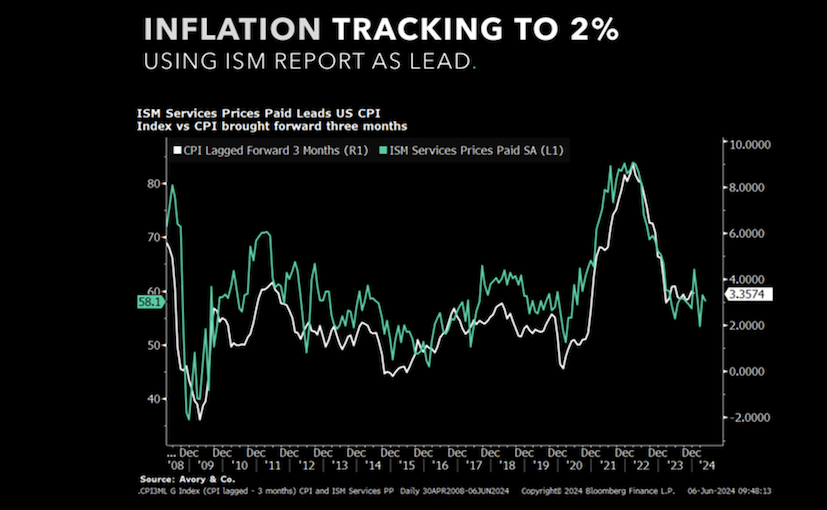

We had some interesting data points come out this week. ISM Service came out with prices decelerating and economic activity perking up slightly. This supports a no landing and /or soft landing thesis.

We also received data on Cash App’s advertising strategy and news of Ebay’s potential separation from American Express (Amex).

Let’s research and discuss the data:

- Cash App Ad Strategy: TikTok or SnapChat or Instagram?

- American Express (Amex) Removed from eBay. Amex removed but implications to eBay?

- ISM Survey Says Inflation 2%. CPI Tracks with 3 month lag.

Data Point #1

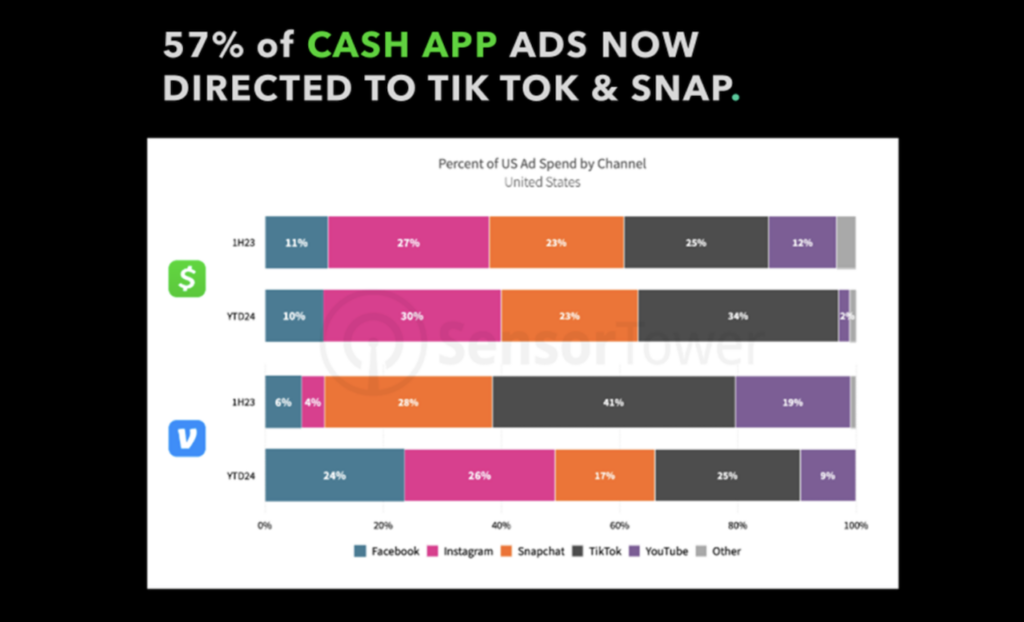

57% of Cash App Ads are TikTok and Snapchat. Venmo Facebook Heavy – SensorTower

Cash App’s success is largely driven by organic traffic and new users, with a remarkable 90% of growth coming from organic sources. This strong brand foundation enables creative marketing approaches, as seen in Cash App’s strategies over the years. When looking at Cash App’s advertising efforts, data shows that they focus on three main platforms today. Snapchat, TikTok, and Instagram. These platforms cater to younger demographics.

In contrast, Venmo allocates a significant 24% of their ad spend to Facebook, whereas Cash App dedicates only 10% of their budget to this channel. Notably, Cash App has significantly reduced their YouTube ad spend, dropping from 12% last year to just 2% currently. Time will tell, but both platforms are battling to become the bank of the future.

Data Point #2

eBay Drops Amex, but Amex Users Spend 2x Average eBay Consumer (says Amex)

“American Express card members have an average transaction size at eBay that is more than double the transaction size of cards from other networks:”

eBay recently announced they’ll no longer accept American Express cards starting August 17th, citing high fees. This follows a similar trend… I just saw a store refusing Amex for the first time in ages. Interestingly, American Express claims their eBay customers spend twice as much as others. It seems eBay wants more than just payment processing. Richer data and consumer insights might be the real reason behind the split. Negotiations could still be happening, but the future of online payments seems to be about more than just accepting credit cards.

Data Point #3

ISM Survey Ticked Lower Further Emphasizing Path to 2%

As I mentioned earlier, the ISM Services survey results came out this week. Here at Avory, we focus on the Prices Paid component. This month’s lower reading suggests inflation may dip towards 2% in the near future. Historically, there’s a strong correlation between the Consumer Price Index (CPI) and service sector prices paid. Data data data.

Miscellaneous Earnings News

We also got data from Lululemon which reported earnings. Their US business continues to moderate while their international business is showing meaningful strength. Is this a sign of the us economy? Or is this a sign of Lululemon fatigue in the states. Time will tell.

Twitter: @_SeanDavid

The author and/or his firm have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.