Materion (MTRN) is a $1B maker of advanced engineered materials trading 24.35X Earnings, 0.97X Sales and 24.15X FCF with a 0.78% yield. MTRN posted 15% revenue growth last year, best since 2011 and eyes 6.5% revenue and 31% EPS growth in 2018. On the chart shares have formed another weekly consolidation pattern, similar to a strong breakout move in 2017, and look for continuation higher.

MTRN is a leading supplier of beryllium-containing products, high-purity metal for physical vapor deposition, high-end optical coatings, test strips for medical diagnosis, and the only supplier of a unique copper-nickel-tin material. Consumer Electronics are 28% of sales with smart devices, sensing and IoT growth drivers, Industrial 15%, Medical 11%, Defense 9%, Auto Electronics 8%, Telecom 6% and Energy 5%. New products are driving strong sales growth and MTRN has exposure to a number of mega growth trends.

Ituran (ITRN) is a $735M provider of location-based services trading 16.3X Earnings, 3.37X Sales and yielding a 2.75% dividend. ITRN shares have formed a nice looking bull wedge just above its 200 day MA.

Ituran is growing revenues at a double-digit clip and 2017 EPS jumping 34.5% Y/Y. Stolen-Vehicle recovery represents 85% of revenues while it also has other growth services like Driver Analysis, Concierge, Real Time Accident Notification, Remote Vehicle Diagnostics, Fleet Management and Temperature Control. Its stolen-vehicle recovery business has more than 1M subscribers, mainly in Israel and Brazil.

Tower International (TOWR) is a $675M maker of structural metal components in the auto industry trading 7.85X Earnings, 0.35X Sales and 28.3X FCF with a 1.5% yield. On the chart shares formed a bull flag the last few weeks after clearing a downtrend in late September. TOWR is expecting 4.3% revenue growth and 8.4% EPS growth in 2018. TOWR is benefitting from secular trends of light-weighting and outsourcing, the latter as companies shift investments to electric and autonomous vehicles.

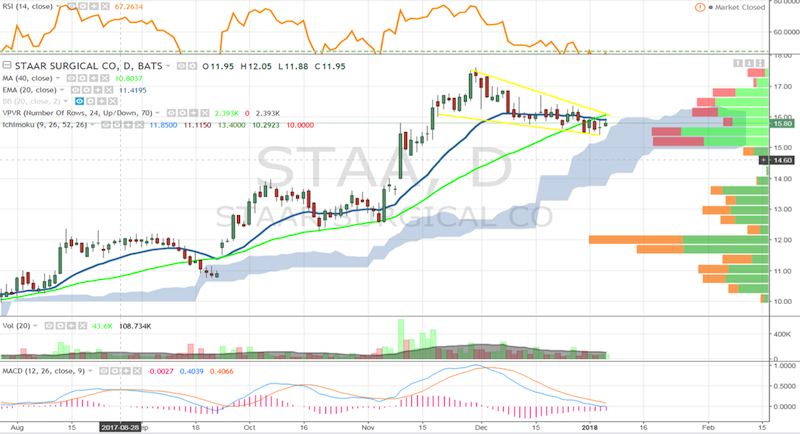

STAAR Surgical (STAA) is a $667M maker of implantable lenses for eye surgery trading 7.6X Sales. STAA shares have formed a great looking bull wedge back to cloud and volume support, and above $16 can start a strong move higher. STAA has seen revenue growth accelerate the last two years and expects that trend to continue in 2018 with 13% revenue growth expected. Myopia is a condition expected to grow for many years due to more screen usage and STAA is likely to see increased demand with a long runway for growth. STAA is a very small company operating in a $12B addressable market, and expects to launch Toric in 2018 followed by the EVO application. It also has potential to target the cataracts market addressing presbyopia.

Care.com (CRCM) is a $592M online marketplace for finding and managing family care, trading 31X Earnings, 3.4X Sales and 23.6X FCF. On the chart shares are flagging on the weekly nearing a breakout, a strong trend name from 2017 looking for continued momentum in 2018. CRCM saw rapid growth in 2013-2015 and expecting 9.5% topline growth in 2018 with 18% EPS growth, surely to benefit from the rising rate of dual-working families. CRCM operates in a massive fragmented market with a long runway for growth. It estimates a $305B spending on care market in the US and $8-$10B total addressable spending US Matching & Payments, a current 4.3% penetration. It is also capitalizing on mobile with strong growth for its platform. CRCM is a leader across multiple segments like child-care, senior care, housekeeping, pet care, and tutoring.

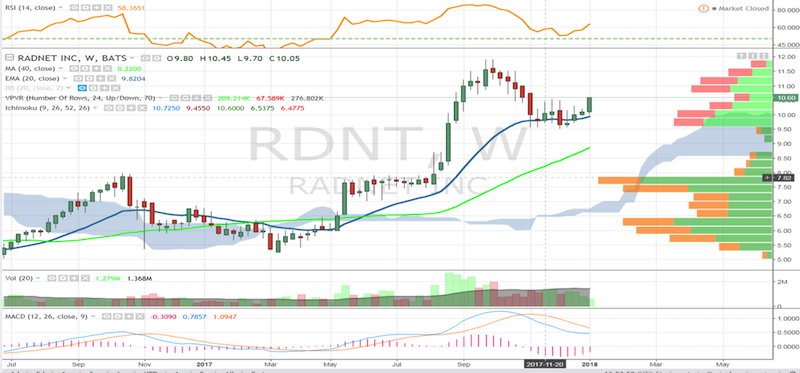

RadNet (RDNT) is a $500M provider of outpatient diagnostics imaging services trading 21.2X Earnings, 0.55X Sales and 5.6X FCF. On the chart shares corrected off 2017 highs and based at the 20 week EMA, now moving out of that base with MACD nearing a weekly bull crossover. RDNT has 298 imaging centers and expects to reach $1B in revenues in a few years with concentration in CA, NY, NJ, and MD/DE. The medical imaging market is running with a 7.9% CAGR, a $100B market that is fragmented outside of the 60% of imaging that takes part in hospitals. An aging populating and move towards preventative medicine diagnostics are positives for the business.

Check out more of my investing research and options trading ideas over at OptionsHawk. Thanks for reading and good luck out there!

Twitter: @OptionsHawk

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.