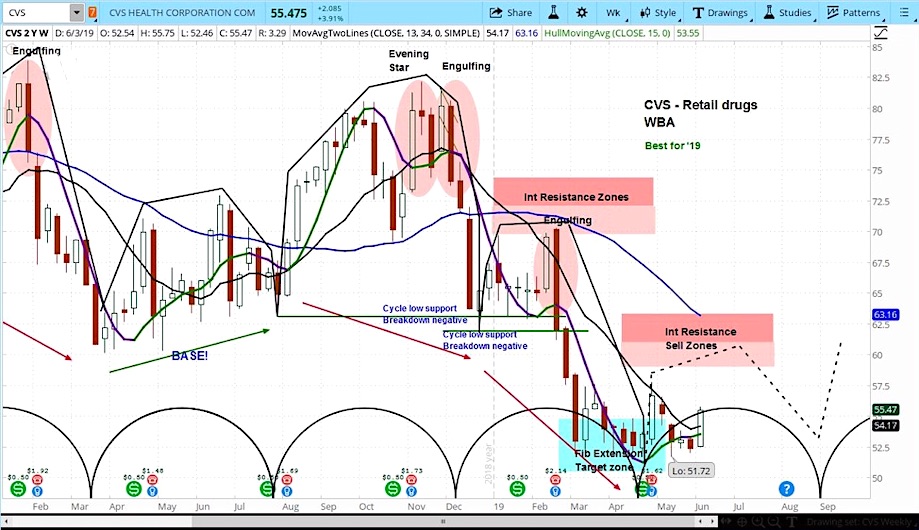

CVS Stock “Weekly” Chart

Shares of CVS (NYSE: CVS) are in rally mode after the company delivered a compelling vision for how it plans to thrive in the US healthcare sector on Tuesday.

Based on the stock’s market cycles, we see further upside for CVS stock (CVS)

At its investor day event, CVS explained its plans for reshaping healthcare in America. According to management, this begins with its acquisition of Aetna and building out the CVS HealthHub concept, which has the capacity to meet 80% of the scope of a primary care practice.

CEO Larry Merlo said, “Our mission is to be the most consumer-centric health company in the country. With nearly 70% of people living within 3 miles of a CVS pharmacy, we believe we have an unparalleled community presence.”

Our approach to stock analysis focuses on market cycles. CVS is likely still in the rising phase of its current cycle, which points to further upside. Using our Fibonacci-based intermediate resistance zone, our near term target is $59-61.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.