In this week’s investing research outlook, we analyze the current trend of the S&P 500 Index (INDEXSP:.INX), key stock market indicators, and discuss emerging themes and news that we are watching closely in our investing research.

Here’s a summary of our findings for the week ending June 16, 2017:

Tensions Between Stocks and Bonds – The S&P 500, Dow Industrials and Russell 2000 all have made new highs this week, while the 10-Year Treasury Note Yield (INDEXCBOE:TNX) dropped to its lowest level of the year. With its rate hike yesterday, the Fed seems to have sided with the confidence being displayed by stocks rather than skepticism expressed by bonds.

Copper Continues to Consolidate; Gold Unable to Breakout – The commodities markets are also tilted toward the economic confidence camp. Copper has not built on its breakout, but continues to see price consolidate while momentum is re-building. Gold (NYSEARCA:GLD) has rallied to downtrend resistance but, as was the case last year, has been unable to sustain a breakout.

Stocks Strengthen Beneath the Surface – The new highs in the popular averages come as some recently high-flying mega-caps have run into turbulence. This has caused recent leaders (like the NASDAQ 100 index and the Technology sector) to stumble, but beneath the surface trends are improving. The percentage of stocks in uptrends is expanding and the Financials sector is seeing renewed strength.

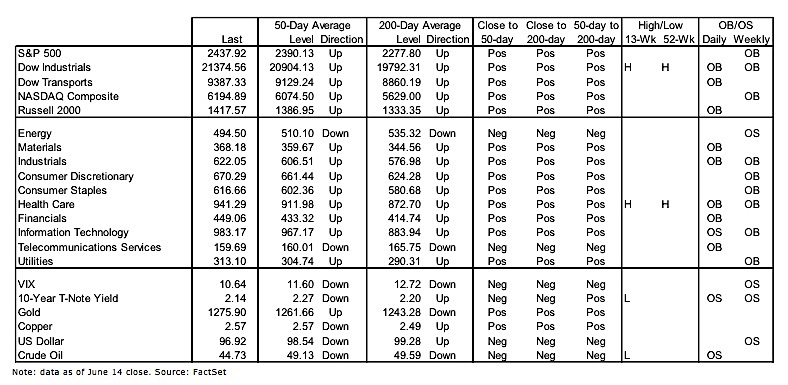

Stock Market Indicators

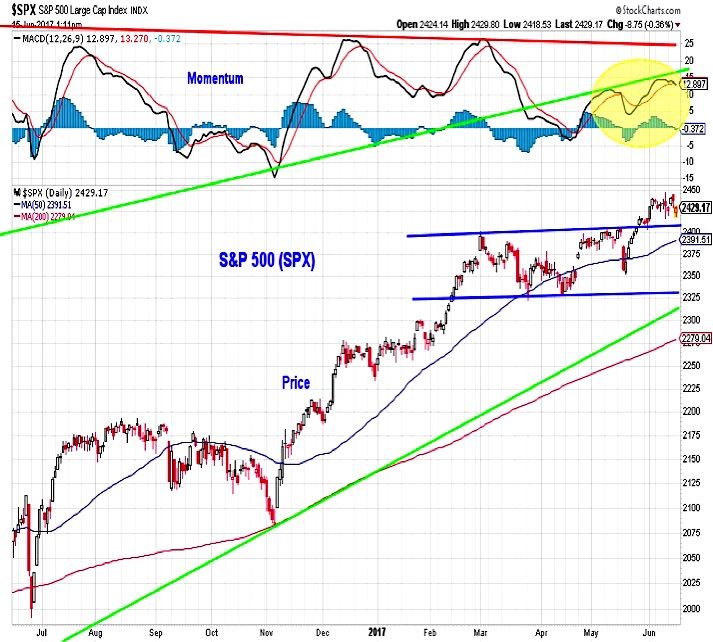

S&P 500 Index

The S&P 500 continues to drift higher from a price perspective, but without a meaningful expansion in momentum, near-term upside may be limited. The recent stumbles from the mega-cap leaders has been amply absorbed as rally participation is broadening and new leadership is emerging (more on this later). Completing the process of leadership rotation could leave the market vulnerable to some near-term consolidation. If that is seen, 2400 and 2325 look like support levels.

10 Year US Treasury Note Yield

While the S&P 500 has moved to new highs, the yield on the 10-year T-Note has moved to its lowest level of 2017. While yields have moved lower, momentum has made a higher low, suggesting that yields could be overdone on the downside. If the bond market buys into the confidence being expressed by the Fed (the return of upside economic data surprises could help), yields could turn high heading into the second half of 2017.

Gold & Copper Prices

Commodities markets seem to be signaling more confidence than skepticism. The price action for gold is different than for copper, but the macro message (confidence, not skepticism) is similar. While Gold has rallied in 2017, this rally has stopped at downtrend resistance and has come within the context of a momentum downtrend. The failure to break above $1300/oz could set up a test of support below $1200/oz.

continue reading this article on the next page…