American Tower ($AMT) is a $45B wireless infrastructure provider with cellphone towers located across the world. Last year, the company acquired 11,448 wireless communication sites from Verizon, pushing their total to north of 100,000. More recently in a $179M deal with Bharti Airtel, the real estate investment trust acquired 1,350 towers to expand their presence in Tanzania. And these deals could help push American Tower stock much higher.

Let’s take a look at both the technical and fundamental backdrop for the AMT.

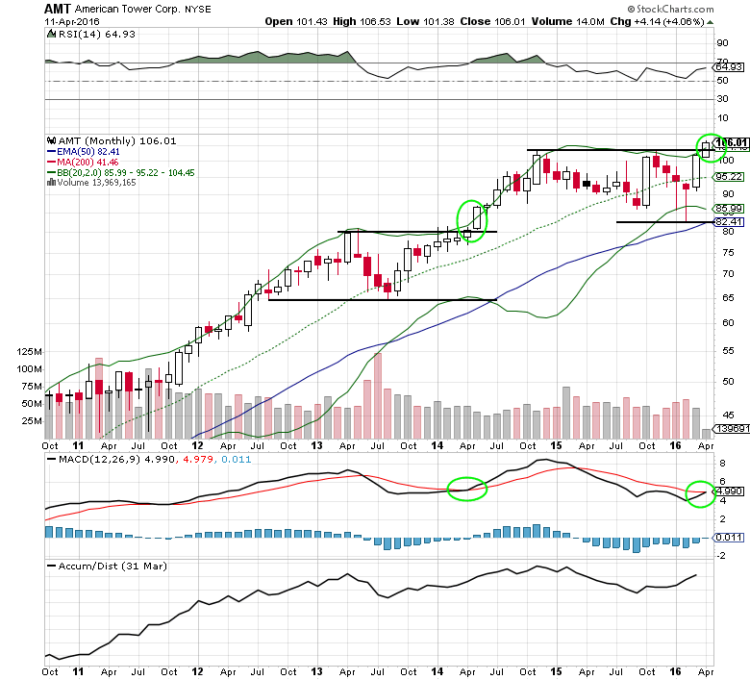

American Tower Stock Chart ($AMT) – Technical Analysis

For nearly a year and half, American Tower stock traded in a $20 range ($83-$103), but its share price is now breaking out of that range to all-time highs.

The setup is very similar to 2014 and the massive rally that ensued. American Tower stock rallied after an extended period of consolidation and confirmation from the technical indicator, moving average convergence/divergence. Once again, the MACD is giving a bullish signal for the first time since the start of 2014. Using the February 2016 low near $83 and prior resistance at $103, AMT is setting up for a potential measured move to the low to mid $120’s by next year.

American Tower Stock ($AMT) – Fundamental Analysis

American Tower stock is currently trading at a P/E ratio of 16.49x (2017 estimates), price to sales ratio of 9.39x, and a price to book ratio of 6.73x. Bottom line growth continues to rise 11%-14% on an annual basis, while revenue is projected to top $6B in 2017.

Because of the rapid demand across the globe for better, faster cell phone service and improved data speeds, American Tower is in a prime position for organic longer-term growth. Even though they pay a solid 2% dividend, their solid balance sheet allows management to invest in new projects and seek additional acquisitions. On April 6th, American Towered stated they will invest roughly $2B in India, which comes after purchasing a majority stake in Viom Networks.

With Q1 earnings expected to be released on April 29th, bullish traders could consider using options to minimize risk.

American Tower Options Trading Ideas

One could buy the Jan 2017 $105 call for $8.00 or better. Below gives an idea of how I might manage that risk (I’m currently considering this options trade).

Stop loss- $3.50

1st upside target- $14.00

2nd upside target- $20.00

OR alternatively:

One could buy the Jan 2017 $110/$120 bull call spread for a $3.40 debit or better. (This includes buying the Jan 2017 $110 call and selling the Jan 2017 $120 call, all in one trade). Again, my thoughts on how I might manage this one as well.

Stop loss- None

1st upside target- $6.50

2nd upside target- $9.90

Thanks for reading.

Twitter: @MitchellKWarren

The author does not hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.