U.S. markets have “celebrated” the Trump election, with the S&P 500 () rising ~8% after a quick ~4% drop pre-election (and much deeper drop in futures the night of the election). There are quite a number of themes, positive and negative, continuing into the new year.

The “positives” – infrastructure spend, tax reform, healthcare reform, and deregulation – have built a relentless bid, or scared off sellers… for the time being.

The “negatives” – dollar strength, dollar scarcity, global debt bubble, Fed divergence, stress in European and Chinese banks, Yuan devaluation, rising populism in Europe (with French, Italian, German elections around the corner), low but rising probability of Euro-Exits, protectionist leanings (Smoot-Hawley tariffs contributed to a 66% decline in global trade from 1929-1934), and U.S. equity valuations at the third highest level ever (median stock on the S&P 500 at 98th percentile, and the all-time highest valuation for the index when including the enormous amount of corporate debt growth over the past decade) – are relegated to the dark recesses of pre-election… pre-light.

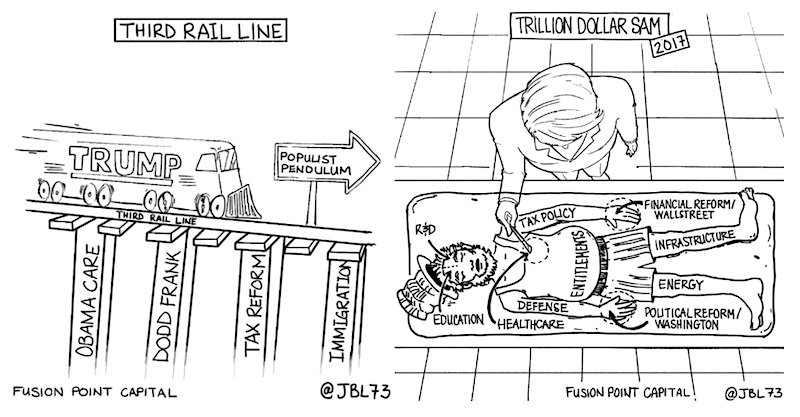

There are myriad estimates of what Trump’s policies could add to GDP and thus corporate earnings. If these policies are well thought out and passed quickly, no doubt there will be boosts. But, and there are several big “buts” here, with the current state of divisiveness, every issue is “third rail” and unless Republicans are willing to use the nuclear option (reconciliation where simple majority passes in the Senate) like a tactical weapon (i.e., repeatedly), the “positives” being pulled forward into today’s market pricing may take many more moons than anticipated. And, as detailed in iterations of Trillion Dollar Sam, these deep structural problems are decades in the making and will require more than outpatient Trump surgery in the first 100 days to rectify.

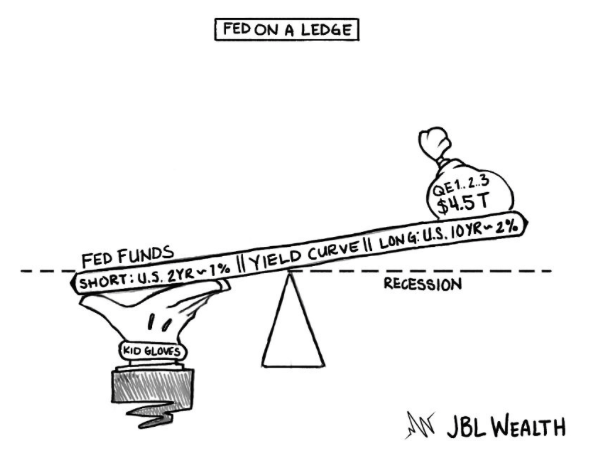

The Trump election is seen as the hand off or inflection point from monetary policy to fiscal policy. Significant infrastructure would have been nice… 5-6 years ago before the national debt rose another 33% to ~$20 trillion (missed window), and before the Fed started a hiking cycle. If infrastructure is somehow passed this year, and employment and wages continue to improve, the Fed could be forced to move faster. This could contribute more to dollar strength (along with repatriation, a potential border tax/tariff, and dollar shortages in Europe and Asia). Fed hikes (particularly moving the 10-year above 3%) and a continuation of the bull market dollar move could ameliorate the benefit from infrastructure spend, tax fixes, deregulation etc., or worse, invert the yield curve (historical 9-month to 1-year lag to recession), disrupt markets (more on this below), and put a pin closer the $231T global debt bubble, where dollar denominated debt approximates $57T. Remember, the last two major bull market dollar moves ended in crises in Latin America in the mid-late ‘80s, and Asia/Russia in the late ‘90s.

Now, let’s look at the S&P 500 and equities market.

continue reading on the next page…