Broad Stock Market Outlook for March 22, 2018

This morning’s action across the board looks weak as supports are tested across the board, giving back the bounce from prior days. Bounces are still likely to fail here, but the formation is still not trending overall.

Watch your edges and manage risk especially in these sideways formations. With the lower open, support is critical.

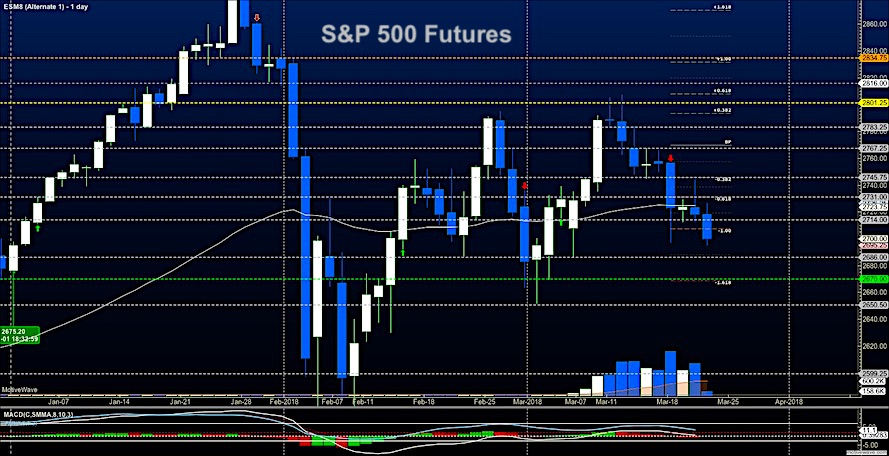

S&P 500 Futures

Support has broken but – taking a short here will expand risk due to the shape of the current formations having flat slope and the critical zone that we all see. We sit in bearish patterns but at key support so we should bounce off the morning lows. First pass bounces should still fade. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2726.5

- Selling pressure intraday will likely strengthen with a bearish retest of 2695

- Resistance sits near 2707.5 to 2716.5, with 2726.75 and 2734.75 above that

- Support sits between 2699.75 and 2688.75, with 2681.5 and 2667.5

NASDAQ Futures

NQ_F- Dips lower and fades to break us lower in a current intraday trending formation that is certainly bearish but at support levels that are important. We will see a battle to recapture strength here if buyers have the ability to do so. Resistance remains formidable. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 6854

- Selling pressure intraday will likely strengthen with a bearish retest of 6805.5

- Resistance sits near 6823.5 to 6854 with 6912.5 and 6949.5 above that.

- Support sits between 6810.5 and 6790.75, with 6769.75 and 6733.75 below that.

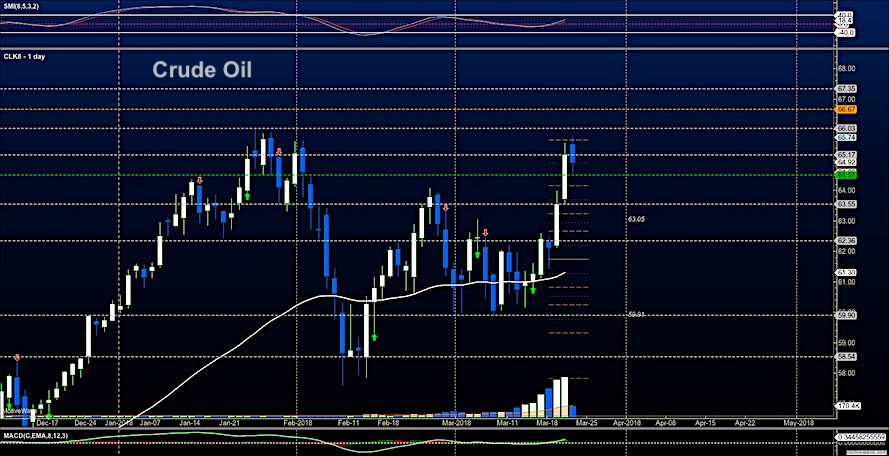

WTI Crude Oil

Expansions to higher resistance stopped at the 65.7 region as sellers began to gain strength in this area. Momentum is bullish and the price is somewhat extended but the formation suggests that pullbacks will still be buying zones with higher support showing near 63.9. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 65.25

- Selling pressure intraday will strengthen with a bearish retest of 64.87

- Resistance sits near 65.17 to 65.54, with 66.04 and 66.63 above that.

- Support holds near 65.01 to 64.6, with 63.96 and 63.44 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.