OMG, did he say QE may last forever? I feel like a school girl (or was that school boy? — cue, Lloyd Christmas please). Comments early yesterday from Fed Chief Ben Bernanke sent the markets in a tizzy. He caught shorts leaning the wrong way, and properly lathered up the equity bulls for another run at the highs. Afterall, “QE” is the market steroid of choice.

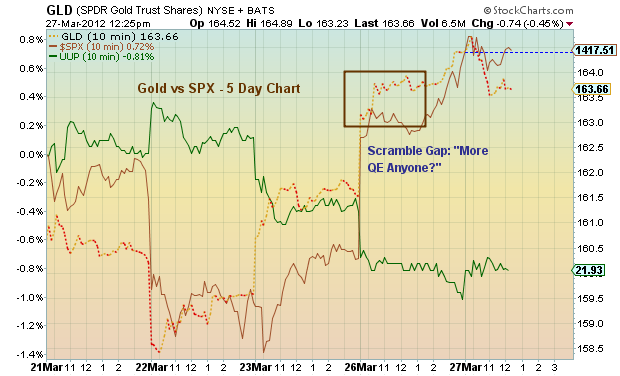

But what caught my attention as well was (is) the pop in Gold and Silver. For obvious reasons, metal heads like these comments (see: inflation). But the metals had been sliding for the past few weeks and were nearing key support — see my chart of Gold. Note as well that the metals recent slide came while equity markets continued to move higher (see charts below). The idea that the two are rising in sync (along with just about every sector) supports the possibility of an “all one market” theme. And when everything rises together, this usually means that we are in the final stage of this move higher.

Play the move higher, but keep perspective over the coming days/weeks. Be sure to emply stops (at trend line support levels) and incorporate a hedge strategy depending upon risk profile. G luck!

———————————————————

Your comments and emails are welcome. Readers can contact me directly at andrew@seeitmarket.com.

Twitter: @andrewnyquist and @seeitmarket Facebook: See It Market

Position in S&P 500 related short index fund SH.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.