November delivered a different tone compared to the last few months, with markets grappling with renewed volatility, concerns over stretched valuations, and uncertainty around the path of monetary policy.

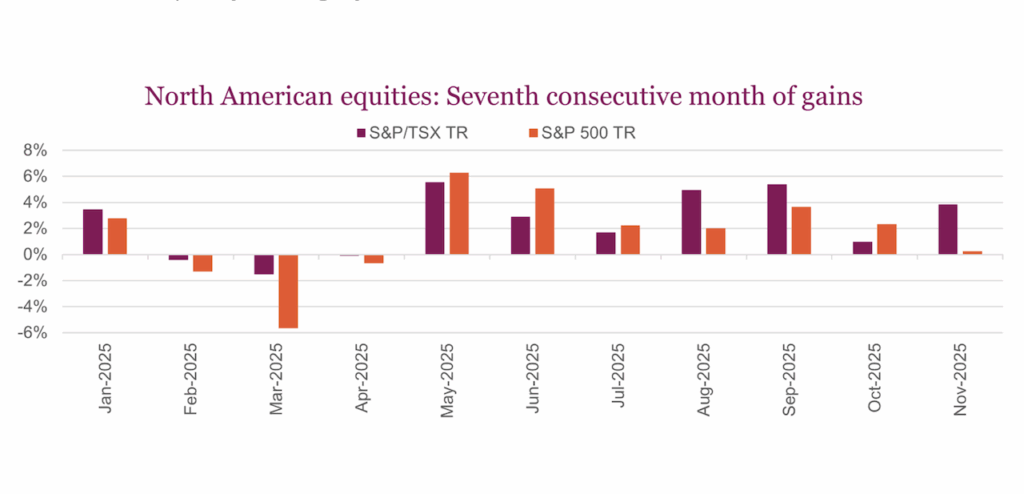

Still, North American equities managed to claw back from mid-month losses to finish in the green for the seventh consecutive month of gains, supported by solid earnings and expectations for continued policy easing by the Fed.

The S&P 500 Index (INDEXSP: .INX) eked out a 0.25% gain on a total return basis in November, its worst performance since April, after spending most of the month in the red.

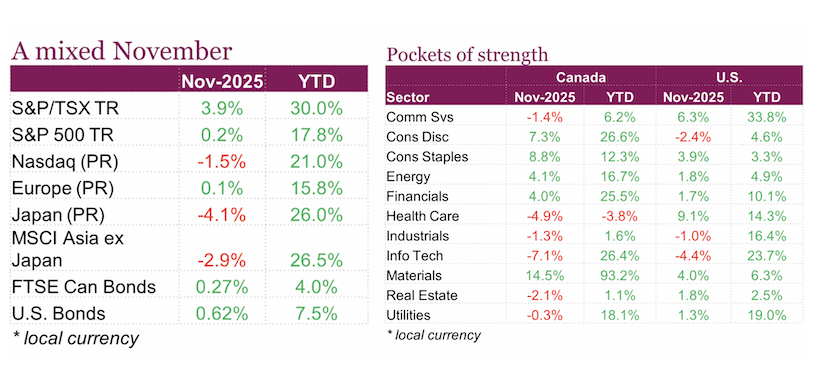

Investors digested mixed economic data, the lingering effects of the U.S. government shutdown, and rising questions around the sustainability of AI-driven capital spending. Profit-taking hit the tech sector particularly hard, leading to a -4.4% sector decline despite another quarter of blockbuster earnings.

Overall, growth stocks underperformed value significantly, reversing the trend that had dominated most of the year. Still, the U.S. earnings picture remained impressive, with S&P 500 operating earnings and revenues surprising to the upside. Sentiment remains mixed, as the U.S. economy contends with a K-shaped economy although optimism is growing by the prospect of further Fed easing at the December meeting.

Luckily the story was a bit different in Canada, with equities delivering stronger returns. The TSX Composite Total Return Index gained 3.9%, with Materials once again leading the way. Global markets outside North America were mixed, with Europe’s major indices flat to slightly lower, while Asian equities struggled, led by losses in Japan, Korea, and Taiwan.

Fixed income markets were generally strong in November, helped by falling U.S. Treasury yields and expectations for additional rate cuts. U.S. aggregate bonds gained 0.6%, while Canadian aggregate bonds rose 0.3%. This came after the Fed cut rates to 4.0% in late October, and markets began to price in an additional 25 bps cut at its December meeting.

The impact of the government shutdown on economic data releases left policymakers leaning on private-sector indicators, which painted a mixed picture. Still, the consensus remains that the labour market is weakening and inflation appears controlled, giving the Fed the ability to ease further. In Canada, markets expect rates to remain unchanged for the foreseeable future as the BoC weighs stronger-than-expected Q3 GDP growth, surprise labour resilience, and controlled inflation against weakening domestic demand, stagnant business investment, and softening consumer spending.

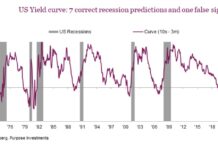

Looking ahead, December tends to be favourable for equities, but this year has been anything but normal. Elevated valuations, questions around the stability of AI-related investment, and deteriorating forward growth indicators could limit the upside. At the same time, strong earnings fundamentals, seasonal tailwinds, and a supportive policy backdrop continue to boost optimism. This has left investors entering the final month of the year balancing familiar year-end optimism against a growing list of macro, market, and geopolitcal uncertainties.

Apart from a volatile spat in March/April and a few smaller wobbles, 2025 has been a solid year with the most recurring theme: joy with a high level of nervousness. In our Outlook 2025: Three in a row?”, we questioned if either the KC Chiefs or the markets could achieve three in a row victories. We now know the Eagles prevailed last February, but it seems the markets pulled it off.

And while the headline noise remains challenging and does inject brief spats of volatility, it is the underlying fundamental trends that really delivered. The economy remained decent, not great but just good enough. Inflation remained somewhat contained, moving a bit higher in a few pockets, but generally a mildly lower trend. This was good enough to keep bond yields rangebound, currently near the lower end of that range. Meanwhile, earnings delivered. S&P posted decent earnings growth as did most other jurisdictions. This was in contrast to the previous few years where S&P earnings growth was materially higher than most other major indices.

We could argue a Santa Claus rally seems unlikely, considering it appears Santa came really early this year and already dropped presents into investment accounts. But who knows, this could just push till the end. December often does see larger market moves, more up than down, in part due to investor unwillingness to realize gains late in the year, as lighter volumes tend to exacerbate market moves

This report is authored by Craig Basinger, Chief Market Strategist at Purpose Investments Inc.

Sources: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.