From the very beginning, 2014 seems determined to assert its independence from 2013’s steady and timeworn market themes. Active investors enter the New Year with a Fed finally pulling the trigger on tapering QE: the initial response is risk-positive, but what goes down as larger quantities of the cheap money punch bowl is pulled away remains to be seen. There’s a just-brokered bipartisan 2-year US budget deal just don’t forget the debt ceiling on the books that caught exactly none of the broader market’s interest. And now the S&P 500 (SPX) is off to its worst opening start (which is to say, negative) in several years following January 2nd’s still-unfilled opening gap down.

Arbitrary calendar-imposed division or not, 2014’s market context feels new, pointing to a year full of unique challenges and opportunities. We reached out to See It Market’s broad community of Contributors to gauge what 2014 market insights are foremost on their minds:

Robert Lesnicki:

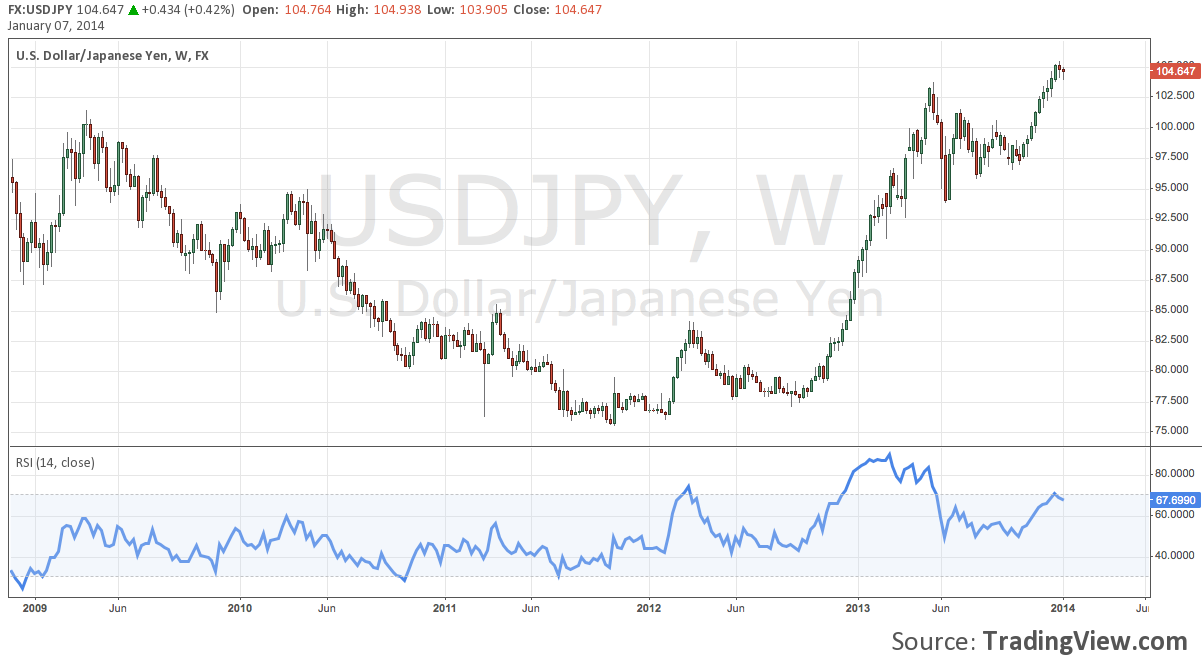

- Japanese Yen: The Yen has been continually punished since markets began prepping for Abenomics in November 2012. Looking at the US Dollar/Japanese Yen (USD/JPY), Lesnicki observes that the long side (long USD, short JPY) “seems to be a very overcrowded trade. What I’m also wondering is what other investments this trade is funding? (besides the purchase of Japanese equities) What could result after a large unwind of this trade?”

- Late Cycle Strength: Lesnicki will be watching what he terms “late cycle plays”: “Names like CAT, X, and FCX should thrive, assuming improving economic conditions around the world.”

- The 10-Year: “The 10 year yield (TNX) will be a must watch in 2014. I think it will be a huge problem if that yield starts to dip back towards 2%. It will also hurt the economy if it spikes too high, too fast. For now, the path of least resistance seems higher.”

Alex Bernal:

- Rising Rates May Renewed FI Interest: “In general real interest rates are now positive. This could cause capital to see value in certain areas of fixed income”

- Steepening Curve to Benefits Financials, Banks (with a Twist at the End): “The curve is primed and steep at the moment so banks should be making lots of revenue from the spread between borrowing short and lending long. This cycle of out performance in the financial/banking sector sometimes coincides with tops in the stock market.”

- The Beginnings of the Next Bond Bear Market: “I think we are in the early stages of a mega bond bear market in the long term but I expect short term retracement rallies in 2014 which could be excellent times to position for the long wave 3 down where the downtrend accelerates rapidly and panic starts.”

Alex Salomon:

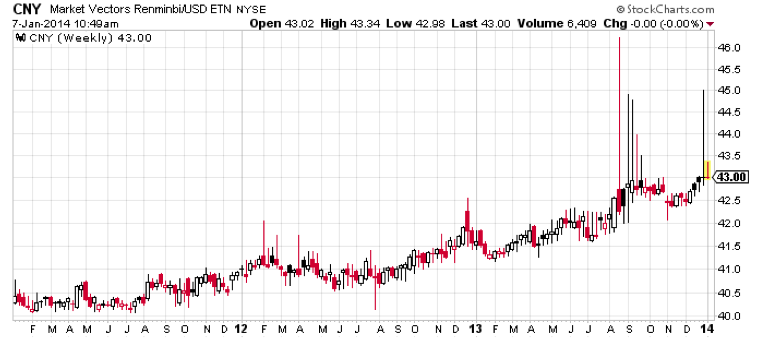

- Chinese Yuan Remains on the Road to Reserve Currency Status: “The Chinese Yuan/Renminbi (CNY) will little by little become the new gold, or at very least, continue down the road to becoming a reserve currency. Not fully, not quite yet; but that’s the trend and it is here to stay.

