This article is a collaboration between between Arun Chopra (@FusionPtCapital) and Aaron Jackson (@ATMcharts).

Biotech had a banner week, leading the market after a base breakout on news. Let’s dig a little deeper into the sector to see where things stack up.

Biotech relative to the S&P 500 continues to work higher after recovering an 11 year uptrend.

Say what you want about relative performance charts, but it’s not often such a clean trend develops in a common sense instance (an emerging industry is growing relative to a bunch of large cap stocks).

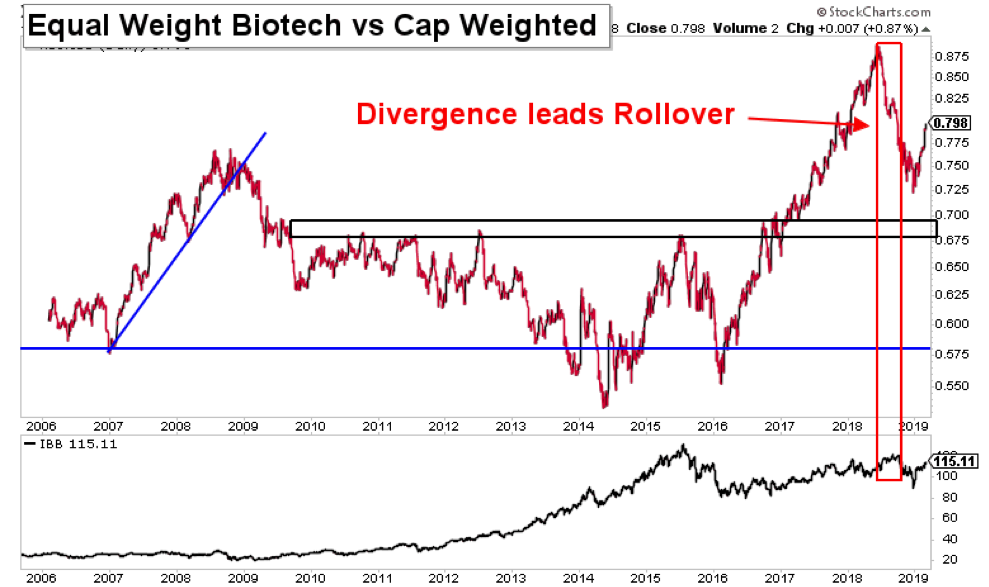

Equal weighted biotech is outperforming cap weighted biotech. After a quick divergence in the ratio prior to the market correction, it’s turned back higher within an uptrend on almost every time frame.

It’s a positive sign if this continues to trend up.

