In a previous article, The Fed’s Body Count, I stated:

“Markets and economies, like nature itself, are beholden to a cycle, and part of the cycle involves a cleansing that allows for healthy growth in the future. Does it really make sense to prop up dead “trees” in the economy rather than allow them to fall and be used as a resource making way for new growth?”

I come back to that thought in this article inspired by the notion that investors find themselves in a forest increasingly littered with dead trees. In today’s market parlance, the dead trees (corporations) are called zombies. This article details the corporate zombie concept in-depth and provides a few examples to illustrate the topic.

The Walking Dead

It is no small irony that one year after the end of the great recession, a television show about the zombie apocalypse quickly became one of the most successful shows on TV. The Walking Deadfeatures a large cast of “survivor” characters under near-constant threat of attack from mindless zombies, or “walkers” as they are called.

In the investment world, the term zombie has a special connotation generally referring to a company that might otherwise not be around had the Federal Reserve not suppressed interest rates for so long.

The zombie label is fitting as these companies do not die as they should and at the same time, they devour capital and resources that could otherwise be used by healthy companies. They are a drain on the economy.

Although not a matter of life and death, investing in zombie companies or failing to understand the implications of their existence poses a unique risk to one’s economic well-being.

Zombies Defined

The generic description used for zombified companies is too obtuse to use to precisely identify such companies. If the suppression of interest rates served a key role in maintaining these firms, what would be the circumstances fundamental to that condition?

Corporate zombies are generally described as companies that cannot function without bailouts and/or those firms that can only afford to service the interest on their debt while deferring repayment of principal indefinitely. In our view, those definitions do not go far enough.

In a recent interview, James Grant of Grant’s Interest Rate Observer offered what seems to be the most precise definition – zombie companies fail to generate enough operating income to cover the interest on their outstanding debt. Furthermore, that condition would have to persist for more than one year to eliminate any anomalous results.

In other words, a corporation that fails to cover its interest expense can, for a time, keep borrowing to make up the shortfall, especially if money is cheap. On the other hand, true zombie status is revealed, and the “headshot” of demise ultimately comes, when the company runs out of borrowing runway. That circumstance can unfold rather quickly in an economic downturn or a period of rising interest rates when the negative differential between operating income and interest expense widens further.

Operating Income is defined as gross revenue minus wages, cost of goods sold, and selling, general and administrative expenses (SG&A). Operating income does not include items such as investments in other companies, taxes, or interest expense. Isolating the difference between operating income and interest expense is a way of comparing the revenue that a company expects to become profit versus the cost incurred for borrowed funds. It is a variation of a leverage ratio.

Zombie Hunt

We analyzed the broad S&P 1500 to identify companies having zombie characteristics under Grant’s definition. Namely, does their interest expense exceed their operating income and has it done so when averaged over the last three years?

The list of stocks that qualify as zombies under this definition using Bloomberg data through Q1 2019 reveals 204 companies or 13.5% of the S&P 1500. Some of these companies do not show any interest expense but have operating income losses, so we removed those companies. That leaves 128 companies or 9% of the members of the index. Using a stricter methodology of requiring three consecutiveyears of interest expense exceeding operating income returns 43 companies that meet the criteria or roughly 3% of the index. These 43 companies are the worst in class of the zombie population.

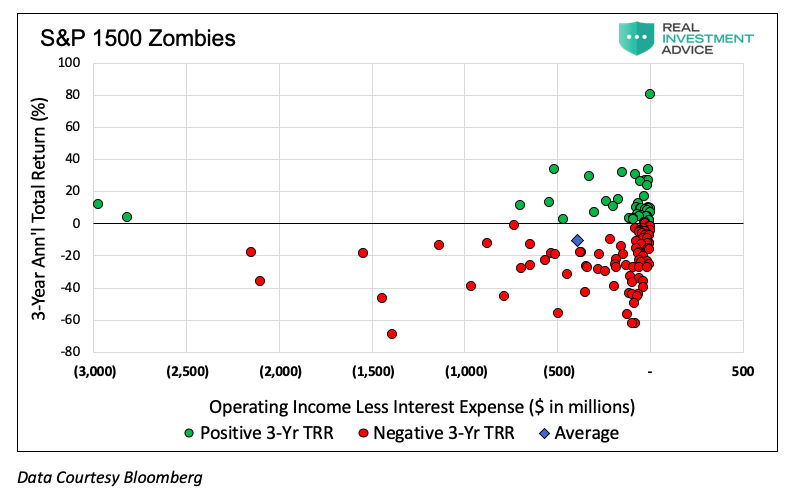

While defining and identifying the zombies is a good start, what we care about is a divergence between fundamentals and valuations. In other words, we want to truly protect ourselves from the zombies who appear alive due solely to a well-performing share price. In doing this, we find that 34% of the 128 companies have positive 3-year annualized total returns. Of these firms, the average 3-year annualized return of that population through June 30, 2019, is 13.6%. There are also another 11 companies that have been relatively stable as defined by annualized total returns of zero to -5%.

Such returns do not reflect the underlying fundamentals of companies that cannot service their debt and are a recession away from going bankrupt. The graph below charts operating income less interest expense with the three-year total returns for the 128 zombie companies.

For the 128 companies represented in the graph, they either have weak revenue generation and/or onerous debt levels. That, however, raises another issue for consideration – just how bad is the situation if the company cannot cover the interest expense on their debt due to weak demand for their products and/or services? Equally concerning, what if there is so much debt that even solid demand for their products and accompanying revenues do not cover that expense?

