Next week is the 38th week of the year. Might not mean much to you, but this is actually the worst week of the year for the S&P 500 (SPX) going back to 1950. Yes, I just noted how September options expiration week (this week) tends to be strong, but it all changes next week. Now the 38th week usually takes place during the latter part of September and we all know that September is usually the worst month. Whatever the exact reason, I think this is something traders should be very aware of going into next week.

Next week is the 38th week of the year. Might not mean much to you, but this is actually the worst week of the year for the S&P 500 (SPX) going back to 1950. Yes, I just noted how September options expiration week (this week) tends to be strong, but it all changes next week. Now the 38th week usually takes place during the latter part of September and we all know that September is usually the worst month. Whatever the exact reason, I think this is something traders should be very aware of going into next week.

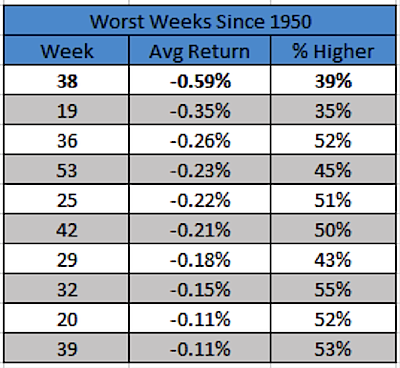

Here are the top 10 worst weeks on average. So besides the worst week next week, the 39th week is the 10th worst week. In other words, two of the 10 worst weeks are coming up over the next two weeks. Seasonality isn’t doing anyone any favors here.

In case you’re wondering (sure you are), the best week of the year is actually the last week of the year – week 52. This one is up an incredible 72% of the time for an average gain of 0.84%. Santa Claus rally indeed!

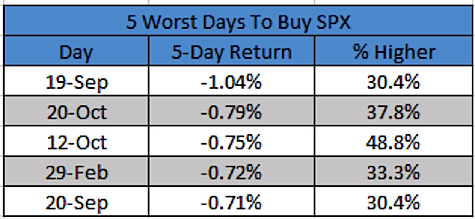

Ok, back to the bad news. I broke this down a little further and found that September 19 is actually the single worst day to buy and hold for five days. Since ’50, the five trading days after September 19 are higher just 30.4% of the time (14 out of 46 times) for an average return of -1.04%. To summarize, there isn’t a worse day to buy and hold for five trading days than September 19.

Wouldn’t you know it that this year September 19 falls on this Friday? So we have the weakest five days coming up on top of the fact next week is also the 38th week of the year. I guess some good news is September 19 is on the weekend next year.

Here are the five worst days to buy and hold for a week since 1950 on the SPX.

I do think overall we finish the year higher than where we are right now, but be on your toes the next two weeks is my best advice.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.