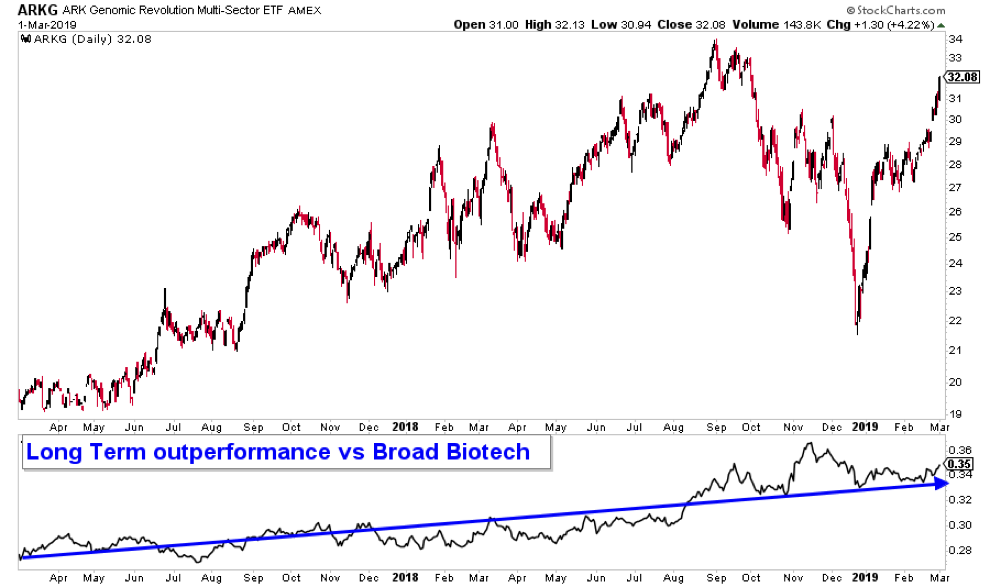

ARKG is an ETF created as a proxy for the benefactors of advances in genomics. Some of the top holdings include Illumina, Medidata Solutions and CRISPR Therapeutics with some Nvidia and Apple as well.

Despite this fund holding Apple and Nvidia, it’s is outperforming biotech and the broad markets as it approaches 2018 highs. This is a group to watch in the coming months. If the major indices are going to break to new highs, this theme could really take off.

Illumina is the genomics bellwether. On a long term basis it continues to rally, with a steady multi now decade uptrend. The most recent consolidation range appears to be between 270 and 370.

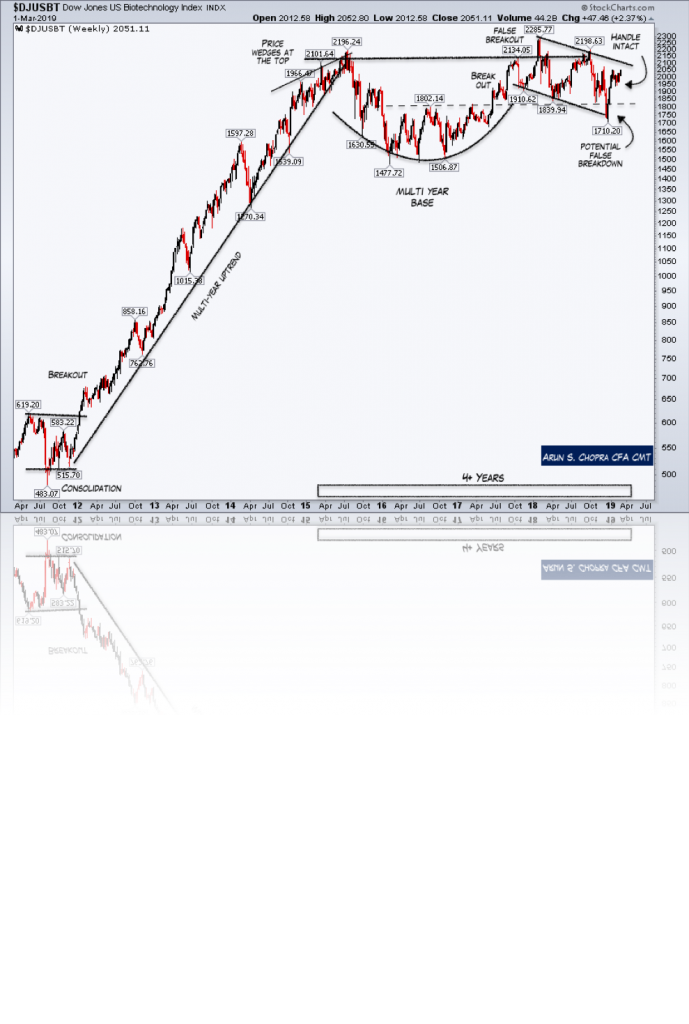

Finally, the Dow Jones Biotech index enters its 4 year of consolidation as price continues to build a handle. After breaking down to 1710, we’ve seen a sharp recovery back above the base or cup breakout level of 1800. Price remains under the all time highs however the index has certainly been resilient since the major uptrend peaked in early 2015.

As you can see, 2200 in the Biotech Index is the most important level on the chart. If it can break free of that area, biotech is well positioned for a new leg higher with genomics as a leading industry group.

Thanks for reading. Trade ‘em well!

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.