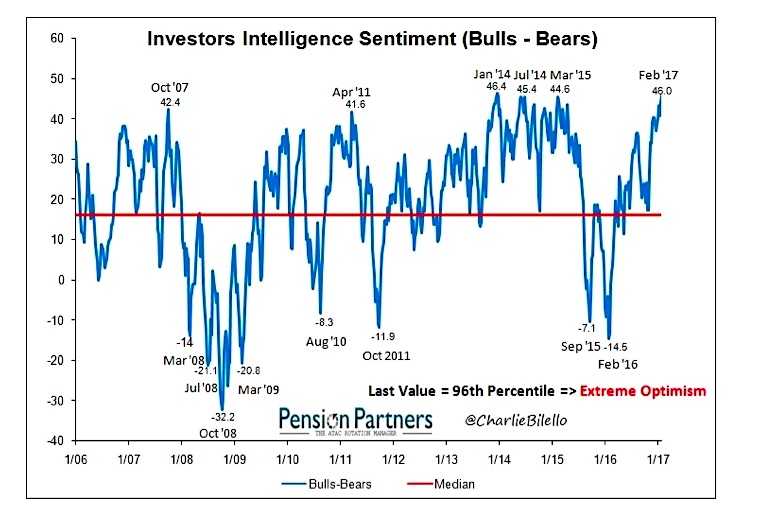

Investor Sentiment Is Getting Overly Optimistic

The President has been a carnival of contradictions, but one thing he’s remained is optimistic. Investors are extremely optimistic and it shows.

2017 Bullish Trump Themes

- Higher EPS growth (earnings recession is officially over despite many companies cautiously guiding lower)

- Hotter US growth market to sell into (4% promised growth, somehow)

- Fewer regulations (if they pass + nothing blows up)

- Fewer overseas competitors (direct result of tariffs + currency threats)

- Repatriation of profits (for more than buy-backs we hope)

- Lower US corporate tax rates (35 to 15 to 25%, none?)

- Infrastructure (“yuge, tremendous” projects)

If all of this aggressive (read: massively debt-inducing) fiscal policy is implemented and executed with precision, and there are no impeachments, currency and/or trade and/or military conflicts…

Here is The Supremely Bullish Case:

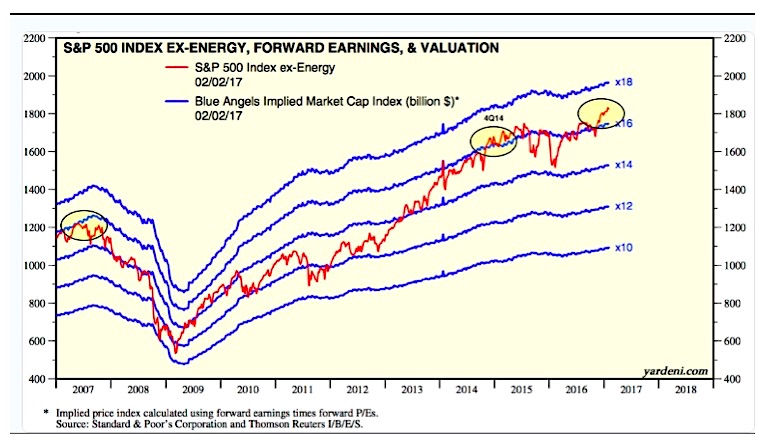

- Valuations in low-interest rate environments run ~20X EPS vs. 16X estimated so that can produce valuations of (drum roll please):

- SPX EPS est. of $133 x P/E of 20 = $2672!

- IF IF IF Corporate Tax Rate Cut from 35 to 15% can drive SPX EPS to $157 (vs. $133 above), then (queue marching band):

- SPX EPS est. of $157 x P/E of 20 = $3140!!

Stocks are Cheap Thanks to Trumpeconomics! Or are they?

Most analysts agree, the market rally is getting pulled higher based on hopeful S&P valuations that rise with economic growth projections based on Trump’s promises. Most analysts also agree S&P valuations this high are historically unsustainable.

Markets are Priced for Perfection

I have come across repeated references to how the market—financials and tech companies in particular—are trading like it was 1999. The Trump Bump we conceptually understand is based on those often-talked about promises to grow the US economy up up and away, but the latest jolt—corp tax rate reform—is what helped launch SPY (and all the other indices) up and above break-out range, further crushing volatility (and market bears) in the process.

Premise is a simple one: Bringing the corporate tax rate down, potentially to 20- 25% (although Trump has suggested even lower at 15%), would help keep US companies from moving offshore (and bring some back perhaps), boost corporate profits (and with it valuations) and almost certainly boost US economic growth (assuming oil and dollar are stable). With that major policy reform on the docket, the odds of repatriation increase significantly because repatriation and corp tax cuts go hand in hand. Another words, tax revenues must be raised to offset lost revenue from a corporate tax cut so both will likely pass together.

The firms who will benefit the most by corporate tax cuts are small companies that aren’t large enough to do tax inversions or make substantial profits overseas so they have fewer breaks and pay the effective tax rate. However, if import taxes aren’t offset by a rising dollar these small firms will be hurt by the border adjusted tax. This is all such a fine balancing act and I for one don’t consider Trump to be a man of subtleties. And to bet on the movement of our currency as the main driver of the benefit to a major tax policy seems risky, to say the least.

Having said that, the Bull Case driving this market frenzy is clear: Companies running in a 1-2% growth market world perform much better in a 3-4% economic environment. The bet is they do even better if the tax burden is lessened. And when earnings go up, price to earnings goes down which drives even higher valuations.

Hence, it’s 1991 all over again!

What Could Go Wrong?

The market seems to be pricing in Big Tax Cuts (capital “B”) that could have similarly “Yuge” GDP effects that the Bush cuts had in 2003 when Q3 2003 GDP grew 7.0% and Q4 2003 GDP grew 5.5%. But we were in very different market environment then, not the least of which was full-on global trade expansion not retraction like Trump proposes now. Oh, and our debt picture was slightly SMALLER pre-financial crisis and unlimited QE.

What if Protectionism back-fires and incites nasty trade wars? Growth doesn’t materialize but jobless claims do? Corporate sales weaken as revenue from abroad declines and ex-US revenue measured in dollars is negated by a rising USD?

Color me skeptical, but I imagine at some point this year, the market will start to doubt Trump and his promises. Or a by-product of his bully posturing (think China) will appear suddenly (like that China devaluation back in Aug ’15 which caused a market swoon). Point is, the market prices in the truth only after reacting (overreacting) to the best case scenario when it’s ‘happy’ and the worst case when it’s not. Human Nature meets Law of Natural Consequences.

Oh, and if Trump wasn’t enough of a wild-card, we need the dollar and oil to be stable in order to achieve better economic and corporate growth under the new administration’s plans. And since both are intricately linked with Rest of World, it would create more confidence in business and investment planning, if our President was less of a hot-head. Supporters and Detractors alike usually agree, Trump’s retaliatory nature can spur, well, big retaliations! And it is in this arena of Foreign Trade where the markets can be repriced—for better or worse. He would engender more trust if he had a plan for prosperity without provocation.

Friendly Sidebar:

It’s easy to subscribe to my Free Fishing Stories/Blog for more insights like these.

You are also invited to Come Fish With Me on any trading day!

Thanks for reading and Happy Trading.

Twitter: @SamanthaLaDuc

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.