The Russell 2000 (IWM) closed over its previous 3 trading days, making a small breakout from a consolidation area that has also held over its 10-Day moving average at $181.38.

Additionally, many of Mish’s Economic Modern Family members are following the same pattern as seen in the above chart.

So far, the weakest Family member is the Biotech ETF (IBB) which is attempting to hold over its 10-DMA.

However, if the rest of the members hold over recent support from their 10-DMA, does this show a turning point for the market, or do we have more downside ahead?

There is no doubt that the stock market is in a tough spot fundamentally with increasing interest rates, inflation, and a downward trend from the technical side.

While traders look for clues for either upside or more downward price action, we continue to expect the market to continue to fluctuate within a range.

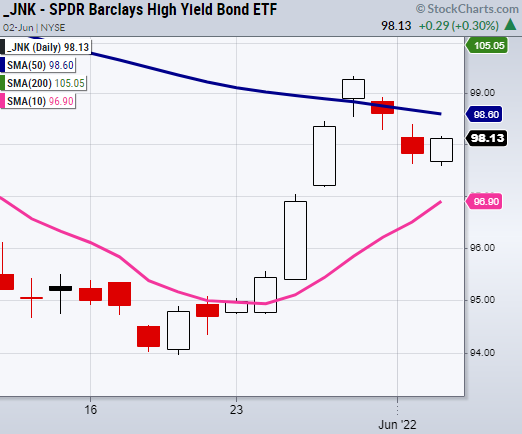

With that said, to focus on the short-term market picture, let’s not forget about the High Yield Corporate Bonds ETF (JNK) which helps us look for direction confirmation.

So far, we have talked about a similar pattern in our Modern Family which gives us a quick snapshot view of where the market is going in key sectors.

Notice how JNK has rallied along with the sectors but has pulled off while other Family members in the above chart are clearing over their previous day’s high.

Now we can look for a divergence in price action if the Family members continue upward while JNK breaks down.

On the other hand, if JNK rallies we could see the market take another step upwards.

Stock Market ETFs Trading Summary:

S&P 500 (SPY) 402 needs to hold. 424 50-DMA to clear.

Russell 2000 (IWM) 191 50-DMA to clear.

Dow Jones Industrials (DIA) 323 support area.

Nasdaq (QQQ) 326 50-DMA to clear.

KRE (Regional Banks) Watch to hold over 64.58 the 50-DMA.

SMH (Semiconductors) 243.40 the 50-DMA to hold over.

IYT (Transportation) 227.36 support area. Like to see this hold over 235.

IBB (Biotechnology) Flirting with the 10-DMA at 116.02.

XRT (Retail) Now needs to hold over the 10-DMA at 64.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.