Money Flow, Foreign Investments and Trade: Modern Day Lessons from Richard Cantillon

“But the resource of these borrowings which gives a present ease comes to a bad end and is a fire of straw. To revive a State it is needful to have a care to bring about the influx of an annual, a constant and a real balance of Trade.” – Richard Cantillon

The 18th century economist, Richard Cantillon, warned that an overabundance in the money supply as a result of foreign investments or trade surplus makes for dangerous economic kindling. Excess money, he said, accelerates the domestic economy by making money and credit easy to come by, and eventually this drives prices up until a crisis results.

The collapse of the US housing bubble and the ongoing global financial crisis stand testament to this.

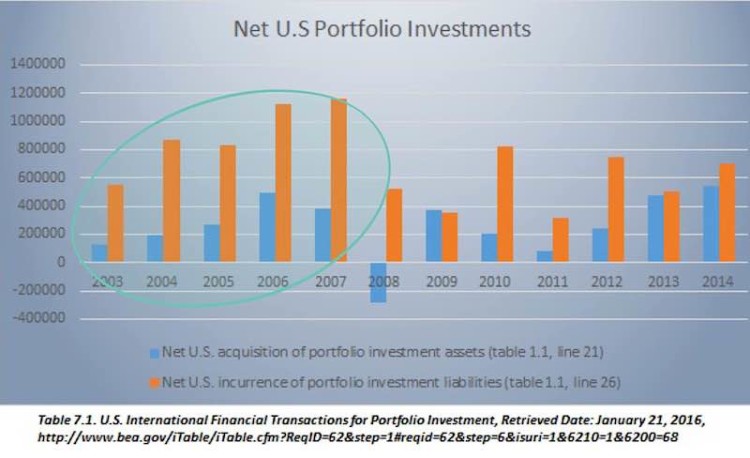

Figure 1 Table 7.1 U.S. International Financial Transactions for Portfolio Investments, Retrieved January 21, 2016, Bureau of Economic Analysis

Richard Cantillon argues that surpluses in foreign trade and foreign investment are typically the source of too much money in a given system. A surplus in foreign investments for U.S. securities is indeed what we saw in the earlier part of decade leading up to the crisis. Figure 1 compares foreign investments in U.S. securities (orange) vs U.S. investments in foreign securities (blue), and depicts the large imbalance in investment-related money flow leading up to the peaks in 2006 and 2007.

I have already remarked that an acceleration or greater rapidity in circulation of money in exchange, is equivalent to an increase of actual money up to a point. I have also observed that the increase or decrease of prices in a distant Market, home or Foreign, influences the actual Market prices. On the other hand money flows in detail through so many channels that it seems impossible not to lose sight of it seeing that having been amassed to make large sums it is distributed in little rills of exchange, and then gradually accumulated again to make large payments …. It is also usually the case that the increase or decrease of actual money in a State is not perceived because it flows abroad, or is brought into the State, by such imperceptible means and proportions that it is impossible to know exactly the quantity which enters or leaves the State. (Richard Cantillon, II.VI.6).

Much ado has been made about the Federal Reserve’s use of repo to backstop the liquidity crisis in the banks following the acceleration of the crisis. The irony is that there was less concern of having far too much money in the system to begin with because of the surplus in foreign investments that increased the money supply that fueled the boom and bust of the housing crisis.

Quantitative Easing: Effect on the Money Supply

The liquidity effect of the Fed’s repo operations has been hotly debated since the crisis, as well as the Federal Reserve’s response to it. Many have argued “printing money” would result in another crisis in the form of hyperinflation, but in our current deflationary environment this fear has proven unfounded because risk-averse investors will move out of stocks and other investment vehicles into the perceived security of government bonds, U.S. treasuries, and the like. Capital flight into bonds depresses yields, absorbing any excess liquidity. Cantillon writes:

As to subsidies which the State has received from foreign powers, either they are hoarded for State necessities or are put into circulation. If we suppose them hoarded they do not concern my argument for I am considering only money in circulation. Hoarded money, plate, Church treasures, etc. are wealth which the State turns to service in extremity, but are of no present utility. (Richard Cantillon, II.VI.23).

Hoarding in a risk-off environment demonstrates the limits of monetary tools to prop up prices when investors already lack the faith to put money into riskier ventures. Hoarded money doesn’t add inflationary pressure; as Richard Cantillon writes, it has “no present utility”. This means that, so far, concerns regarding QE are misplaced. However, fear will eventually subside and money hoarded will begin to flow out of savings/bonds. In the chart above, growing investor confidence saw some measure of that money begin to flow abroad in 2013 and 2014.

Richard Cantillon’s Second Warning: Trade Balances

The negative net balances of exports versus imports of goods and services is probably not surprising. However, what we see when we compare Net Goods and Services (Figure 2) to Portfolio Investments (Figure 1), is that any risk of excess money flow out of the country as a result of trade deficits was more than balanced against in foreign investments. Further, Portfolio Investments (Figure 1) signal that there is a trend (2013-2014) to encourage outflow of money abroad once confidence returns and hoarding ends.

Figure 2 Table 1.1 U.S. International Net of Goods and Services and Income Receipts, Retrieved February 23, 2016, Bureau of Economic Analysis

The Take Away

Richard Cantillon reminds us that an imbalance of payments either moving abroad or brought in to the state because of foreign investments and foreign trade serves as the kindling for the next crisis. The present crisis saw the influx of a massive imbalance in the flow of investment dollars leading up to the housing boom and bust in 2006 and 2007. As that imbalance corrects itself, we must not now ignore the other great drivers of money flow: trade and labor. Moreover, the effectiveness of monetary policy has limits in a deflationary environment in which there’s hoarding of excess liquidity.

Thank you for reading and have a great week.

More from Maria: “Low Commodity And Wage Costs Will Drice Next Growth Cycle“

Article References:

Cantillon, Richard, Essai sur la Nature du Commerce in Général (Essay on the Nature of Trade in General). Henry Higgs, ed. and trans. 1959. Library of Economics and Liberty. 19 February 2016. <https://www.econlib.org/library/NPDBooks/Cantillon/cntNT.html>.

Twitter: @rinehartmaria

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.