It is normal during every Presidential election cycle to become concerned about its impact on the markets. This election, though, does seem to stand out in terms of concern regardless of your political persuasion. I’m 51 years old and I can’t ever remember an election like this before! And, no doubt, there will be even more surprises ahead for the S&P 500 (INDEXSP:.INX) and various asset classes.

The question for investors is how will this impact our investments? For me, my concern is focused on the bond markets – notably U.S. treasuries (NASDAQ:TLT), as that is where I am heavily invested. But either way, I wanted to share three considerations as the wild presidential election continues to march toward November (and beyond).

First, there is little I can do at this point in time because most of what we hear is rhetoric. In my opinion, very little of it will actually happen. That’s partly why the markets don’t seem to have reacted to the political news (aside from some short gyrations). Compare that, for instance, to an announcement by Saudi Arabia or Iran about their oil production numbers—that’s much more likely to have an immediate impact on the markets.

That said, as we get closer to November we may see the markets pay closer attention…

Second, regardless of who wins, it will take months and months to see legislation enacted. And the markets may start to adjust depending on the probable outcome. And it will depend on the makeup of Congress which can affect the Supreme Court justices, etc. Any legislation could take 6-9 months to enact so that’s still quite a ways out for the markets.

Lastly, and importantly, I believe that there are forces greater than the election that are driving global economic cycles. Countries around the world continue to fight deflation. In many countries, interest rates are negative and they still can’t engineer economic growth. Central banks around the world continue to use the same broken play book to spur growth. And the global debt load weighs heavily on all the major countries. So far, not a single country has figured out how to rectify this situation and some are speculating that it may take some sort of a global reset driven by the IMF—but that is just speculation. What IS true, though, is that the situation is serious.

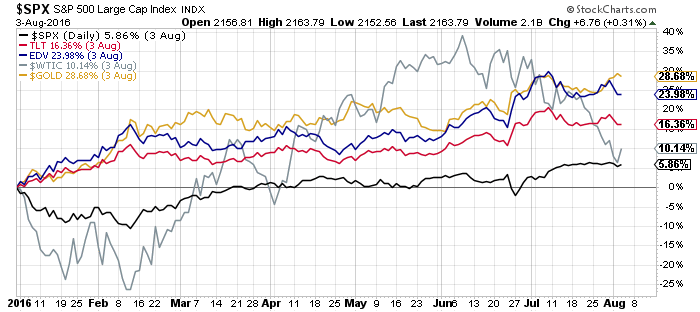

Here’s a quick snapshot of the market:

The election may impact markets as we get closer to the election and as the facts change so can/will my opinion. In my opinion, the key is to be positioned somewhat defensively not just because of the election but because we are past-peak in the economic cycle and it may take several more months (if not a year) to see real underlying economic growth to return. Until then, I expect to avoid high-beta stocks and will instead focus on (surprise!) US Treasury bonds and defensive stocks that could include utilities, municipal bonds, etc.

That positioning has done well the last 12 months and I expect it to do so over the next 3-6 months as well.

Good luck out there and thanks for reading.

Twitter: @JeffVoudrie

The author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.