I am currently reluctant to engage in this bear market rally as I believe the next down leg is about to start.

The U.S. stock market indices reviewed here have either hit or are close to hitting MFU-2 price target zones based on the daily timeframe.

Further, this counter-trend move has several stock indices trading into price resistance zones where the odds of a reversal have increased.

Below, we look at the S&P 500 Index. It is trading into a confluence of overhead resistance. I remain cautious and expect another leg down to start soon.

Turning to the currency and commodity world, the U.S. Dollar Index (DXY) achieved our MFU-3 target area (109) and pulled back to a support area. We are waiting to see if it can have a turn back up to take out the recent high and start the next leg higher to our long-term target of 121.

Gold pulled back and held a MOB band price target and the 2021 lows. We need to see if price can get above the $1845—$1850 area to say we have a turn up in place.

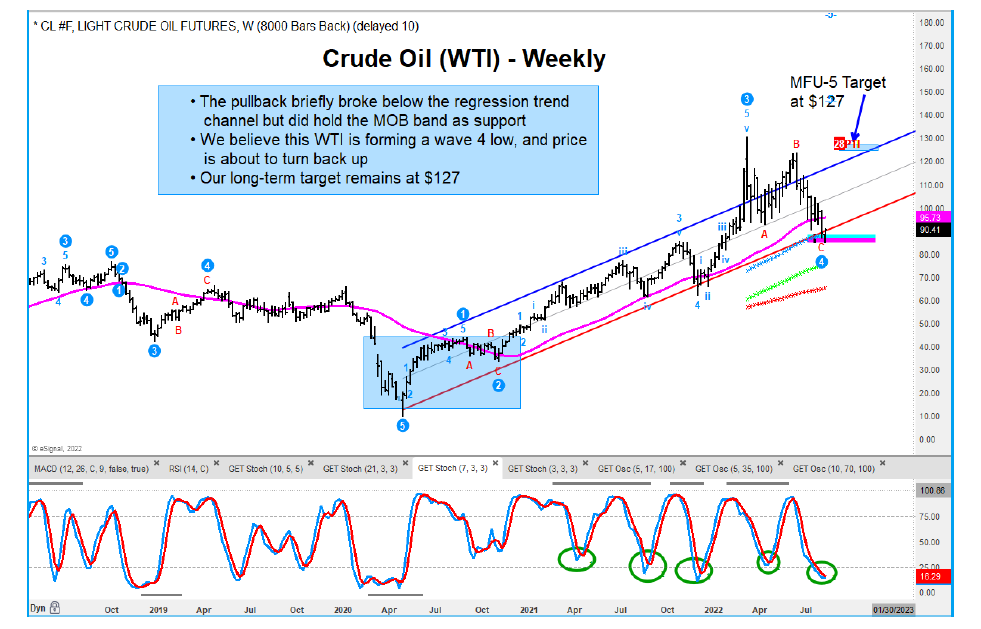

Crude Oil has pulled back hard from the June high, but this pullback has not disturbed the uptrend off the 2020 low. Crude oil has held at MOB band price support and the lower end of its regression trend channel. Momentum is also in the oversold zone. I believe a low is in place and will look for price to turn back up.

Twitter: @GuyCerundolo

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.