After years of participating in the markets, I know how important the financials are to the overall health of the broader equities market. As Todd Harrison used to say, “as go the piggies, so goes the poke.” And this theme may become even more important in the days ahead as bank earnings hit the markets this week.

After years of participating in the markets, I know how important the financials are to the overall health of the broader equities market. As Todd Harrison used to say, “as go the piggies, so goes the poke.” And this theme may become even more important in the days ahead as bank earnings hit the markets this week.

The banks have joined the broader market theme of choppy consolidation over the past several months. Two factors that have limited the market’s visibility are the Fed (when will they raise rates?) and the US Dollar (how strong is too strong). These factors will likely play a role in the weeks ahead, but the more the market can show its ability to absorb a rate increase and a stronger dollar, the better.

And this starts with the financials. And bank earnings this week. How the financials act out of earnings season will be key. So let’s review who’s on tap this week and what to expect.

Wells Fargo (WFC) and JP Morgan (JPM) are the first of a string of bank earnings – both report on Tuesday morning. These reports will be followed by Bank of America (BAC) on Wednesday, and Citigroup (C) and Goldman Sachs (GS) on Thursday. Below are the consensus bank earnings expectations according to Estimize:

- Wells Fargo: $0.97 / $21.10B

- JP Morgan: $1.38 / $21.29B

- Bank of America: $0.29 / $21.53B

- Citigroup: $1.41 / $19.97B

- Goldman Sachs: $4.14 / $9.2B

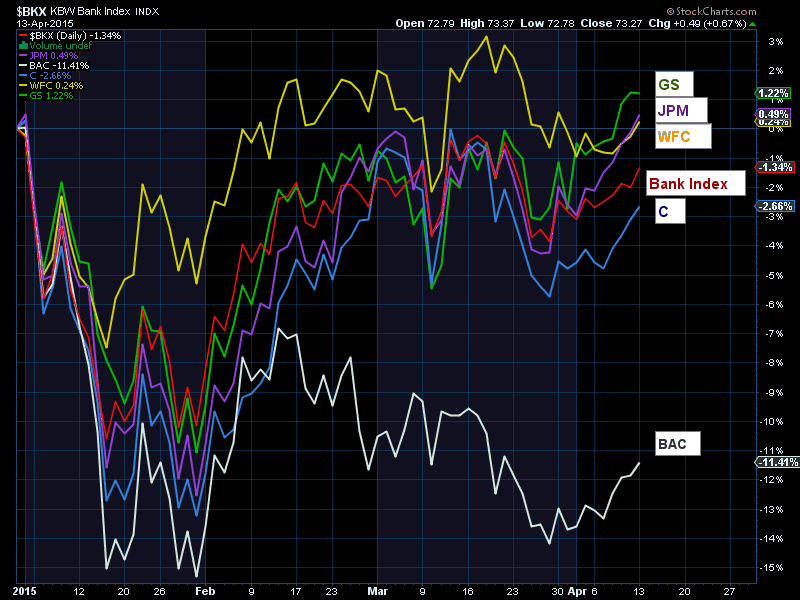

Below is a chart highlighting the performance of the Bank Index (BKX) vs the selected banks. As you can see, the Bank Index is negative for the year and underperforming the S&P 500. WFC, JPM, and GS are the current leaders, with BAC pulling up the rear. Although the banks (and financial sector) have been lagging, Morgan Stanley recently upgraded the financial sector to “overweight” for the first time in 7 years.

