A month ago I pointed out in a note about the S&P 500‘s (Select SPDR ETF: SPY – Quote) fibonacci pullback sequence that the modest and viciously negated corrections that equities continue to have are anything but random in a larger context – all building out as separate, strikingly similar leaves on the same up-trending branch of pullback and advance.

A month ago I pointed out in a note about the S&P 500‘s (Select SPDR ETF: SPY – Quote) fibonacci pullback sequence that the modest and viciously negated corrections that equities continue to have are anything but random in a larger context – all building out as separate, strikingly similar leaves on the same up-trending branch of pullback and advance.

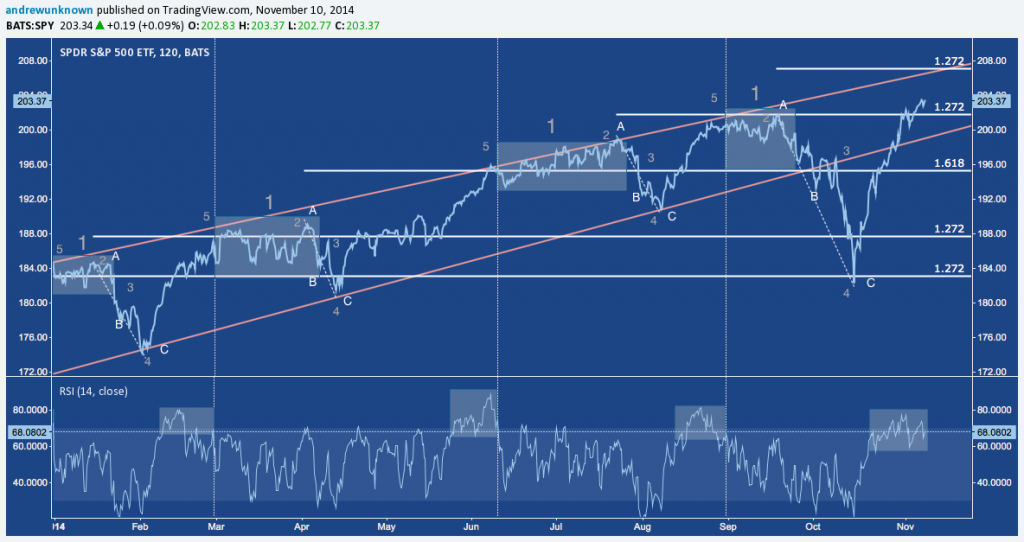

Here’s what we noted then, following in the wake off the V-bottom move off the mid-October lows:

SPY has regained the 2013-2014 Rising Channel, where overhead trend line resistance coincides in price and time with the 127.2% extension, giving a higher probability target for the current leg up near 207.

The chart featured then:

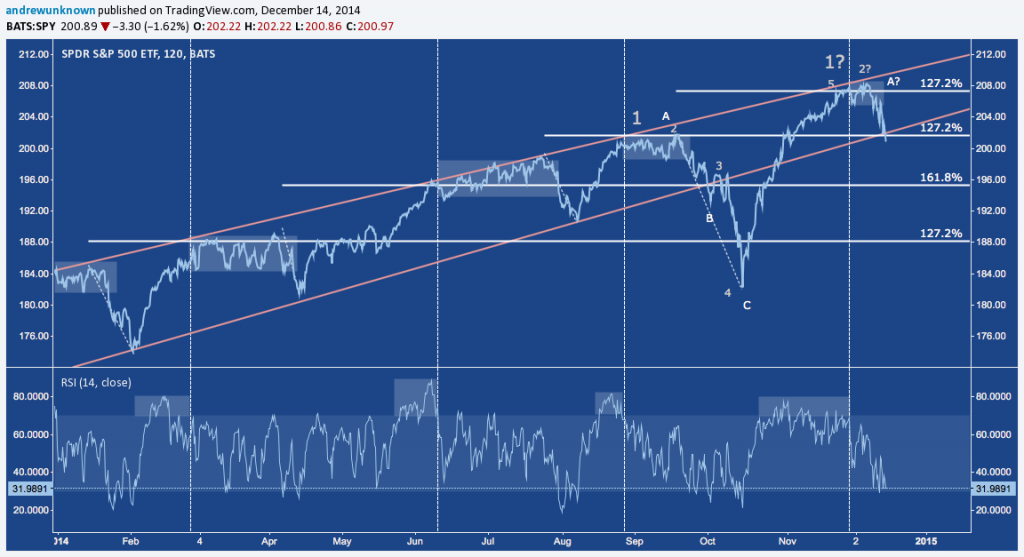

And here’s how the sequence has played out on the same chart 5 weeks later:

So what’s next? Whether drawn on an arithmetic or log scale, SPY’s rising channel (orange) has broken down a second time this year. The increasingly porous nature of this trend line doesn’t necessarily invalidate the rising channel; but following quickly on the heels of October’s violation, it does make it somewhat tenuous as a technical foothold. At the least, the dominant technical feature of the S&P 500 last year (actually the last 2.5 years) is faltering. Whether the trend can move higher by reasserting itself is now the question, rather than the presumptive scenario.

So what’s next? Whether drawn on an arithmetic or log scale, SPY’s rising channel (orange) has broken down a second time this year. The increasingly porous nature of this trend line doesn’t necessarily invalidate the rising channel; but following quickly on the heels of October’s violation, it does make it somewhat tenuous as a technical foothold. At the least, the dominant technical feature of the S&P 500 last year (actually the last 2.5 years) is faltering. Whether the trend can move higher by reasserting itself is now the question, rather than the presumptive scenario.

Looking backward across 2014, the average of the 4 pullbacks noted is -6.25%, plotting a pullback off the recent ATH at 208.47 to 195.44. RSI is near 30, but note RSI reached this oversold threshold -2.6% into October’s decline; only to nearly triple the decline creating that condition before October 15’s bounce. If this decline follows October’s script to any degree (as it has by breaking the channel), some noise may occur around 200 (note September’s resistance is potential support) creating a “B” wave before pushing lower.

Twitter: @andrewunknown

Author holds no exposure to instruments mentioned at the time of publication. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice.