S&P 500: Gimme Three Steps

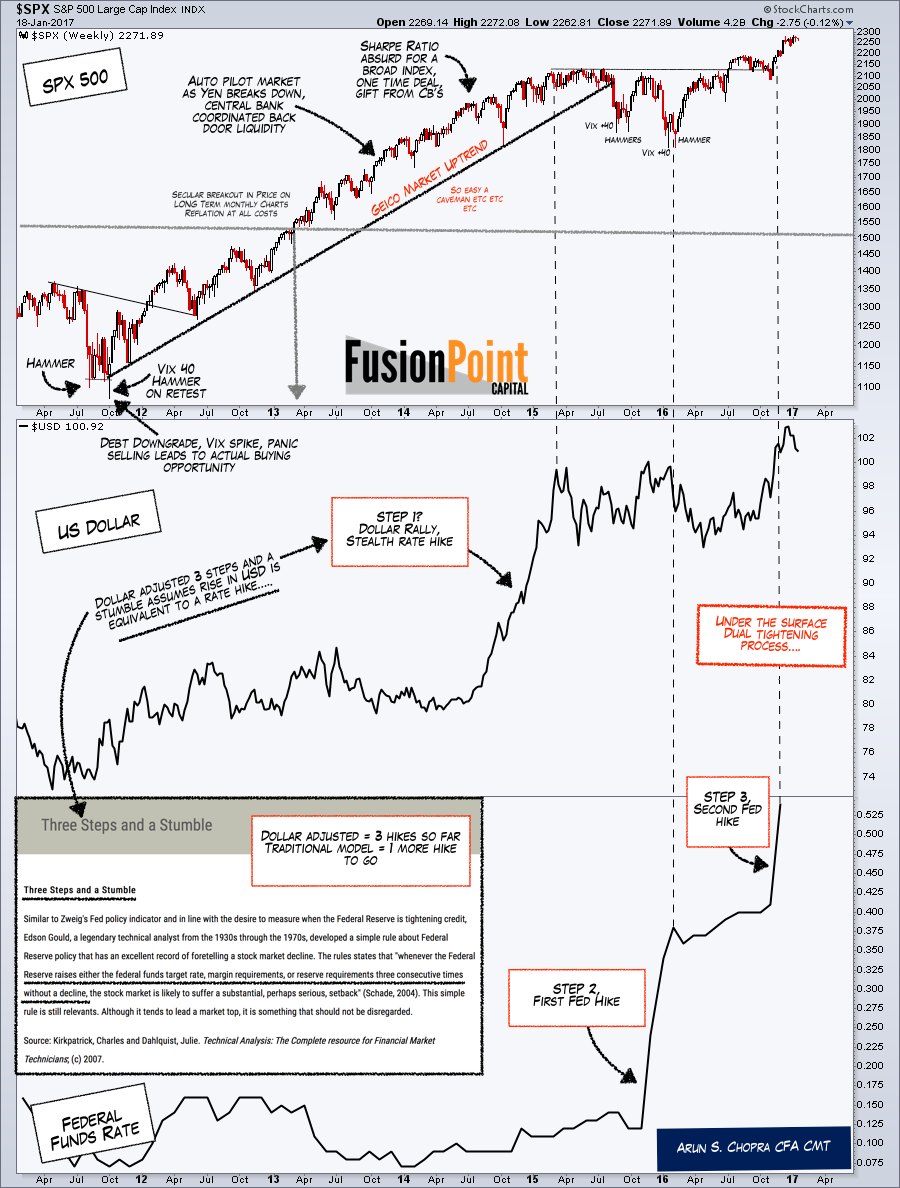

Every recession has been preceded by a significant increase in Fed Funds, margin or reserve requirements – tightenings. And as my colleague Arun Chopra, CFA CMT notes, major market downdrafts can occur after “3 steps and a stumble”.

Some argue that 75-100 basis points, or 3-4 increases is not significant, but it comes off the zero bound and follows a 25% increase in the dollar. In Arun’s chart below, note the interesting “dollar tightening” perspective on this tightening cycle. Link to content here.

- From late 2011 through late 2015, the S&P 500 glided up on Fed & BOJ QE-induced auto pilot.

- Since late 2014, the dollar has risen 25% and the Fed has raised the Fed Funds rate twice – 3 effective tightenings.

- These three tightenings did not result in market declines.

“Three steps and a stumble” posits that if markets endure three hikes without declines, they are vulnerable to a substantial or serious setback possibly on the fourth hike. Interesting perspective.

