Market volatility picked up in recent weeks with the VIX Volatility Index rising from the low 20’s to 37 before falling back to 21 again.

Learning strategies for trading a rising volatility environment is the key to becoming a successful options trader.

Let’s look at 3 options strategies to trade when we are expecting volatility to rise. But first…

What Is Implied Volatility?

Implied volatility is a key concept for option traders and even if you are a beginner, you should try to have at least a basic understanding.

Implied volatility measures the expected move of the underlying stock over the course of its life.

When volatility rises, the price of options rise because there is more chance that stocks will make a large move.

When volatility is low, we want to add positive vega strategies to our portfolios to protect against the inevitable volatility spikes that occur.

Here are three strategies to consider if you’re expecting volatility to rise:

1. Long Straddle

Long straddles have a lot of positive vega, so do well when volatility rises.

A long straddle is set up by buying an at-the-money call and an at-the-money put. This results in the trade “straddling” the one option strike.

A long straddle costs a lot but starts to make profits if the underlying stock makes a big move or if volatility rises.

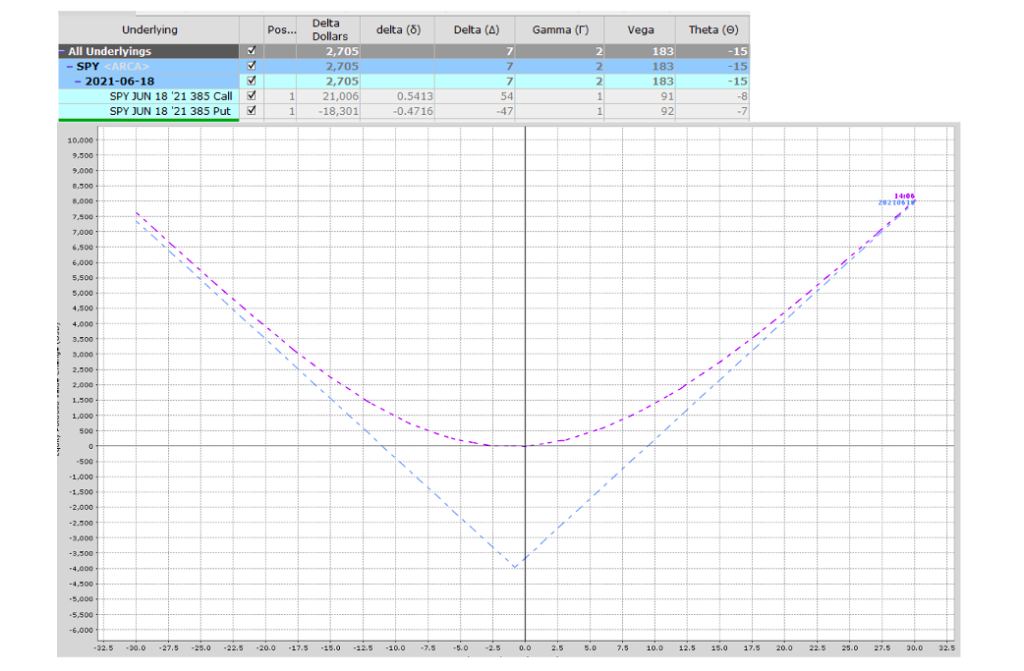

Let’s look at an example using SPY, one of the most liquid vehicles for option traders.

Date: February 5, 2021

Current Price: $387.71

Trade Set Up: SPY July Long Straddle

Buy 1 June 18th SPY 385 Calls @ $20.55

Buy 5 June 18th SPY 385 Puts @ $19.10

Premium: $3,965 Net Debit.

This position starts with positive vega of 183, so will do well in the event of a volatility spike.

The tradeoff is the -15 in theta, so if the vol spike doesn’t occur, the position will slowly lose value each day.

2. Calendar Spread

Calendar spreads are also long volatility trades that can be created using either puts or calls.

Typically, most traders would use calls and construct the trade by selling 1 front month at-the-money call and buying 1 back month at-the-money call using the same strike price.

Calendar Spreads are also positive vega, but they have the added benefit of being positive theta, so they actually make money through time decay.

However, this only occurs when the stock is in the profit zone.

Calendar spreads involve a net debit, so you are paying to place the spread. This debit is also the maximum that you can lose from the trade.

Calendar spreads can be set up with a neutral, bullish or bearish bias. Use puts for bearish calendars and calls for bullish calendars to reduce the risk of early assignment.

