This morning, Bank of New York Mellon (BK) reported earnings.

The company reported $1.01 of EPS, which beat consensus estimates of $0.91.

BK reported revenue of $4.01B, which also beat consensus estimates of $3.91B.

Net interest revenue decreased to $780M, which fell short of consensus estimates of $792.3M.

CFO, Michael Santomassimo, told analysts that they are expecting continued pressure on net interest income (NII) due to persistently low rates. BK expects NII to fall between 8-11% over the next quarter.

The stock is down 6% on the day. Let’s review our weekly cycle analysis.

Bank of New York Mellon (BK) Weekly Chart

At askSlim we use technical analysis to evaluate price charts of stocks, futures, and ETF’s. We use a combination of cycle, trend and momentum chart studies, on multiple timeframes, to present a “sum of the evidence” directional outlook in time and price.

askSlim Technical Briefing:

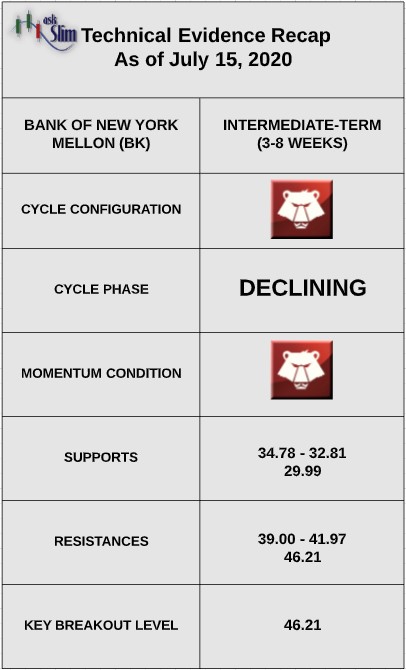

The weekly cycle analysis suggests that BK is in a declining phase. The next projected intermediate-term low is due between the middle-to-end of August. Weekly momentum is negative.

On the upside, there are intermediate-term Fibonacci resistances from 39.00 – 41.97 followed by a higher resistance level at 46.21.

On the downside, there are intermediate-term supports from 34.78– 32.81 followed by a lower support level at 29.99.

For the bulls to regain control of the intermediate-term, we would need to see a close above 46.21

askSlim Sum of the Evidence:

BK is in a declining phase with negative weekly momentum. There is a likelihood that the stock will test the intermediate-term supports beginning at 34.78 by the end of August before entering into a more favorable period.

Interested in askSlim?

Get professional grade technical analysis, trader education and trade planning tools at askSlim.com. Write to matt@askslim.com and mention See It Market in your email for special askSlim membership trial offers!

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.