Deeper Dive

Awareness of this issue and quantifying it is useful and important to help us understand the kinds of imbalances that exist in the economy. At the same time, while most zombie companies would not exist were it not for years of suppressed interest rates, those that do should be priced for the uncertainty of an economic downturn and the higher probability of their demise in that event. As mentioned, many are not. Out of the 128 companies whose operating income cannot cover interest expense, many are priced at valuations that imply they are a normal going concern.

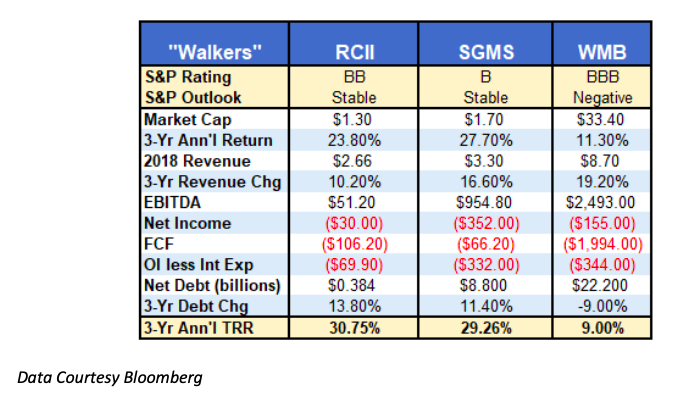

To gain a better perspective of zombies, we selected three individual candidates to explore in-depth. As discussed, the market is crawling with these companies that bear very similar characteristics. A table of the relevant fundamental statistics for each company is shown below each summary.

Rent-A-Center, Inc. (RCII)

RCII, a BB-rated company with a stable outlook, operates and franchises rent-to-own merchandise stores offering electronics, appliances, and furniture under “flexible rental purchase agreements” (lucrative financing plans). Based in Plano, Texas, they have 14,000 employees and a market capitalization of $1.3 billion. RCII stock has a three-year annualized return of 30.7% and three-year average EBITDA (earnings before interest taxes depreciation and amortization) through the end of 2018 of $51.2 million. Meanwhile, three-year average net income and free cash flow are negative $30.0 million and negative $106.2 million respectively.

Their zombie metric of operating income less interest expense was positive $18.3 million in 2018, but the three-year average is negative $69.9 million. Additionally, revenue for 2018 was the lowest since 2006 at $2.66 billion and total debt for the company increased by 52% (from $540 million to $825 million) in the first quarter of this year alone. It is hard to imagine the consumer showing enough strength to bail out the circumstances facing RCII. However, apart from us, most analysts are constructive in their outlook.

Scientific Games Corp. (SGMS)

Based in Las Vegas, Nevada, SGMS is a single-B-rated company with a stable outlook that provides gambling products and services under four operating divisions of gaming, lottery, digital, and social. The company has 9,700 employees and a market cap of $1.7 billion. Despite a significant correction since June 2018, SGMS stock has a stellar three-year annualized return of 29.2%. Given their negative earnings per share, the current price-to-earnings (PE) multiple cannot be calculated, but the expected PE for the end of the year based on earnings projections is 1,693. The company generated over $3.3 billion in revenue in 2018 but had net income of negative $352 million. The company sports a net debt obligation (net of cash) of $8.8 billion at the end of 2018.

Their zombie metric is -$332 million and has been negative every year since 2008. Despite their fundamentals, through June 30, 2018, SGMS produced a 47% 3-year annualized return showing the power and irrationality of momentum investing. The enthusiasm for SGMS revolves around the legalization and commercialization of nation-wide sports betting. Over the last ten years, insider selling dominated executive transaction flows. Our guess is they will wish they had sold even more.

The Williams Companies (WMB)

WMB, based in Tulsa, Oklahoma, is an energy infrastructure company focused on connecting North America’s hydrocarbon resources to markets for natural gas. The company owns and operates midstream gathering and processing assets, and interstate natural gas pipelines. It has 5,300 employees and a market cap of $33 billion. WMB is rated BBB by Standard & Poors with a negative outlook. Through the end of June 2019, WMB shares have a 3-year annualized total return of 14.0%. Net income for 2018 was -$155 million on revenue of $8.7 billion. Revenue grew at a three-year average of 5.7%, but net income was negative in three of the past four years. The company has net debt outstanding of over $22 billion, which is up 200% from $7.4 billion in 2011. Interest expense on that debt has exceeded operating income (zombie metric) in each of the past four years. Since 2017, insider selling of company shares was 4.4 times larger than insider purchases.

The following table compares our three zombies:

Summary

Loose monetary policy contributed to the financial crisis as the Fed held interest rates at 1.0% in 2003-2004 despite an economy that was rebounding and a housing bubble that was inflating well beyond its natural means. The Fed also imprudently used forward guidance to keep rates low for “a considerable period” which further prompted investors to speculate. In a troubling parallel, and proving lessons learned in finance are cyclical, not cumulative, the Fed has maintained and extended emergency policies following the crisis for nearly a decade. New bubbles have since replaced those that popped in 2008.

Upon receiving the Alexander Hamilton award in 2018, Stan Druckenmiller said, “If I were trying to create a deflationary bust, I would do exactly what the world’s central banks have been doing for the past six years.” The important point of his comment is that the deflationary episodes most feared by central bankers are caused by imploding asset bubbles. Those asset bubbles are invariably caused, in large part, by imprudent monetary policies that encourage market participants – households, corporations, and governments – to misallocate resources.

Corporate zombies are but one example. Their existence is evident, but the true extent to which they populate the market landscape cannot be known. Our analysis here reveals only the easiest to identify but rest assured, when economic twilight comes, many more zombies will be fully exposed.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.