There has been no shortage of global news and economic data to consume and consider. Today, we highlight 3 key market insights:

- Yields set to come back?

- Netflix’s health is consumer health.

- Tesla’s story continues.

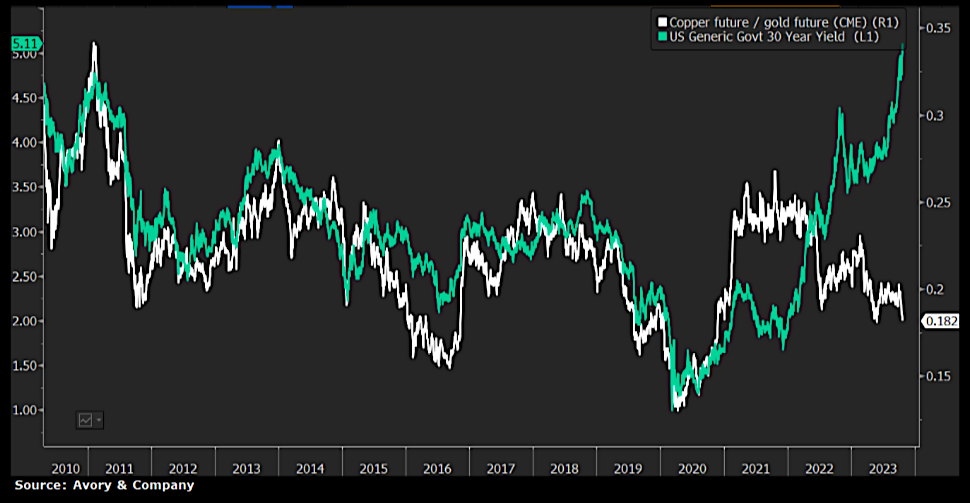

Relationship of Yields and Copper to Gold Ratio Breaking. Yields Snap Back?

Yields were all the rage this week. Today we show the Copper to Gold ratio compared to the 30-year yield. It has reached historically wide divergence. Our analysis suggests that the yield increase may be overextended due to concerns about a government shutdown, budget deficit discussions, and increased paper supply. The move appears to be predominantly technical, particularly given the current real-time inflation rate of 2.2%.

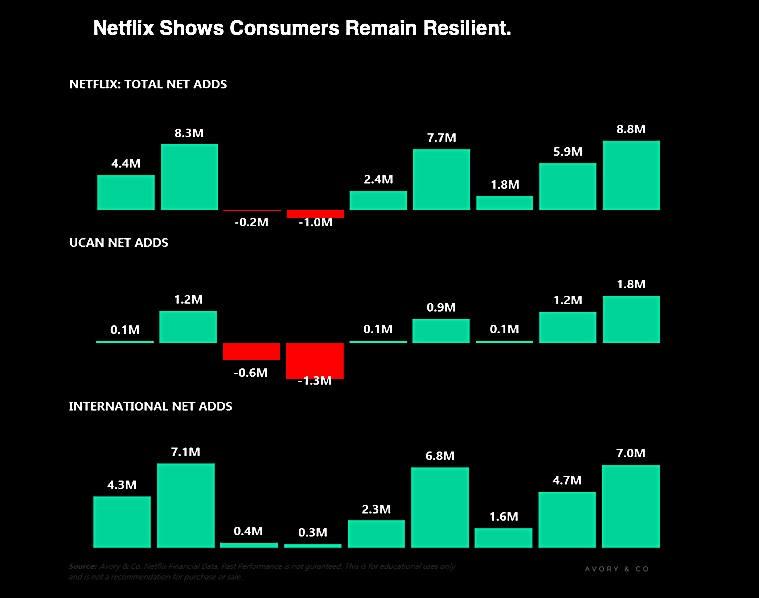

Netflix Shows Consumers Remain Resilient.

Netflix released its earnings report this week, indicating a return to growth adding over 8.8 million net subscribers in the quarter. Over the past year, they’ve added an impressive 24 million subscribers, marking one of their strongest 12-month periods in years according to our data here at Avory.

This growth occurred while Netflix raised prices, enforced tighter sharing policies, and amidst economic forecasts predicting an impending “recession” (don’t get me started).

It’s worth noting that Netflix is a substantial $190 billion company, and its moves can influence the markets. With over 240 million global users, the company remains optimistic about its future prospects, which is good news!

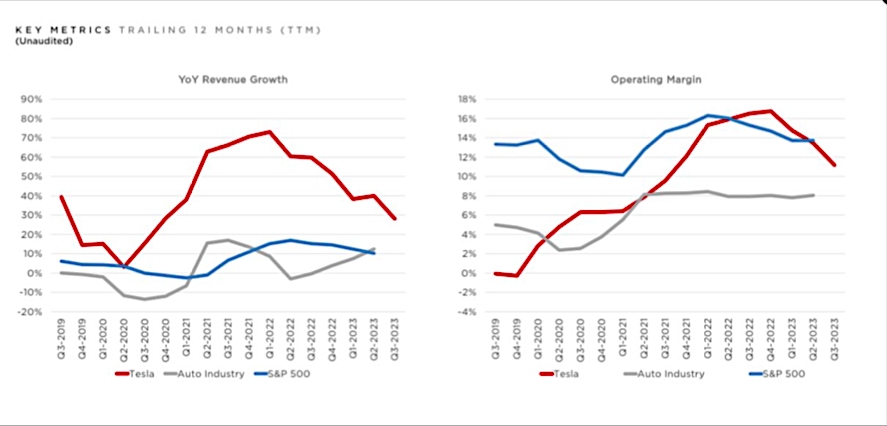

Continuing the Tesla Saga On Pricing

In our recent “Investing with Data Newsletter,” we highlighted Tesla’s ongoing trend of reducing prices, especially in China. While there’s a narrative suggesting this is being done to gain market share, the reality is that Tesla’s margins have seen a significant decline. Analyst estimates for 2023 earnings have dropped by over 40%. UGLY.

When excluding auto credits, margins have dipped below 16%, approaching levels typical of traditional automakers. Elon Musk sounded bleak on profit targets and production for the Cybertruck.

While most of this sounds bad for Tesla, they continue to grow production and deliveries, while now sitting on a pristine balance sheet!

Twitter: @_SeanDavid

The author and/or his firm may have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.