Twitter (TWTR) traded -18% lower on Friday morning, after posting earnings that beat analyst estimates.

They also reported a decline in the closely-watched metric of monthly active users.

The company reported earnings per share of $0.17 and total revenue of $711 million, above Wall Street expectations of $0.16 and $698 million. However, their monthly active users (MAU) declined by 1 million to 335 million, compared with the average estimate of 338.5 million. Daily active users however grew by 11%.

Twitter removed 70 million user accounts during Q3, most of which had not previously been included in the MAU figures because they were not “active”. In Q3, however, they removed what were determined to be “fake accounts,” which will be reflected in their next earnings report.

The company offered a positive spin in its official statement, “We will continue to work hard to improve the health of the platform, providing updates on our progress at least quarterly, and prioritizing health efforts regardless of the near-term impact on metrics, as we believe the best driver of long-term growth of Twitter as a daily utility is a healthy conversation.”

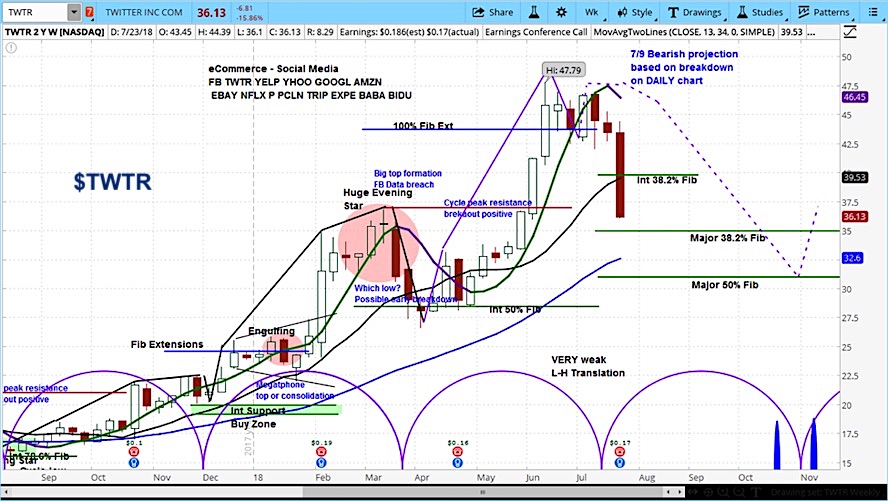

In analyzing the market cycles for TWTR, we believe the stock is now in the declining phase of its current cycle. This is based on the breakdown of the low from which it started the current cycle, as well as a breakdown on the daily chart.

We believe TWTR has topped. Our projection is to reach the 50% Fibonacci retracement by the end of the current cycle. Our target around $31 by November.

Twitter (TWTR) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.