The Russell 2000 (IWM) has lagged to start the new year but it’s pressing up against the 155 price level in a tape that feels “risk-on.”

This could lead to a big breakout and another chance to provide leadership to this bull market.

In browsing charts this weekend I found a few interesting small cap stocks that stood out on the charts as having high quality set-ups. I then paired them with some fundamental data to get a better overall picture of which ones looked interesting.

I came away with 10 small cap stocks to watch into 2018. Most of these names have limited Analyst coverage and are the kinds of names I find the greatest ability to capture Alpha. Data sources: Yahoo, NYSE, Bloomberg

Cubic (CUB)

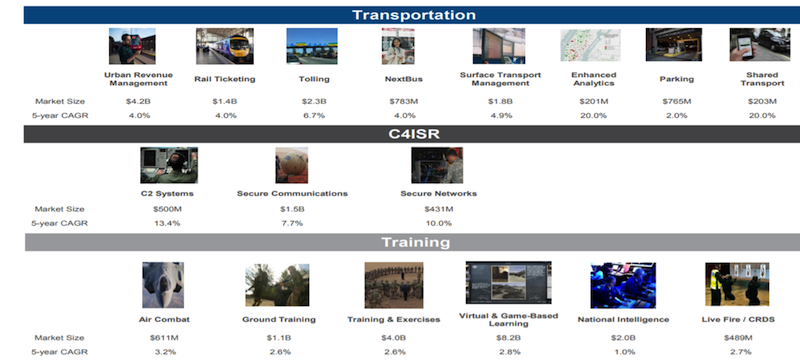

Cubic is a $1.6B provider of systems and solutions for transportation and defense markets. Shares of Cubic (CUB) trade 23.75X Earnings, 1.1X Sales and 2.33X Book with a 0.45% dividend yield. On the chart shares gapped higher in November on earnings but since have pulled back in healthy fashion to base above the 40 day MA, also just above gap and cloud support. CUB gets 39% of revenues from Transportation Systems, 36% from Defense Systems, and 25% from Defense Services and closed 2017 with $3.1B in backlog. Cubic’s markets include urban revenue management, niche C4ISR and Training applications. You can see from its market 5 year CAGR outlook that Enhanced Analytics and Shared Transport in the Transportation segment, and Secure Communications and Networks in the C4ISR segment are major growth drivers, and also carry higher margin profiles. CUB has recently won key contracts in Boston and Los Angeles and management continues to highlight an upside margin opportunity. Cortina Asset Mgmt. was a notable new buyer of CUB shares in Q3.

CSG Systems (CSGS)

CSG Systems is a $1.5B provider of support solutions in the communications industry with shares trading 16.5X Earnings, 1.95X Sales and 16.9X FCF and a 1.76% yield. CSGS is targeting 3% revenue growth in 2018 and 7% EPS growth, so not a high growth name, but a steady earner with a 12.9% ROIC. On the chart, shares have pulled back and based nicely above the daily cloud and 40 day MA. The communications industry is changing rapidly with declining revenues in traditional businesses, rising operating costs, consolidation of the major player, and digital/data services growing exponentially. CSGS helps companies to reduce costs, shift investments to innovative growth areas, launch new services, and improve the customer experience. CSGS operates with a lot of recurring revenues and a high renewal rate with industry-leading operating margins. CSGS has stepped up investments in its next-generation Ascendon platform and has been securing customer wins from competitors.

Hyster-Yale Materials Handling (HY)

HY is a $1.44B maker of lift trucks and aftermarket parts trading 17.7X Earnings, 0.52X Sales and 2.57X Book with a 1.4% dividend yield. HY shares have traded sideways for a few weeks and nearing a breakout move above $87. HY posted 10% revenue growth in 2017, its best year since 2011, and targeting 7% revenue and 17% EPS growth in 2018. HY has been expanding margins and targets 7% operating margins from the current 3.9% level. HY purchased Nuvera as a move into hydrogen fuel cells for its lift trucks, many companies like Amazon using those type of lift trucks.

McGrath Rentcorp (MGRC)

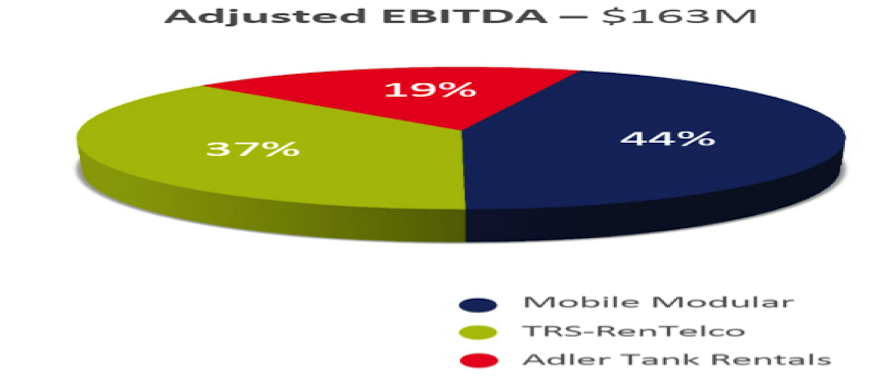

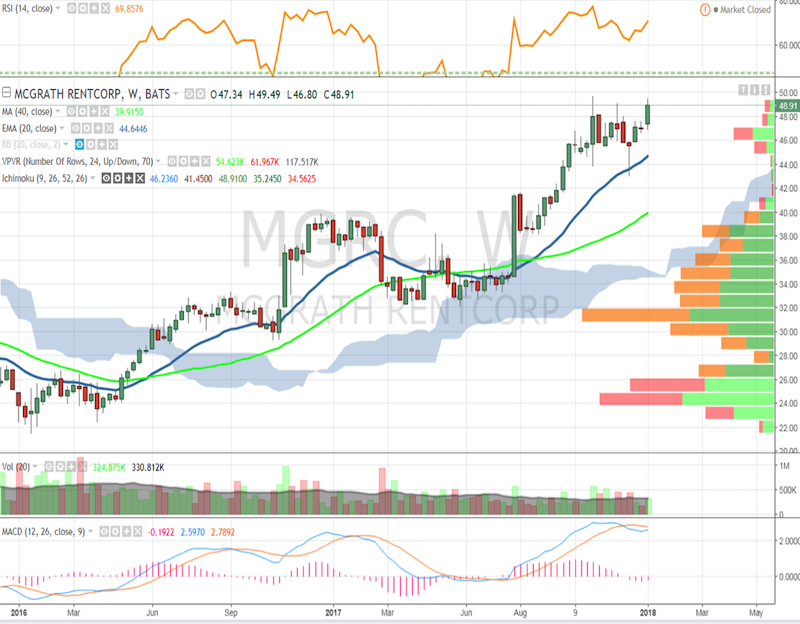

McGrath Rentcorp is a $1.18B business rental company providing modular buildings, test equipment, and containment boxes. Shares of McGrath Rentcorp (MGRC) trade 22.25X Earnings, 2.65X Sales and yield a 2.13% dividend. On the chart shares of MGRC are clearing a weekly bull flag looking to make another trend move. MGRC forecasts 5.4% revenue and 9.5% EPS growth in 2018.

MGRC’s customers include Schools, Businesses, Construction Companies, Refineries and Aerospace & Defense companies. The Adler Tank business should see a strong rebound with the improving dynamics in the Energy industry for 2018.

Continue with more small cap stocks on the next page…