The market has been full of Big Surprises in the last year. From the worst start of any year in 2016 to the best start of any year in 2017, money was made betting on the outliers.

As a directional, volatility trader, I am comfortable with extremes. Extremes, are however, best lived through with an open mind and a sense of humor.

In fact, many laugh at the fact the S&P 500 (INDEXSP:.INX) has rallied 30% in less than a year off the February/March 2016 lows, despite one of the biggest oil collapses in history. Or that 10% of that rise was from the election of a man who had by most accounts no chance of winning six months prior.

Many more laugh out loud at the historically-unsustainable, outsized stock valuations and price appreciation since the March 2009 lows.

After just a few years of actively playing this board game, I have learned it really pays to be open-minded and smile a lot.

Last Spring: “State of The Market: Setting up for a Summer Surprise”. That was the title of my Spring talk to the Boston Investor’s Group at MIT. In short, my analysis—Macro, Technical, Intermarket, Fundamentals and Sentiment—seemed aligned for much higher prices. I went even farther and said, “what if rates rise and market rallies? I see a case for both.”

Long story short, my bull case became a bull chase and the bull is still running.

But for how much longer?

A Look At Recent Market Action & A Look Ahead

Few thought we would survive Brexit let alone Trump, but at least this time the market makers were prepared:

We tagged the lower range of that 3 standard deviation move before reversing higher like one of those circus clowns shot from a cannon.

It’s still going. And so is the recovery. Jobless claims are at more than a 40 year low and retail sales are at an all-time high. The US economy continues to expand and this foundation was laid long before Trump.

The Earnings Recession Ends

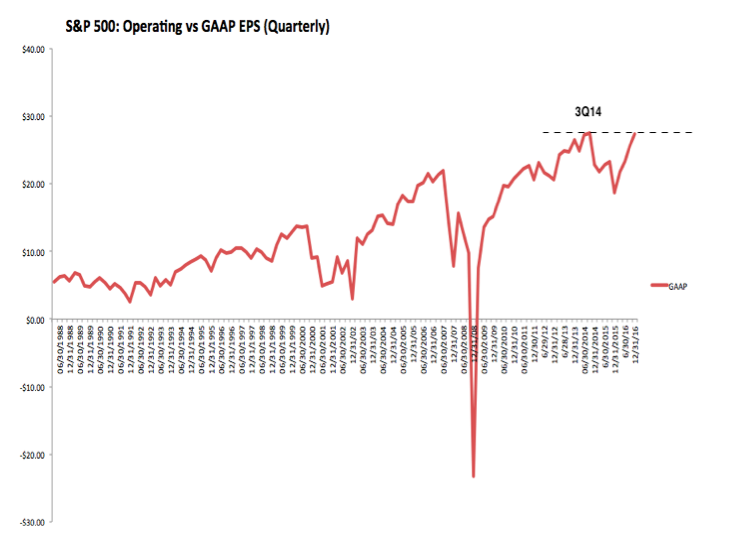

New Year, New All Time Highs and I believe part of that is due to the fact we closed on two consecutive quarters of year-over-year positive EPS and revenue growth. Remember my premise in April 2016: positive earnings and sales growth surprises can drive stocks higher.

S&P profits have grown 46% YOY and sales are 4.5% higher. This is the best sales growth since 3Q14 – more than 2 years ago. This is a remarkable turnaround from a year ago, when profits had declined by 15% and sales were 3% lower.

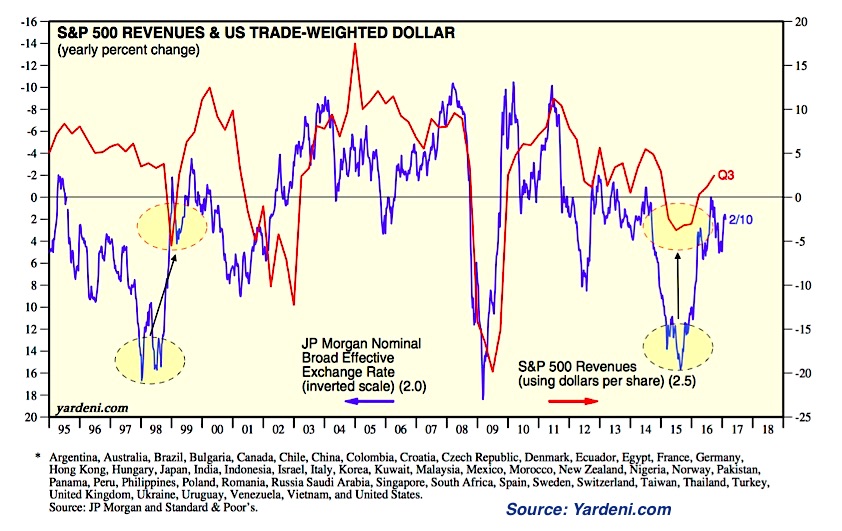

A most important reason lies, I believe, with the Energy sector (NYSEARCA:XLE), and the Dollar, (CURRENCY:USD) stabilizing. And we need oil and the dollar to stay rangebound for forward sales and earnings growth to continue because it is likely that energy will now contribute positively to overall S&P sales growth whereas before it was a significant drag.

Urban Carmel points out:

The trade-weighted dollar began to rapidly appreciate in July 2014 (3Q14) just as sales (and corporate profitability—emphasis SL) on the S&P peaked. By the beginning of 2016, the dollar had appreciated by 25%. With half of the sales of the S&P coming from outside the US, the dollar’s appreciation alone cut S&P sales by more than 10 percentage points. In the chart, you can see that a similar fall in sales growth occurred in 1997-98 when the dollar also rapidly appreciated over the course of a year. It’s not well remembered now, but the heart of the 1990s bull market had an earnings recession that lasted for the better part of 1996-98. It dissipated after the affects of the dollar’s appreciation had passed. That seems to have occurred now as well.

So it really is like 1999 again!

Energy profit margins fell from 9% in 3Q14 to negative 11% in 4Q15. This one sector was the source for nearly all of the decline in the overall margins from 3Q14 to 4Q15.

Without the negative drag from energy, total margins for the S&P (blue line) are now as high (10.3%) as they were in 3Q14.

We Made It Back To Even!

CONTINUE READING ON THE NEXT PAGE…