Every week I look for stocks with trading setups on the edge of support or resistance to trade on the long / short side.

Below I share 3 stocks that have good setups for the week of July 29.

They are Deere and Co (NYSE: DE), ServiceNow (NYSE: NOW), and OKTA (NYSE: OKTA).

These trades can be taken with options or straight up equities. My favorites are stocks in strong trends or those that are breaking out.

Deere and Co (DE)

$DE closed above the $170 level on a weekly basis for the first time ever (been major resistance since early 2018). The 2 year weekly chart shows the $130-$170 trading range and more recently the higher low relative to the previous reversal points. Q3 earnings are due out on August 16th.

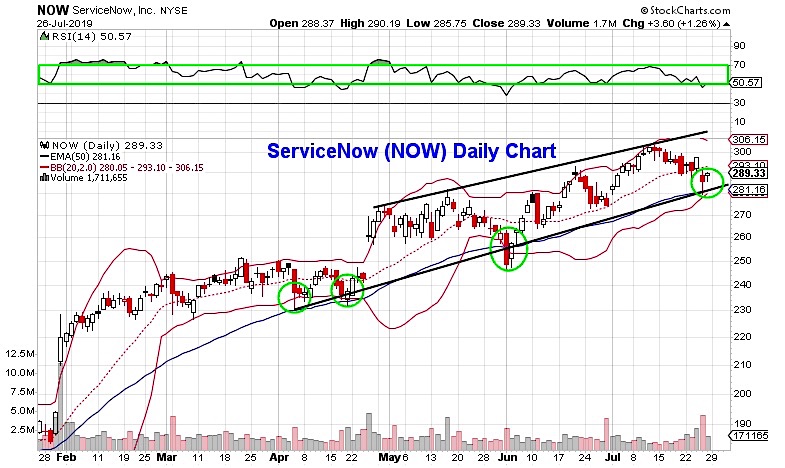

ServiceNow (NOW)

$NOW the stock pulled back to the 50-day EMA after reporting better than expected quarterly results and raising guidance; now shares are seeing buyers step in at the prior support level. Consider opening the Aug 16 2019 $260/$280 bull put spread for a $2.75 credit or better. The implied volatility on the $280 put is 27.5% vs historical volatility of 25.9%. The $280 puts are implying a 28% chance of the stock hitting $280 by options expiration.

Stop loss reference- close below $280 in the underlying.

Upside target- $1.35 debit or a move up to $300-$305

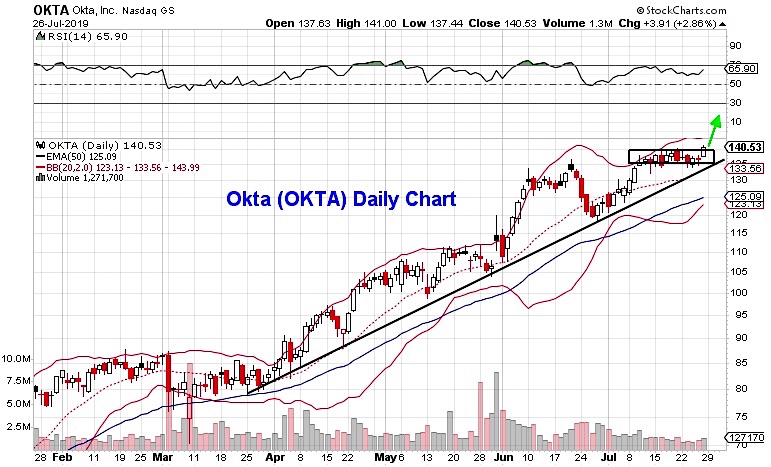

OKTA (OKTA)

$OKTA shares have been consolidating in a high, tight range over the last couple of weeks as the uptrend remains intact. Now it is making a move above the $140 level for the next leg higher. Q2 earnings are due out at the end of August/early September.

Twitter: @MitchellKWarren

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.