3M Company stock (NYSE: MMM) tanked 13% on Thursday, after the company posted earnings that missed Wall Street expectations.

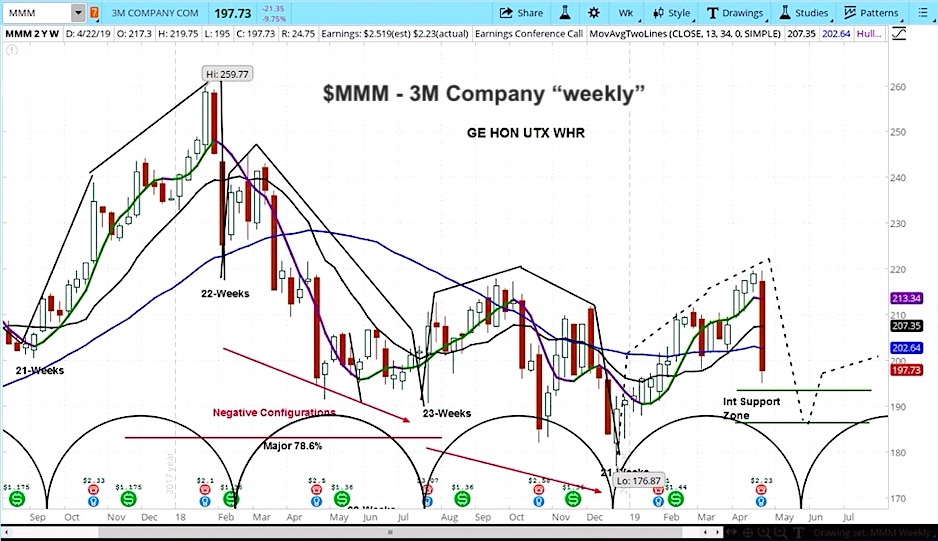

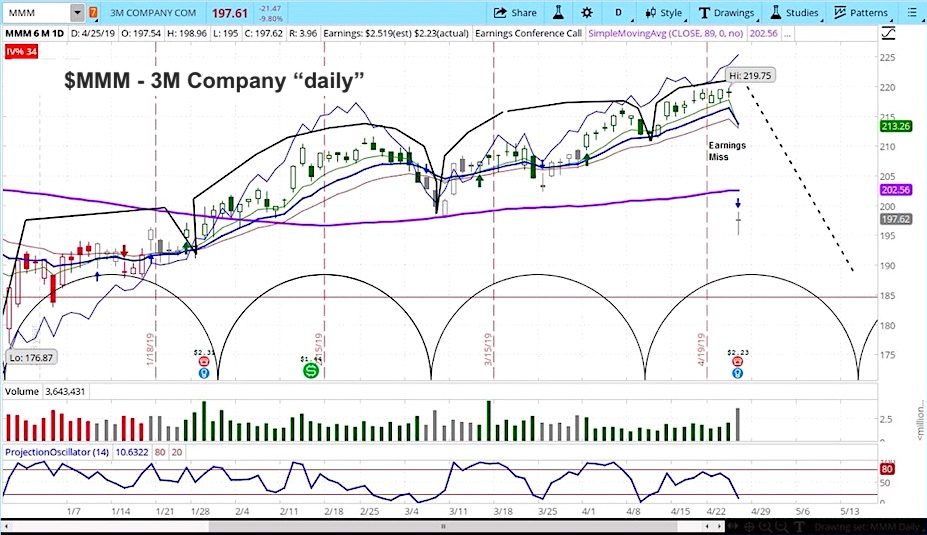

Our analysis of 3M’s stock market cycles shows there is likely more downside risk to MMM stock in the coming weeks.

3M Company reported earnings per share of $2.23 and total revenue of $7.9 billion, compared to analyst estimates of $2.49 and $8.0 billion. For the fiscal year, management cut earnings projections to a range of $9.25-9,75, below expectations of $10.52.

3M CEO Mike Roman explained that, “The first quarter was a disappointing start to the year for 3M. We continued to face slowing conditions in key end markets which impacted organic growth and margins. Our execution also fell short of the expectations we have for ourselves.”

Our analysis of the market cycles on the weekly chart for MMM is that the stock is now in the declining phase of the current cycle. The gap lower on the daily chart is deadly, with plenty of time left in the cycle to sink lower.

Our analysis is clear, for the near-term, 3M faces another month of downside risk. Our target is $186.

3M (MMM) Stock Weekly Chart

3M (MMM) Stock Daily Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.