- The Great Moderation in Chinese Growth: “The Chinese economy will work its way, yet again, towards global acceptance that it is OK to grow at 4.5% steadily rather than 9% arbitrarily; and over the next few years, the world will welcome such a more realistic trend”

- Europe will Survive, Despite Political Headwinds: “Europe will put doubters on the edge, forcing them to predict newer and darker omens. Be ready for tons of ominous coverage over the May EU elections and the rise of far-right neo-nationalistic movements”

- US Energy Renaissance Continues, Exerting Impact on International Relations : “The US will keep a steady pace of being the new world’s largest energy producer and it will shape the next 5, maybe 10 years of diplomatic interactions”

- The Social Media-Enabled “Collective Sharing” Trend Is Just Getting Started: “Facebook, Twitter, Kickstarter, Bitcoin, AirBnB: the era of “collectively sharing everything” will shape the economy as strongly as the Internet did in the ‘90s.” Salomon sees this as a persistent, game-changing trend that is just get off the ground: “The impact on GDPs is not even calculable yet, but it will redefine human-scaled capitalism for our generation, just like the Internet shaped the 1994-2008 era. It’s just a start and it’s not to late to ride the train!”

Maria Reinhart:

Mid-Late Cycle Stocks: Like Lesnicki, Maria Reinhart sees 2014 opening at a similar station in the business cycle and is looking to individual names that will benefit from the rotation: “We are headed into 2014 mid-late cycle. Energy names should begin to break out of first bases such as Exxon Mobil (XOM) and Chevron (CVX).” Maria’s research currently involves scouring for names that will benefit from this point in the cycle.

Ross Heart:

Last Year’s Slim Negative Breadth Points to Potential Q1 Value Plays: “I think the possibility exists that a number of last year’s losing investments could quickly morph into early winners. Their scarcity last year likely caused investors to aggressively harvest tax losses in an extremely concentrated group. This could have led to some over-accelerated selling, which increases the probability of their “bouncing” early in 2014 as selling dissipates”

Randall Liss:

Consider Insurance While It’s Cheap: Idling in the low teens with only the occasional pop toward 20, the VIX continues to suggest a broadly complacent market. Does this mean stocks are about to sell off? Not necessarily. As an options educator and former market maker, Liss sees a tactical benefit in a low VIX for those who are long stocks – put premiums are generally cheap. With that in mind, consider the “opportunity to buy cheap insurance even if you believe that the bull market still has a ways to run.”

- “Benign” Market Psychology Setting a Low Bar for Market Surprises: Kassen believes that the long plod of 2013 has so reinforced the perception of a “benign” environment for stocks (and risk assets generally) that market sentiment is now highly sensitized to surprises. “Recency bias is the tendency to disproportionately weight what is just past over what is further in the past. With an S&P 500 (SPX) installing 30% gain, crushed volatility and the perception of a Fed put buoying markets alive-and-well, 2013 was a 252-day study in positive behavioral reinforcement, carrying the message that risk appetite is handsomely and immediately rewarded.” Anything that doesn’t align with that message could exert an adverse impact on sentiment that would be less significant in an environment of “mixed” returns and sentiment.

- Watch the Underwatched: Last year’s secular breakout in SPX above 2000 and 2007 resistance was a huge technical event; but Kassen cautions against pushing other indices to the margin. “The Russell 2000 (RUT) broke above 2000’s resistance long before 2007; and 2007’s all-time high long before the S&P; as did the Dow Transports (DJT). Both of these markets are at secular broadening formation resistance right now. The NASDAQ 100 (NDX) is still 33% off the 2000 high and is on its way to completing 15 months without a 10% correction – a feat exceeded only once ever (in 1996 with 16 months).” While the S&P’s benchmark achievement is rightly emphasized, Kassen suggests keeping these and other markets in mind: “Looking around, there isn’t clear blue sky overhead as the S&P 500 might suggest. That isn’t intended to sound ominous; only that the larger technical picture has many shades of gray compared to looking at the Dow or S&P in isolation”.

Andy Nyquist:

- 1st Major Correction For Stocks in Almost 2.5 Years: “Equities should see first 1st deep correction in over 28 months during 2014. And I wouldn’t be surprised if it lasts 3-5 months… just long enough to wring out some bull juice.”

- Gold: Medium-Term “Up” Potential, but Down Looking Out Further: “Gold may become relevant again (at least for a few months!), potentially posting a multi-week rally during the first half of 2014, perhaps as high as 1525 (the scene of last Spring’s breakdown). Among other things, a possible bounce is suggested here by major support around 175-200 on HUI, the Gold Bugs Index (check out HUI and 3 Other Key Gold Charts for 2014 here). But it’s all about time frames, and I personally (and ultimately) think Gold will bottom closer to $1000, perhaps in 2015.”

- Crude Oil: Narrowing Toward A Major Directional Decision: Crude is “definitely worth keeping an eye on. $100 is important resistance on the upside, but if this level is taken out, look for a retest of the 3 year highs. This could coincide with an uptick in geopolitical tensions. That said, if stocks correct on a “slowing global economy” theme, Oil could retest its 3 year lows (watch supporting uptrend lines).”

Best of luck from the entire See It Market community in 2014!

Twitter: @andrewunknown and @seeitmarket

Author holds no exposure to asset classes mentioned at the time of publication.

“2014, Man with Umbrella” image sourced: scmp.com

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.