The answer is no, which means, as of this writing, the net aggregate opinion favors higher highs in the coming months relative to lower lows.

The previous sentence contains a probabilistic statement based on the facts we have in hand today. If the facts change in a material manner, we must reassess the probabilities.

PATTERNS REFLECT COMMON HUMAN BEHAVIOR

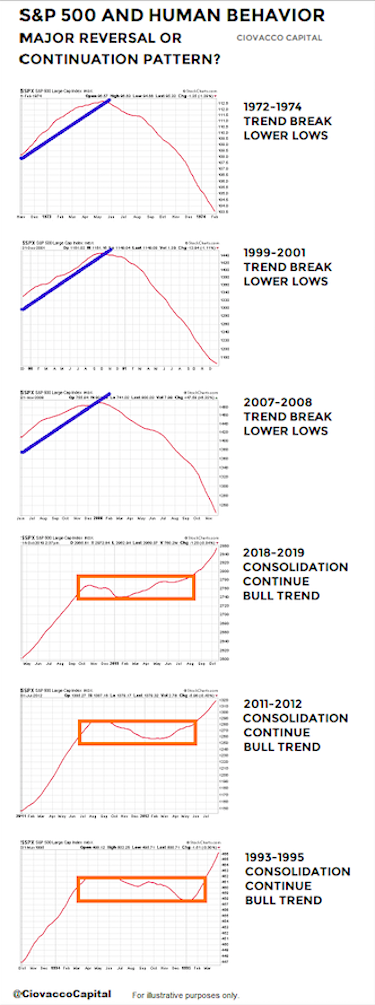

The 200-day is useful here because we have a discernible pattern, just as there were discernible patterns in the three major bear market cases. In a continuation-pattern scenario, the net aggregate opinion over time is adversely impacted by a set of concerning issues (think Fed policy errors and the trade war in 2018).

These issues cause the net aggregate opinion to shift in a similar manner to what transpired near the major S&P 500 peaks in 1973, 2000, and 2007. The difference in the continuation-pattern case is the concerning issues are addressed in some manner (Fed shifted in early January 2019 and trade has been trending in the right direction).

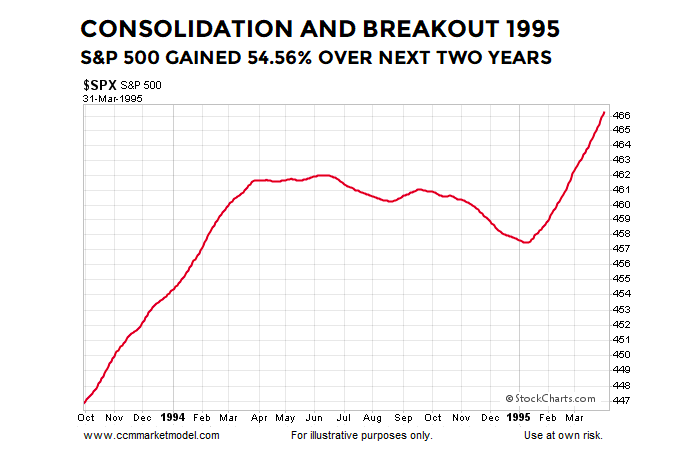

Thus, in the continuation-pattern cases, the net aggregate opinion shifts back to a bullish bias allowing the prior bullish trend to continue, which is exactly what happened in the 1994-1995 case shown below. The combination of factors is unique in each case, but the net outcome is the same. After consolidating and breaking out, the S&P 500 resumed its bullish trend and gained 54.56% over the next two years from the date shown on the chart below.

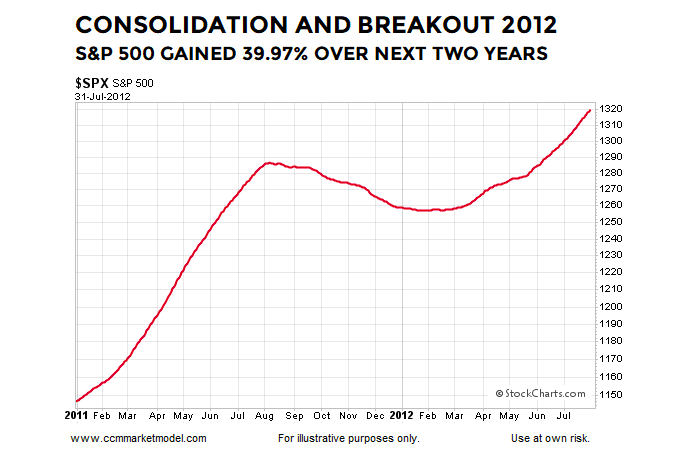

A similar shift in fundamental perceptions and human expectations occurred in the 2011-2012 continuation-pattern case. Once again, the combination of fundamental issues were different in the 1994-1995 and 2011-2012 cases, but the net interpretation and subsequent behavior by market participants was very similar. The results were similar as well; from the date shown in the chart below, the S&P 500 gained 39.97% over the next two years.

