3. During the week ended September 16th, U.S.-based stocks funds attracted $12.7 billion in inflows. This preceded outflows of -$16.2 billion in the September 9th week, -$865 million in the September 2nd, and -$17.8 billion in the August 26th. If these inflows were a result of recent stability in the stock market, the latter should continue to behave, of which there is no guarantee.

This is where it can get tricky. The action on Thursday and Friday is a sign that there are still plenty of nervous souls out there. It is possible the sellers were waiting to see if the 203 resistance gets taken out, and as soon as they saw signs to the contrary they bailed. In other words, there is not much conviction in recent buying.

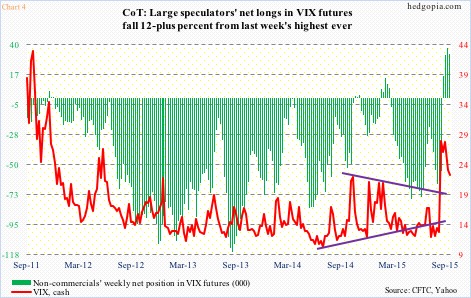

This is probably the reason why non-commercials have stayed net long VIX futures for the fourth straight week. This week, they cut holdings by 12-plus percent, but last week’s reading was an all-time high (see chart 4 below). Historically, this has been a time to sell volatility. Indeed, spot VIX has tumbled from north of 53 on August 24 to north of 22 now. Here is the rub. VIX looks to be itching to move higher in the near-term – the same way SPY ($195.45) seems to want to go lower on a daily chart.

All this probably sets up well for some income generation in options.

September 25th weekly SPY 197.5 calls fetch $1.30. Naked calls inherently are risky, but work in a neutral to mildly bearish scenario. Hypothetically, if called away, it is an effective short at $198.8 – near last Friday’s high ($198.68).

Thanks for reading!

Twitter: @hedgopia

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.