THE MARKET’S NEW HOT TOPIC

Markets tend to move from one hot topic to the next. The latest concern stems from political uncertainty in Italy. Any time stocks drop over 1%, it is unsettling. Therefore, it can be helpful to put recent volatility in some historical context.

WILD SWINGS ARE NOT ABNORMAL

In 2011, markets were nervous about Europe, as noted in the Time magazine headline below dated September 29, 2011.

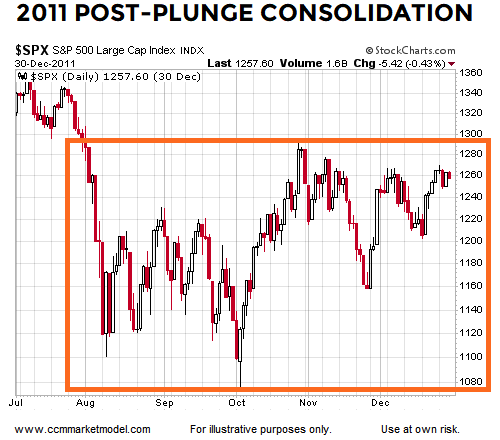

As concerns about Europe increased in 2011, stocks plunged in August and then remained in a wide, violent, and frustrating period of consolidation for several months.

In the period shown above, stocks were red on 60 trading days; 33 trading days featured a loss of 1% or greater. There were no shortage of emotional swings for those watching the markets tick-by-tick in 2011. The thick and long red candlesticks above indicate strong selling pressure.

AFTER THE PERIOD OF CONSOLIDATION

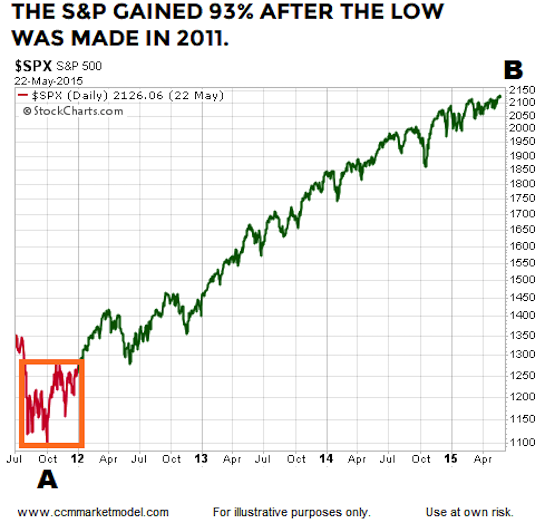

Is it possible for stocks to plunge, consolidate for several months, have numerous gut-wrenching 1% down days, and then go on to make higher highs? As shown via the chart below, the answer is yes, it is possible. From the plunge low in 2011, the S&P 500 eventually righted itself and went on to post very satisfying gains for patient investors.

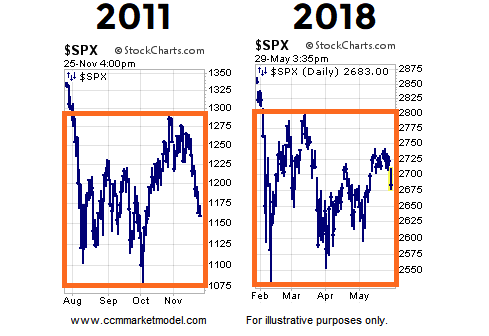

2018: A PLUNGE FOLLOWED BY CONSOLIDATION

The purpose here is not to say that 2018 is exactly like 2011, nor is the purpose to forecast bullish outcomes in 2018. The purpose is to illustrate that a sharp plunge, followed by a consolidation period featuring volatile swings and numerous 1%-down days is far from unprecedented, nor abnormal in the financial markets.

COMPARISONS TO 2000 AND 2008

This week’s stock market video makes longer-term comparisons to the major bull market peaks in 2000 and 2008. The charts help us better understand the probability of good things happening relative to the probability of bad things happening.

THE ISSUE IN 2011 WAS EUROPE, NOT THE U.S. DEBT DOWNGRADE

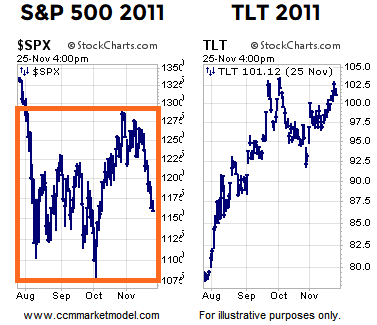

A logical question might be, but what about the downgrade to U.S. debt in 2011? If investors were overly concerned about a U.S. debt default in 2011, they would not have been buying long-term U.S. Treasury bonds (TLT). TLT did quite well during the period shown below, telling us the primary issue was Europe.

Thanks for reading.

Twitter: @CiovaccoCapital

The author or his clients may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.