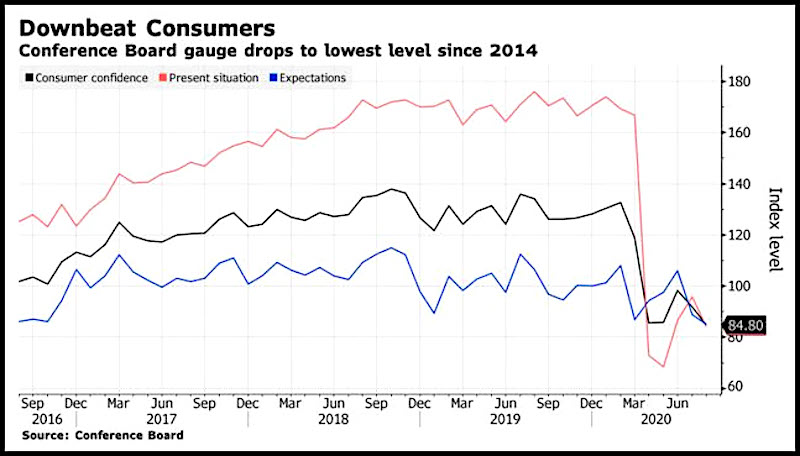

Today we look at consumer confidence survey data, which hit its lowest level since 2014.

At the same time, data on new home sales, and corporate earnings from home builder Toll Brothers (TOL) are at their best levels in years.

It seems inconsistent to have very low AND declining consumer confidence at the same time that there’s a housing boom.

Odd, to say the least.

What is not surprising is that stocks, of course, focused on the bullish data and rallied.

This makes sense considering that housing, real estate, and their related impacts on consumption are often estimated to be responsible for over 10% of GDP.

There are two reasons to take note of the Consumer Confidence data today, and even more importantly, next month’s data.

Low and declining confidence would logically indicate that the economic recovery is happening slower than expected, and this should be bearish for stocks. On a day that didn’t have conflicting bullish news, this data may have caused stocks to selloff.

Additionally, there is some bullish news here. Consumer confidence will come back. With it sitting at such a low level, its return will be big. And when the market sees big gains in consumer confidence, even from a low level, it will be bullish for stocks.

It may not be next month, but keep your eye out for these reports going forward.

Note: PDL = Prior day low, PDH = Prior day high

S&P 500 (SPY) All-time high. 340 then 335 are important support.

Russell 2000 (IWM) Closed over PDH. Now sitting on 10 DMA. Key area to break is 157, then 160 is resistance area. Support at 155 then swing low is 153.60

Dow Jones Industrial Average (DIA) New swing high then consolidation. Gap fills at 291. Support at 280.

Nasdaq (QQQ) Inside day. 275 is pivotal support area. 260 is key support level and a trendline.

TLT (iShares 20+ Year Treasuries) Gapped down into the middle of its range 167-163. In a Warning Phase.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.