Recent price action in the Biotech Sector ETF (IBB) and select biotech stocks has attracted a lot of attention and with good reason: it is not often that we see such a powerful and sustained move spanning multiple years.

Many articles have been written lately (including by yours truly) about the potential top in the Biotech sector and my intention is not to rehash any of those fundamental or technical arguments.

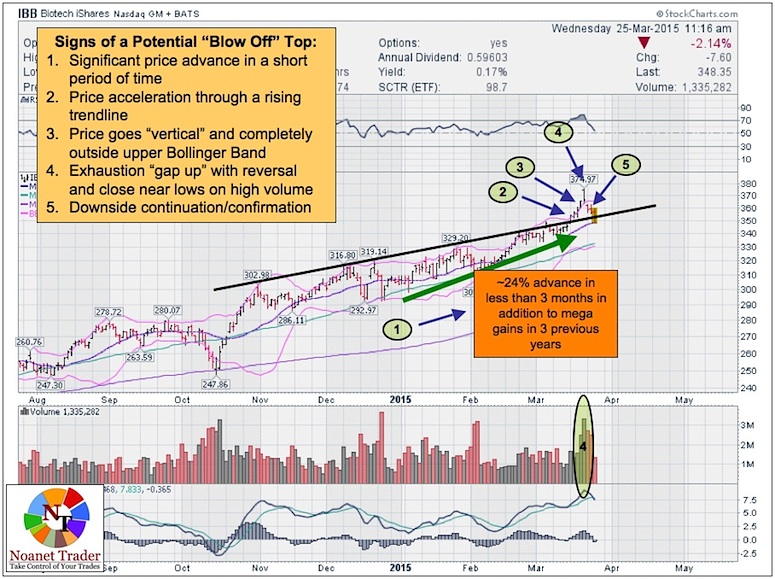

From a purely technical perspective, recent price action in IBB is consistent with a “Blow Off” top. I use “a top” deliberately because we will not know for several months whether last Friday’s gap up to 375 and then bearish reversal was “the top” for the Biotech sector ETF.

IBB’s topping action was not sudden and it evolved over several distinct stages, which should have given plenty of time to investors and traders to prepare for and act on a possible trend change (see below chart for reference and more information).

- To start with, we have a sector that made a significant price advance in a relatively short period of time (roughly +24% YTD for IBB through last Friday, coming on the heels of an incredible multi-year price gain).

- At the beginning of last week, IBB price started to accelerate and broke through the upper trendline.

- Price continued to accelerate higher throughout the week and on Thursday became completely divorced from the upper Bollinger Band.

- As if this wasn’t enough, Friday brought a significant opening gap up, followed by an almost immediate reversal on significantly higher volume and a close near the lows.

- This week IBB was unable to bounce and we had a downside continuation.

Biotech Sector ETF (IBB) Chart – Breaking Down The Blow Off

So what were some ways to act on this information?

For longer-term investors, last week’s price action should have acted as a warning sign to reduce their biotech exposure.

For shorter-term traders, last Thursday’s move and Friday’s gap up open was the perfect time to initiate short positions in IBB or related instruments.

Follow Drasko on Twitter: @NoanetTrader

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.