Recent Options Trading Activity Suggests Tradable Bottom in Select Offshore Energy Stocks

One of the best opportunities to make money comes from noticing trends in options positioning. And over the past several years, I have seen it across countless industries. Particularly when themes develop. A new theme developed last week with offshore Energy stocks as they each saw notable option trades.

And these are the type of trades that I typically see when a beaten down group is bottoming.

First, let’s take a look at options trading activity in 3 offshore energy stocks:

Ensco (NYSE:ESV): On 8/10 a trader sold 5,000 December $8 puts at $1 to buy 7,500 September $9 calls at $0.50, a net credit of $125,000. With shares trading at $8.45, the trade at a net credit is effectively willing to buy 500,000 shares of ESV at $8, while also wanting to participate in any upside move by owning the calls. Ensco has two other notable trades in open interest, a 7/25 sale of 30,000 January 2017 $6 puts to open for $1.5M and a 4/15 sale of 10,000 September $8 puts to open for $900K.

Rowan Companies (NYSE:RDC): On 8/12 a trader sold 3,000 January 2017 $13 puts at $1.55 to buy 6,000 September $15 calls at $0.45, a net credit of $195,000 and effectively willing to buy 300,000 shares of RDC at $13 with shares trading at $13.60, but also participating in any upside move. This put Rowan Companies on the radar.

Noble Drilling Corp (NYSE:NE): On 8/12 a trader sold 15,000 September $6 puts to open at $0.24/$0.25 to buy 5,000 of the December $8 calls at $0.46, another net credit trade and willing to buy 1.5M shares at the $6 level when shares were trading $6.40, and also participating in any upside move. Noble Drilling is the one in this group that has also seen other bullish action including an 8/4 buyer of 2,350 December $7 calls and an 8/3 buyer of 1,000 March $7 calls. NE also has over 28,000 March 2017 $11 calls in open interest, including buyers of 10,000 on 8/4.

To summarize, the trades are being done at a net credit. With this in mind, I’m not necessarily saying these stocks are going to rip higher. However, traders are showing a willingness to own a lot of stock near current levels, seeing limited downside. These risk reversal trades often mark important bottoms in stocks.

One reason to take a bullish view is because we’re seeing stabilization in Crude Oil prices. This translates to stabilizing CAPEX from select E&P names that have cut spending significantly into 2016.

If we look at the Crude Oil chart, a weekly inverse head and shoulders bottom looks to be developing. As well, the recent pullback is holding the 40 week moving average and now is pushing back above the weekly cloud and 8 week EMA. A move above the neckline at $50 sets up a move higher to $72.

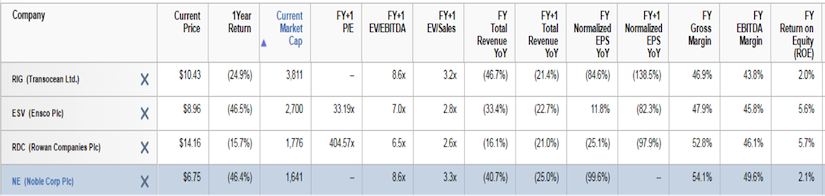

Comparing the 3 aforementioned names on fundamentals, all of them have ugly numbers. But if seeking value, Rowan Companies (RDC) looks to be the best name.

Thanks for reading.

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.