Here’s a breathtaking fact: The IBB (Biotech Index) went down 33% from peak to trough during the “Great Recession.” The IBB is now down 40% from peak to trough in the last few months, and we haven’t even seen a real correction in the broader stock market. In fact, The Dow Jones Industrial Average is up on the year.

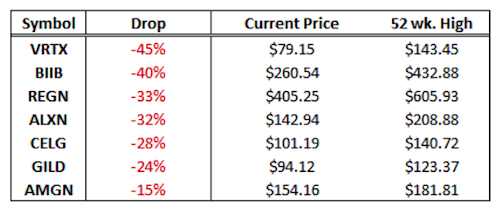

Here is how far some of the best large cap biotech stocks have fallen from their highs:

While the rest of the market is seeing slower earnings and revenue growth, and the private equity world is seeing “unicorns” get hammered, biotech is neither of these phenomena. The political landscape is partially a driver but biotech has been booming and the current sell-off may prove to be one of the greatest opportunities in a decade to participate in the radical innovation coming from this industry.

Let’s take a look at what’s really happening across some of the top large cap biotech stocks.

Gilead (GILD)

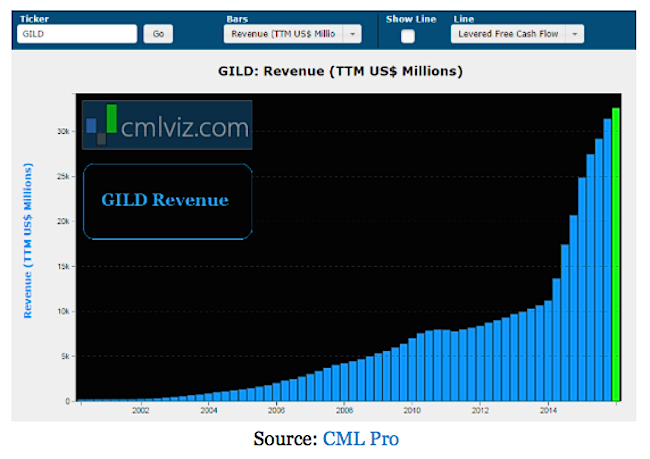

Gilead’s stock price is down nearly 25% from its highs, but this is what revenue looks like:

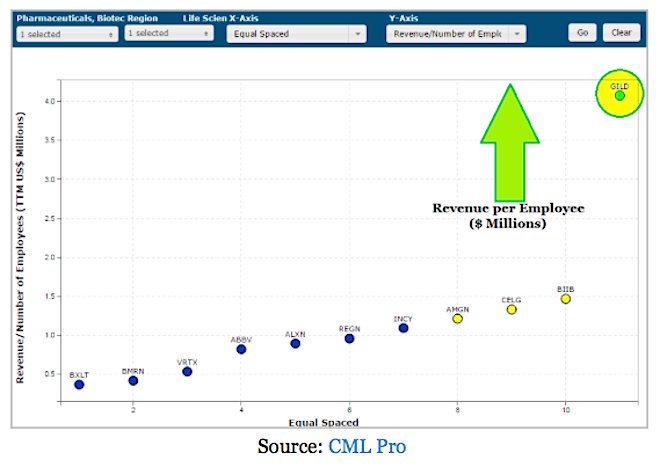

Gilead revenue is up 31% year-over-year. Now, there is a deeper story behind new competition to Gilead’s massive HCV, HIV and hepatitis franchises, but let’s not lose the forest for the trees — GILD is crushing it. Here’s a chart of revenue per employee for all biotechs larger than $15 billion:

Gilead generates over $4 million in revenue per employee and no other biotech in this peer group is even at $1.5 million. Need more data? Try this: This next chart plots the number of phase III trials each firm has that are ongoing. Phase III trials are the final tests prior to FDA approval:

Now, many of these trials are for already existing drugs in an effort to expand their labels for other maladies, but again, let’s not lose the forest for the trees. Does getting this stock at a 25% discount feel like a potential investment opportunity?

Celgene – (CELG)

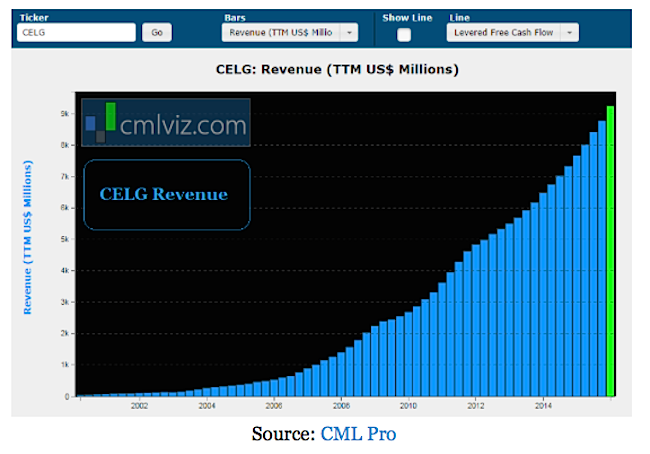

Celgene’s stock price is down 28% from its highs, but this is what revenue looks like:

Celgene’s revenue stands at $9.2 billion and is up 21% in the last year. Even further, CELG released forecasts all the way out to 2020 and the firm estimates revenue will hit $21 billion in five years. Totally nuts? Well, try this: last year Celgene forecasted revenue for 2020 as well and came out with $20 billion. That means with one year more visibility the company actually raised that ridiculous growth number.

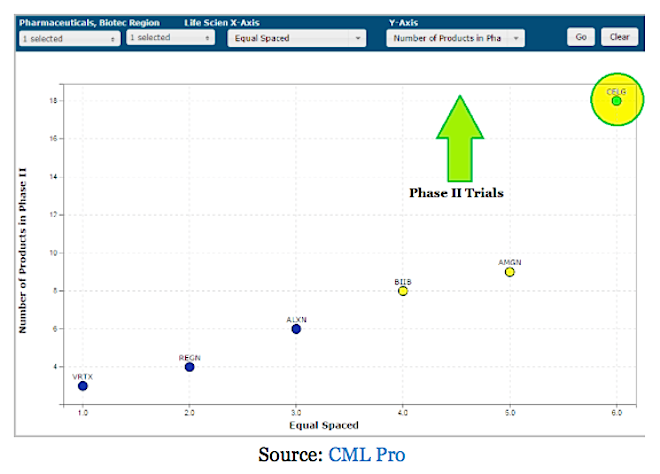

This next chart plots the number of phase II trials each firm has that are ongoing. Phase II trials are the second to final tests prior to FDA approval:

Celgene has the single largest pipeline of drugs in Phase II studies than any other biotech, is growing revenue by 20% a year and has forecasts out to more than double total revenue within five years. It has four “blockbuster” drugs generating over $1 billion in sales each to go along with its fantastic pipeline.

Now let’s look at some more charts of leading biotech stocks.

continue reading on the next page…