INSTITUTIONS AND FUNDAMENTALS

It would bolster the bullish thesis above if (a) present day fundamentals supported ongoing expansion over an imminent recession, and (b) if institutions were still open to bullish economic and market outcomes. This week’s CCM stock market video looks at fundamentals and technicals which support the “avoid a recession” case and the “institutions have not given up on this market” case. After viewing the facts presented in the video, you can draw your own conclusions.

EXECUTIVE SUMMARY

Keeping in mind chart patterns enable us to monitor shifts in the net aggregate opinion of all market participants regarding all subjects on all timeframes, does the pattern in 2019 look more like the major-topping patterns or more like the continuation patterns?

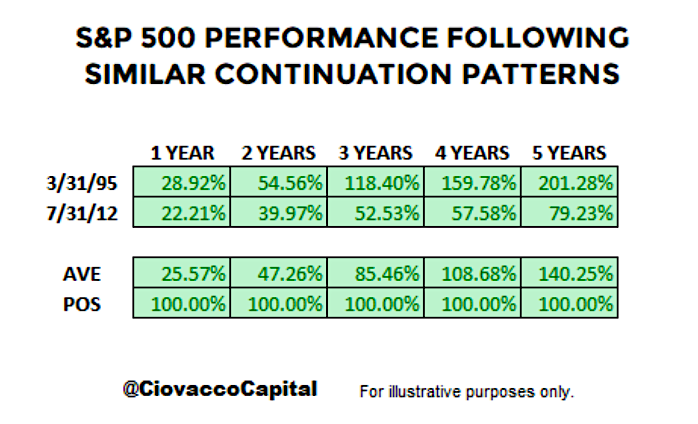

Since there is no question 2019 looks more like 1993-1995 and 2011-2012, it might be helpful to know what happened next in the two continuation-pattern cases. As the table shows below, the S&P 500 did continue the bullish trend and posted very impressive gains over the next five years.

ANALYSIS SPEAKS TO ODDS

Logic can be used to minimize the odds of repeating common investing missteps. The weight of the evidence says we should remain open to better than expected stock market outcomes while respecting the odds are based on the information we have in hand today. When the next major bear market arrives, the concepts outlined above will still be helpful; the message will simply shift from “sit tight with growth-oriented investments” to “take action to reduce risk to our hard-earned principal”. We will continue to take it day by day, while remaining open to all outcomes from wildly bullish to wildly bearish.

This week’s stock market video will most likely expand on the concepts covered above. Recent studies involving the market action near the 200-day and Fibonacci retracements align with the continuation-pattern thesis above.

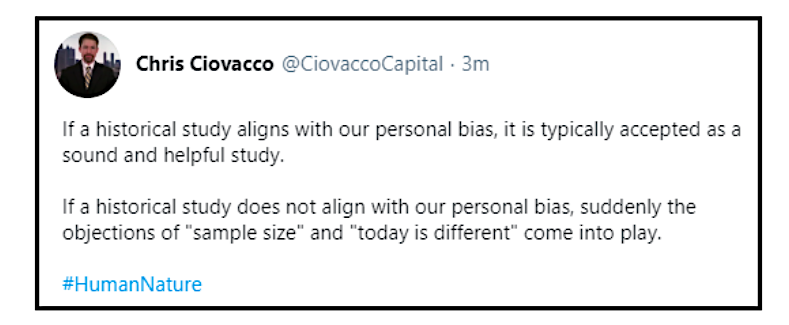

WHAT ABOUT SMALL SAMPLE SIZES?

We cannot control sample sizes. There have only been three 40%-plus declines in the S&P 500 since 1950 (1973-74, 2000-2002, and 2007-2009), which represents a very small sample size. Are we supposed to totally ignore these major declines because of the small sample size? According to Reuters, the S&P 500 was officially launched on March 4, 1957, meaning any S&P 500 study deals with a very limited historical data set. It is what it is.

When we study rare events, we acknowledge the sample size and try to learn anything that can add value in the present day. There are countless economic and market studies that are based on small sample sizes. Typically, the small sample size argument is only raised when the results run counter to someone’s personal opinion. When results agree with someone’s personal view, the small sample size is suddenly not a problem. If you believe a study or data set is irrelevant, there is an easy solution – ignore it.

Twitter: @CiovaccoCapital

The author or his clients may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.