likely much to do with election uncertainty, but the recent Pfizer (NYSE:PFE) $14B deal for Medivation (NASDAQ:MDVN) may spur more deals, and also showed there are plenty of willing buyers as that deal saw up to 6 bidders. Interestingly, Pfizer also did one of the other larger deals this year with a $5B+ buyout of Anacor (NASDAQ:ANAC). In April, AbbVie did a $10.2B deal for cancer drug start-up Stemcentryx, one of the other larger deals this year. For the most part, deals have been on the smaller side with RPTP, VTAE, CYNA, CPXX, XNPT, and RLYP some of the recent buyouts. Last week it was reported that GW Pharma (GWPH) hired an investment bank after it was approached with acquisition interest from multiple drug makers.

The valuation disconnect between large Pharma and Biotech has grown, and Biotech has less of its current valuation tied to its pipeline value, is growing sales and expanding margins at a much higher rate, and has record amounts of cash. All of these dynamics make the Biotech sector attractive for M&A not only inside the industry, but also for large Pharma to make acquisitions. There is an “arms race” in Oncology for strategic assets, and likely to demand high premiums on scarcity value, while rare diseases are a focal point as well. There is nearly $200B in cash for large Pharma/Biotech and recent management commentary across the industry suggests willingness to do deals. A recent trend has been companies seeking more early stage assets, while Phase 3 and already to market assets were historically favored in M&A.

There are so many potential buyers with a lot of cash that once the deals start, it could cause a major domino effect and also may see a few bidding wars. Companies that have declared an appetite for M&A in the past 9 months include Sanofi (SNY), Merck (MRK), Gilead (GILD), Amgen (AMGN), Teva Pharma (TEVA), AstraZeneca (AZN), Celgene (CELG), Glaxo (GSK), Eli Lilly (LLY), J&J (JNJ), Biogen (BIIB), Takeda, Roche, and Novartis.

As for the potential targets, there are also a large number, so I will break them down looking at names with unusual options activity and ones with strong price-action.

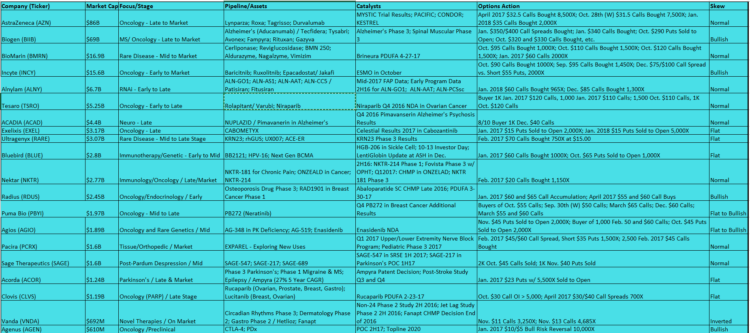

Options Flow Targets

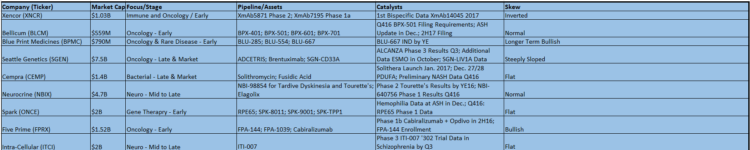

Strong Price-Action Targets

Analysts

A few notable sell-side firms and their top Biotech M&A targets:

Citi (OPHT, PBYI, LXRX, ARDX, VSAR, RARE)

BMO (ALXN, BMRN, ICPT, INCY, NBIX, VRTX, RTRX, IONS, AVXS)

Goldman (BLUE, ARIA, BMRN, ALKS, ICPT, INCY, KITE, RDUS, SAGE, VRTX)

CSFB (TSRO, CLVS, VSAR, CRVS, ADMS, ALXN, INCY, PRTA, PBYI, ALDR, BMRN, CHRS, ICPT, RARE, SGEN)

Gabelli (BMRN, INCY, SGEN, TSRO)

Morgan Stanley (Oncology short-term; Neuro will be hot spot)

Thanks for reading.

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.