The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Regional banks and economic data add to market jitters last week, tech comes to the rescue

- The LERI shows corporate uncertainty easing to its lowest level in nearly two years

- In focus this week: Netflix (NFLX), Tesla (TSLA), International Business Machines (IBM), Intel (INTC)

- Peak weeks for Q4 season run from January 29 – March 1

Mixed earnings results and strong economic data out last week induced some market jitters and a VIX that rose to its highest level in over two months.

After lackluster big bank results at the kickoff of the Q4 2023 season, Goldman Sachs and Morgan Stanley started off last week on a more positive note. Both handily beat analyst expectations on the top and bottom-line thanks to year-over-year improvements in asset management, investment banking and equities trading.[1] [2] Smaller US banks, however, didn’t fare as well. In order to compete with higher-yielding instruments, regional banks had to increase payouts on deposits to retain customers which lowered Net Interest Income (NII). Charles Schwab (SCHW)[3], US Bancorp (USB)[4], PNC Financial (PNC)[5] and Citizens Financial (CFG)[6] all pointed to this in their results.

In addition, these banks also saw a hit to the bottom-line from fees paid to the FDIC as they replenish the government insurance fund that was depleted after the failures of Silicon Valley Bank and Signature Bank last year.

Then there was the better-than-expected jobs and consumer data out last week, continuing the trend of “good news is bad news”. On Wednesday, December Retail Sales increased 0.6% vs. economists expectations of 0.4%, pointing to a holiday shopping season that was more robust than previously thought.[7] On Thursday, Weekly Initial Jobless Claims came in at their lowest level since September 2022, showing that a tight labor market is still in play.[8] Markets retreated after both of these reports as investors are likely worried that a hot labor market and resilient consumer may mean fewer rate cuts in 2024. Expectations for a March rate cut dropped to 54% according to the CME FedWatch Tool.[9]

Coming to the rescue late in the week however were once again the tech stocks. A blowout report from the world’s largest chipmaker, Taiwan Semiconductor Manufacturing (TSMC)[10], helped push the Nasdaq Composite higher for the week, and into positive territory for the year after getting off to a rough start. Shares of Apple also added to that boost after Bank of America upgraded the stock to a buy.[11]

After the mixed earnings results from last week, the blended S&P 500® EPS growth rate fell to -1.7% from -0.1% the week prior.[12]

Corporate Uncertainty Eases to the Lowest Level in Nearly 2 Years

Even as the Q4 season gets underway with some shaky results and commentary, our proprietary gauge of corporate uncertainty continues to sport a very low reading. The most recent reading of the Late Earnings Report Index (LERI) shows that fewer companies are delaying earnings reports than advancing them.

The LERI tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The pre-peak season LERI reading for Q4 (data collected in Q1) stands at 74, the lowest reading in nearly two years. As of January 19, there were 55 late outliers and 67 early outliers. This is in stark contrast to the LERI readings from the Q2 and Q3 earnings seasons which showed CEOs at their most uncertain since the COVID-19 pandemic.

Academic research shows for example that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier would suggest the opposite.[13]

T-Mobile (TMUS) is an example of a company with an outlier date this week. T-Mobile is set to report Q4 2023 results on Thursday, January 25, six days earlier than expected. For the last two years TMUS has reported Q4 results on a Wednesday in the 5th or 6th week of the year, in the four years prior the company always reported on a Thursday in the 6th week of the year. This will be the first time they have reported in the fourth week of the year, and their earliest Q4 report date ever since they IPO’d in 2013.

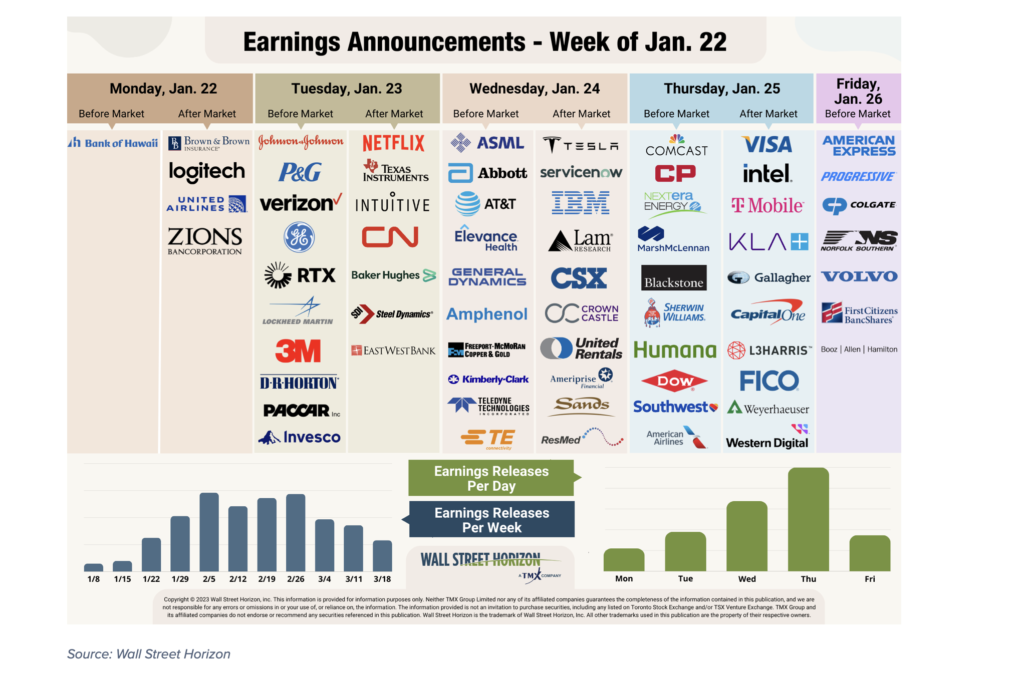

On Deck this Week

The focus will move beyond Financials this week as other sectors start to report their Q4 earnings. Highly anticipated results from Netflix (NFLX) will be out Tuesday, January 23 after the market closes (AMC). According to analysts polled by Factset, YoY EPS growth for NFLX is expected to come in at 1742% which would be the second highest growth rate of any US large cap company this season after Amazon (AMZN).

