Stocks continue to push higher, as the investors begin to jump on the market train (see: investor sentiment data).

But amidst a dizzying news cycle and non-stop social media, it’s difficult to find appropriate perspective.

With this in mind, I think it’s always a good idea for investors to “ground” themselves in some macro themes and considerations that are present in the marketplace.

Here’s a look at 5 global macro investing themes I’m watching across the financial markets:

1. Global macro Pulse: Overall the data remain consistent with a global economic upturn, with signs of a maturing cycle which should be inflation positive and negative bonds.

2. Economic Policy Uncertainty: The charts and indicators that we watch show risk appetites seem to have decoupled from economic policy uncertainty. However, this disconnect is unlikely to last as the global monetary policy tides begin to turn.

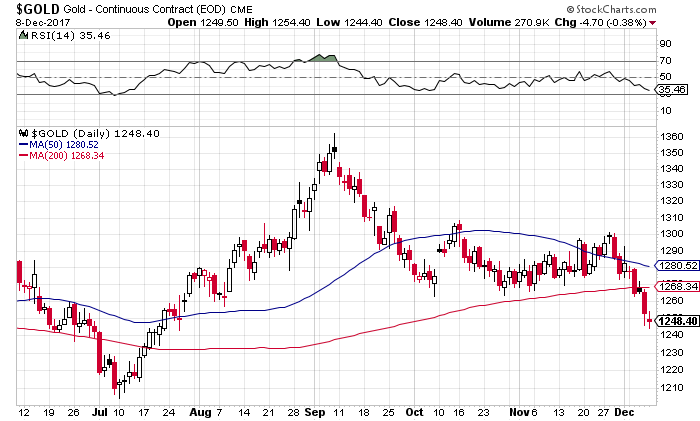

3. Out with the Gold: There are several key factors and graphs which inform the risk vs reward outlook for the gold price – a must see piece of research for those active in this market.

4. Australian Equities: Despite macro risks, Australian equities benefit from dual relative value, calm credit markets, and potentially too negative sentiment on the macro risks.

5. Commodities in Review: The mixed bearish short-term picture vs cautiously optimistic longer term signals for commodities as an asset class makes for a complex outlook – get a copy of the report to see what we think are the key charts and signals to be monitoring.

You can get a more in-depth look at these themes by subscribing to my “Macro Themes” newsletter. Have a great week.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.