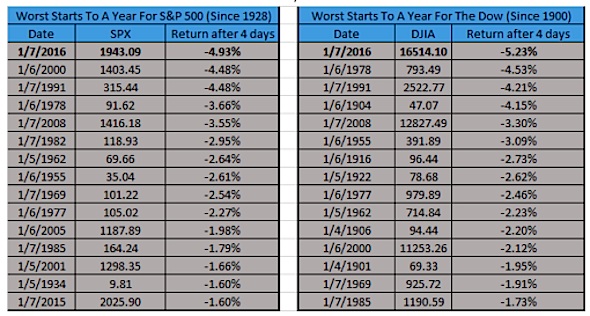

Welcome to the worst start of the year ever for the S&P 500 and Dow. That’s right, the worst start EVER for the stock market.

So what’s it mean? As we are watching CNBC run another “Markets in Crisis” special this evening, the overall opinion of most after such a weak start is the end is near. Especially when you see years like 2000 and 2008 in the data above.

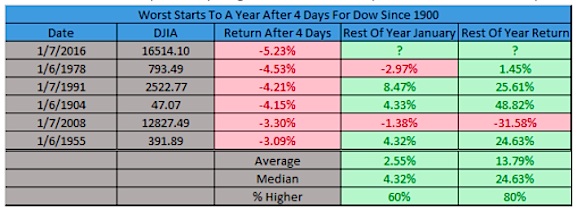

Here are all the times the Dow was down more than 3% after four days. You can see that there’s a nice bounce the rest of January for stocks and up big the rest of the year. Not too shabby. That said, this is the worst start ever for the stock market so we’ll have to monitor how much further this thrust lower in January goes.

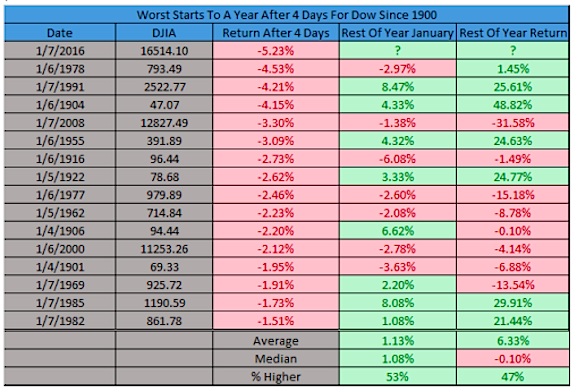

If we extend the data out to down 1.5% after four days, it gives us more data (signals) to work with. and it does mute returns. Still, it says the odds of a huge sell-off the rest of the year isn’t very likely.

Sure, 2008 crashed the rest of the year, but only two other times did the rest of the year lose 10% from here. So worst start ever for the stock market? Yes. A signal that the rest of the year will be down for stocks? Not necessarily.

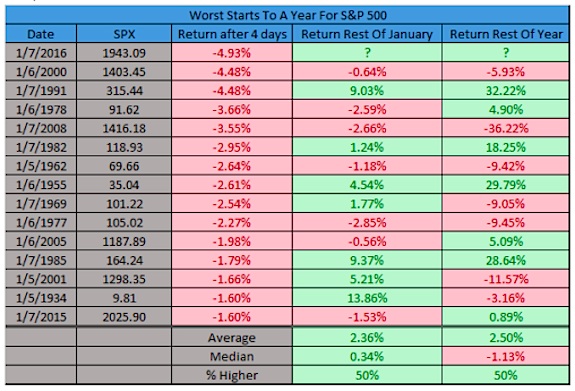

Okay, now let’s look at the returns for the S&P 500. Up the rest of the year a coin flip and pretty much flat on average. Again, 2008 crashed, but rarely did the rest of the year see a significant drop.

Overall, the economy continues to hang in there. Remember, though, the stock market can correct in a strong economy (’87 and ‘11), but all true market crashes take place during a recession or depression. Without signs of a recession (we had record vehicle sales reported Wednesday), the odds of this one being ‘the big one’ continues to be very slim.

That doesn’t mean the weakness cannot continue and and it doesn’t mean that market volatility is over. It does mean panicking right here and now may not be the best decision, even with data points showing the worst start ever for the stock market…

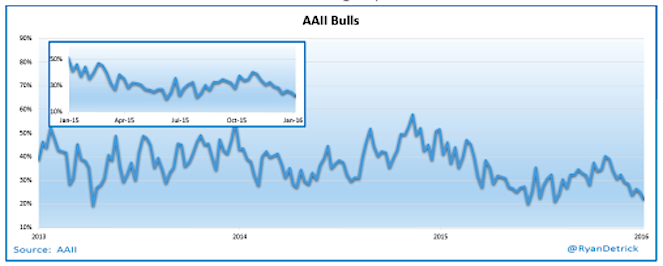

Lastly, check out the AAII Bulls. They came in at their lowest level since last July and near the lowest levels going back three years. The previous times the bulls were this low marked some decent times to be long equities.

Thanks for reading.