Friday’s trading session began with an oversold bounce. Although the markets weren’t near correction territory, they had been seeing a lot of selling lately. The S&P 500 Index (INDEXSP:.INX) was down 8 days in a row coming into Friday. So a bounce felt overdue.

Well, the S&P 500 kept its streak alive. Sellers returned by the afternoon and drove the index lower once more – 9 days in a row!

Throughout the day, we shared some excellent charts on our Twitter stream (and in articles here on the site). Here’s a taste of some important market charts and insights. Enjoy.

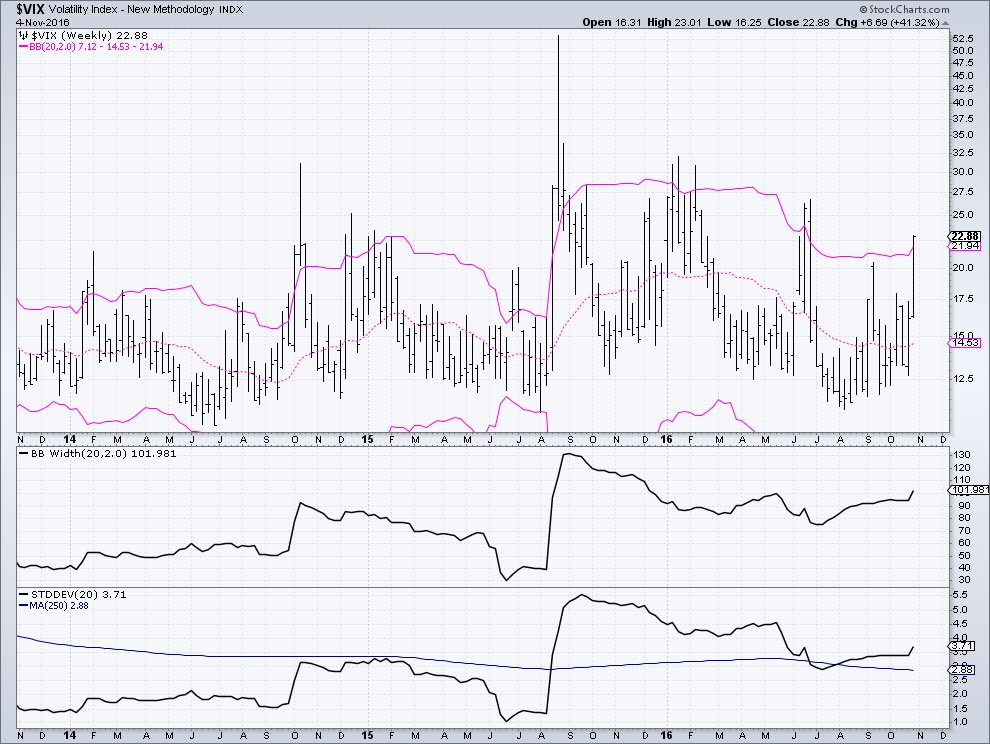

1). Steve Deppe (@SJD10304), a fellow See It Market contributor pointed out that the CBOE Volatility Index (INDEXCBOE:VIX) finished the week above it upper Bollinger Band. That’s a sign that fear is in the air…

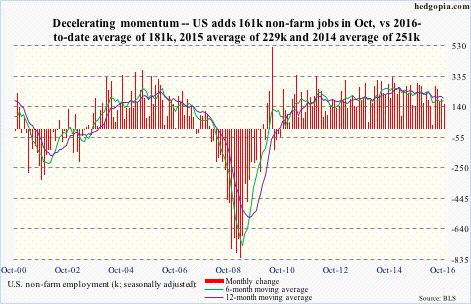

2). Paban Raj Pandey (@hedgopia) looked at the Friday jobs report and noted that the 161K in job adds wasn’t all that exciting. In fact, the 6 month average has been below the 12 month average for 7 straight months!

3). The Volatility Index (VIX) is shooting higher this week. Mark Arbeter highlights some past VIX sell signals (equity buy signals) and explains the 3-step process for a VIX buy/sell setup…

4). Aaron Jackson (@ATMcharts) continues to contribute some great charts to our stream. He points out that the Transports (NYSEARCA:IYT) are showing relative strength. If Transports can hold there own, perhaps the selloff is nearing an end… or close to it.

5). The Health Care sector (NYSEARCA:XLV) has been a mess lately. Aaron Jackson points out that the deep selloff may soon see a relief bounce as XLV is nearing notable technical support.

Thanks for reading and safe trading.

Twitter: @andrewnyquist

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.