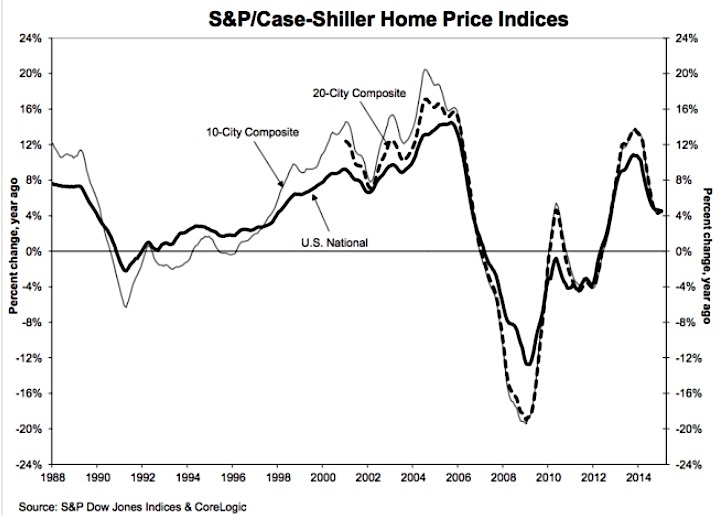

Investors will have some pretty good insights into big banks after Wells Fargo and JP Morgan report Tuesday morning. On one hand you have Wells Fargo who owns over 30 percent of the mortgage market, and on the other hand you have JP Morgan that is heavy on deposits and investment banking and trading. As banking leaders, the market always expects a lot form these banks, especially Wells Fargo. And a little softness in the housing market could temper Wells Fargo’s earnings. Note the Case-Shiller national home price Index has stalled out over the past several months.

S&P/Case-Shiller U.S. Home Price Indices

However, despite some near-term housing concerns, many analysts believe Wells Fargo is well positioned longer term, including Jim Cramer. Although he doesn’t expect a good quarter, he does say that “investors should buy that the most heavily [on weakness] because WFC is thinking about 2016…”

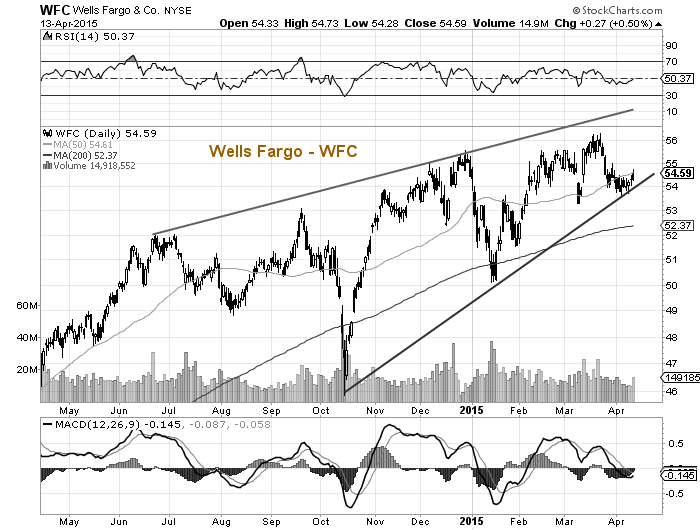

Below is a chart showing how WFC has been grinding higher within a rising wedge over the past several months. But, it is hanging out by a couple of must hold lower trend supports: 1). it is right at its 50 day moving average and 2) it is holding just above its lower trend line support. In short, bulls would like to see the stock hold $54. A dip below the near-term trend line would likely bring a quick test of the 200 day moving average.

Wells Fargo (WFC) Chart

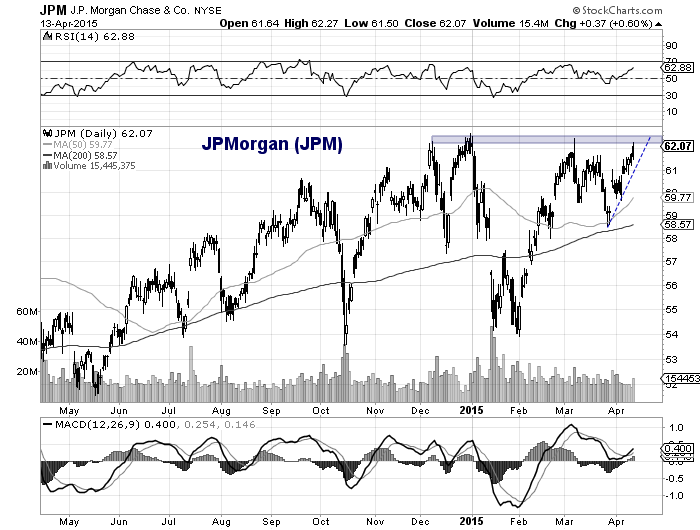

As for JP Morgan, the expectations are perhaps even higher. The stock has been showing strength recently and rallying into earnings. It is currently testing its 52 week highs. Will blowout earnings keep the momentum going? Or will investors sell the news.

JP Morgan (JPM) Chart

These are just two of several bank earnings reports to come. But they should set the tone. Watch those piggies…

Follow Andy on Twitter: @andrewnyquist

No position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.