A closely watched Magnificent 7 component will also be out, when Tesla (TSLA) reports Wednesday, January 24 AMC. Industrials such as 3M (MMM) and Texas Instruments (TXN) will also report results, as well as big tech names International Business Machines (IBM) and Intel (INTC).

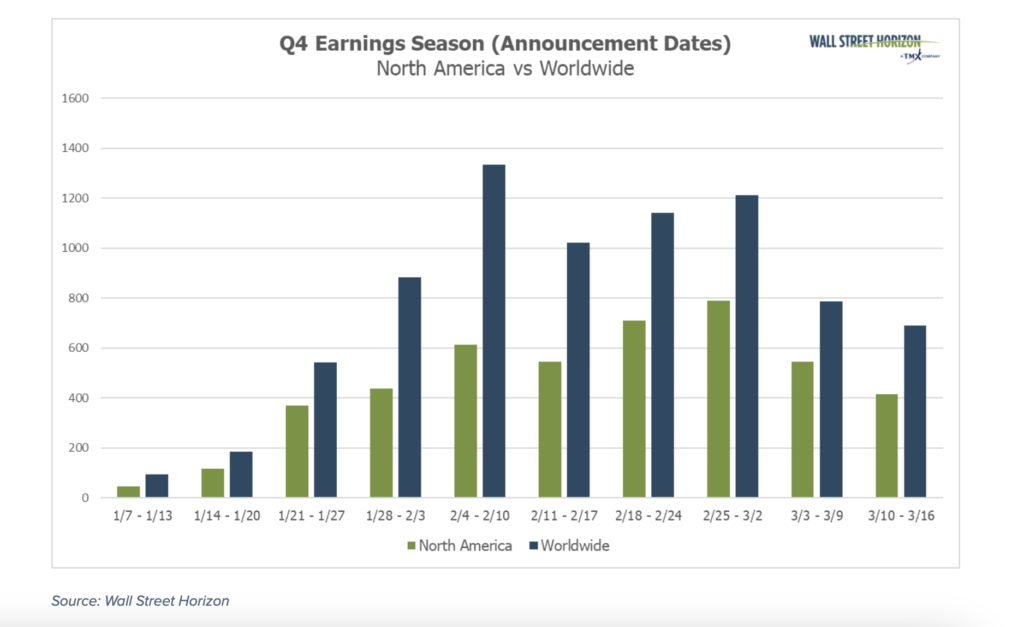

Q4 Earnings Wave

This season peak weeks will fall between January 29 – March 1, with each week expected to see over 1,000 reports. Currently February 22 is predicted to be the most active day with 599 companies anticipated to report. Thus far 47% of companies have confirmed their earnings date (out of our universe of 10,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data. Keep in mind the Q4 reporting season is always a bit more prolonged, typically stretching over four or five peak weeks rather than the usual three peak weeks seen in Q1 – Q3.

Sources:

1 Full Year and Fourth Quarter 2023 Earnings Results, Goldman Sachs, January 16, 2024, https://www.goldmansachs.com

2 Morgan Stanley Fourth Quarter and Full Year 2023 Earnings Results, Morgan Stanley, January 16, 2024, https://www.morganstanley.com

3 SCHWAB REPORTS FOURTH QUARTER AND FULL YEAR RESULTS, Charles Schwab, January 17, 2024, https://content.schwab.com

4 U.S. Bancorp Fourth Quarter 2023 Results, U.S. Bancorp, January 17, 2024, https://ir.usbank.com

5 PNC Reports Full Year 2023 Net Income of $5.6 Billion, $12.79 Diluted EPS or $14.10 as Adjusted, PNC, January 16, 2024, https://d1io3yog0oux5.cloudfront.net

6 4Q23 and 2023 Financial Results, Citizens Financial Group, January 17, 2024, https://investor.citizensbank.com

7 Advance Monthly Sales for Retail and Food Services, United States Census, January 17, 2024, https://www.census.gov

8 UNEMPLOYMENT INSURANCE WEEKLY CLAIMS, U.S. Department of Labor, January 18, 2024, https://www.dol.gov

9 CME FedWatch Tool, CME Group, January 19, 2024, https://www.cmegroup.com

10 TSMC Reports Fourth Quarter EPS of NT$9.21, TSMC, January 18, 2024, https://investor.tsmc.com

11 BofA upgrades Apple stock to Buy citing Vision Pro and generative AI as growth catalysts, Yahoo Finance, Daniel Howley, January 18, 2024, https://finance.yahoo.com

12 Earnings Insight, FactSet, John Butters, January 19, 2024, https://advantage.factset.com

13 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.