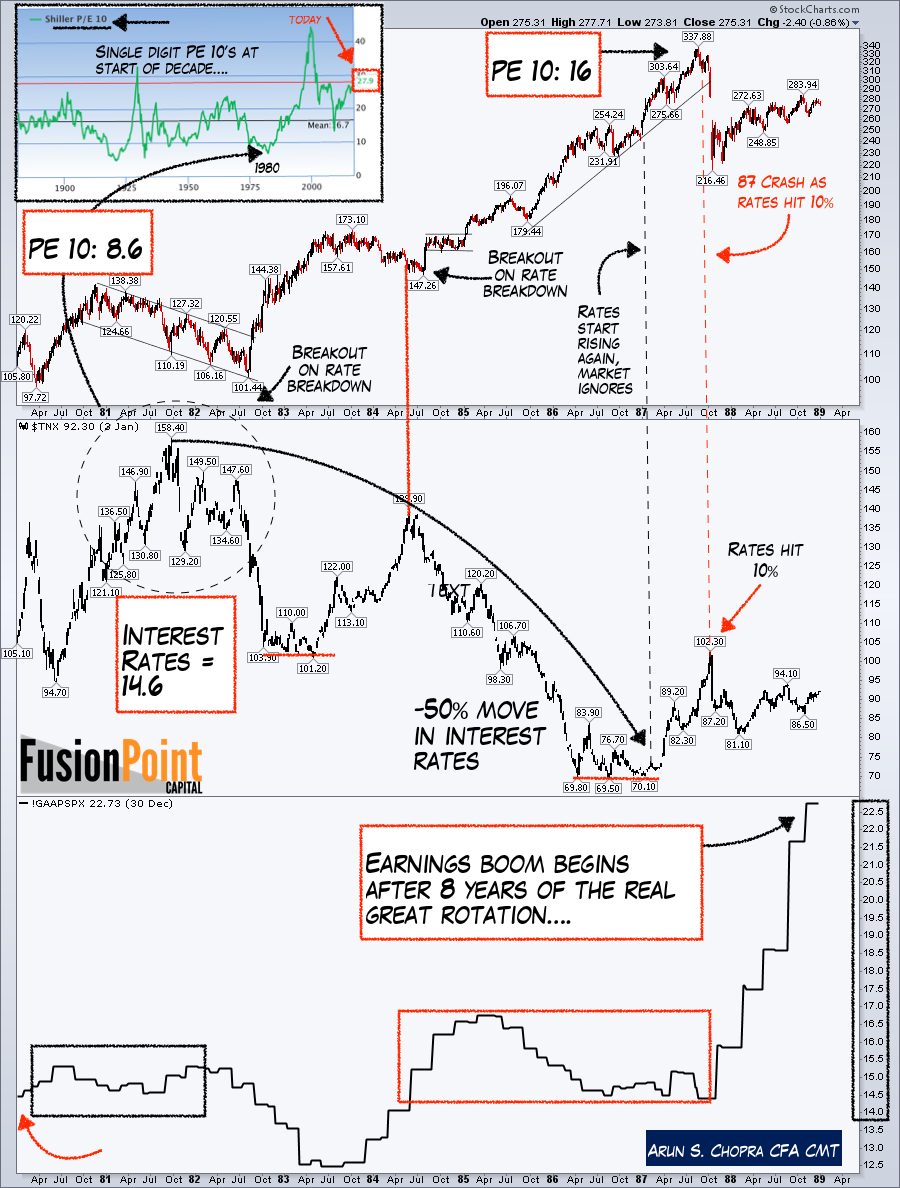

And, below is another chart from Arun contrasting the 1980s rate environment, valuations and S&P 500:

- At Reagan’s inauguration, PE10 was 8.6x and 10-year Treasury yields were 14.6%.

- From ’81 to ’87 markets witnessed a 50% decline in rates, and a 100% increase the S&P 500.

Earnings growth began to take off after 8 years of “real great rotation” from fixed income to stocks.

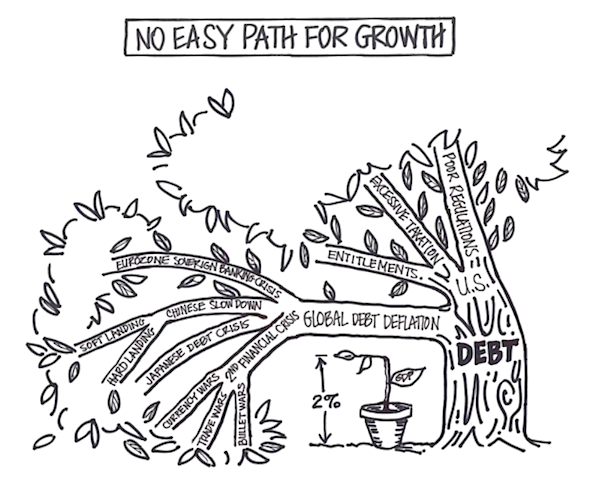

Today, the S&P 500 PE10 stands at 27.9x and 10-year Treasury Yields at 2.47%, pretty much the opposite scenario. A great rotation from here would be much different in a debt laden world.

The euphoria in markets is based on a seismic change in policy. The questions are on timing, efficacy, and whether the Fed tightening cycle overcomes any benefits. And, the environment today is much different than the 1980s, and just ten years ago.

The market is pricing in a lot of “Everything is Awesome”, but has all that awesome, real or fantasy, been pulled forward? We will see.

Check out the site. It is useful for individual retail investors up to professional money managers.

Twitter: @JBL73 & @fusionptcapital

The authors may have positions in mentioned securities by the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.