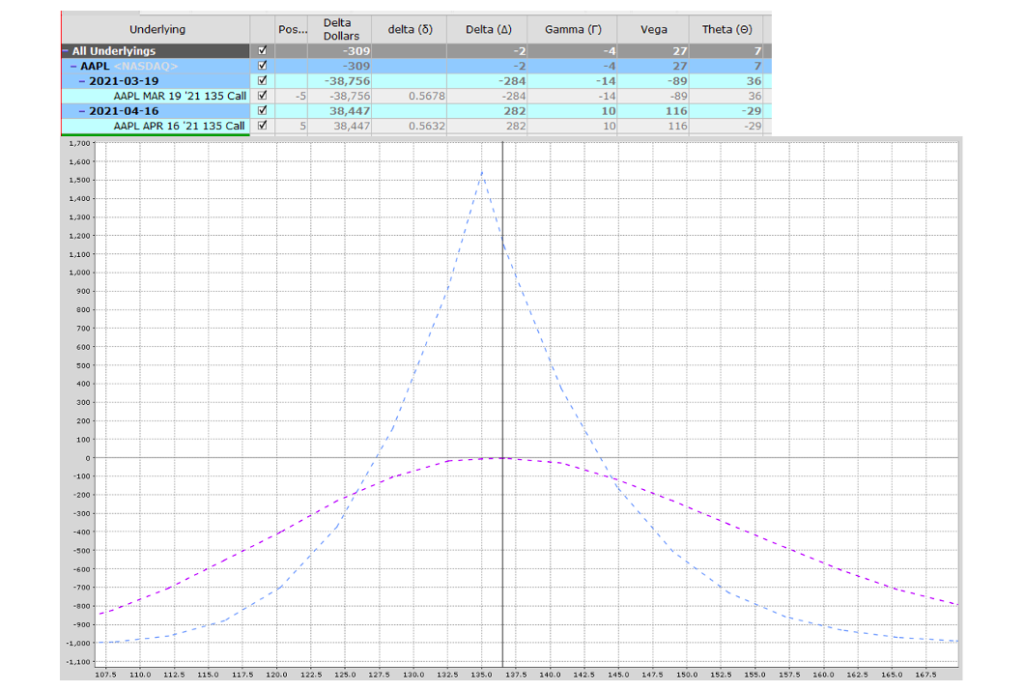

Let’s see how an example might look, using AAPL stock.

Date: February 5, 2021

Current Price: $136.76

Trade Set Up: AAPL March-April Calendar Spread

Sell 5 March 19th AAPL 135 Puts @ $6.90

Buy 5 April 16th AAPL 135 Puts @ $8.90

Premium: $1,000 Net Debit.

This calendar spread has positive vega of 27 and positive theta of 7. But, we need the underlying to stay in a relative tight range which usually doesn’t happen during a volatility spike.

3. Put Ratio Backspread

A put ratio backspread is an option trade that involves selling put options and buying a larger number of put options on the same instrument and the same expiration date.

This strategy is positive vega but doesn’t cost as much as simply buying puts.

The downside is the “valley of death” as you will see in the profit graph.

The risk with the trade is when the stock price stagnates between the two breakeven prices, leaving the trade stuck in the valley.

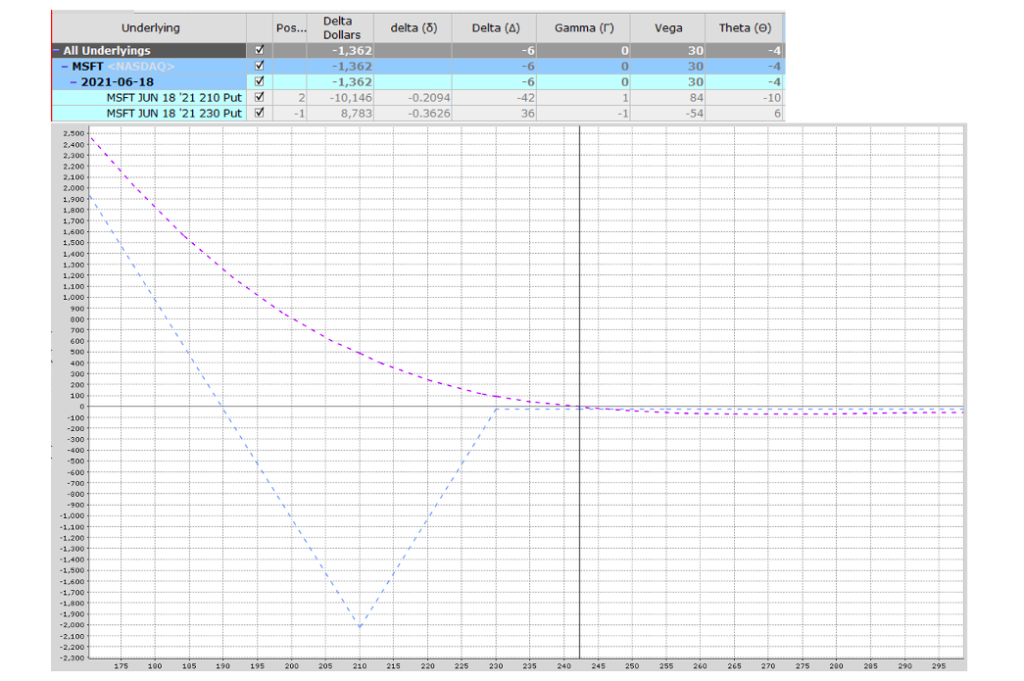

Let’s look at an example using MSFT.

Date: February 5, 2021

Current Price: $242.20

Trade Set Up: MSFT June Put Ratio Backspread

Sell 1 June 18th MSFT 230 Puts @ $12.10

Buy 2 June 18th MSFT 210 Puts @ $6.20

Premium: $30 Net Debit.

This trade has vega of plus 30 and theta of minus 4. The trade will do well if MSFT drops significantly, particular if that occurs early in the trade.

There you have three different ways to trade rising volatility. Which method do you prefer?

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

Twitter: @OptiontradinIQ

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.