Everyone knows that Apple, Inc. (AAPL) is one of the titans in the stock market. And due to their market cap (currently $728 Billion), they can often weight down major market indices such as the NASDAQ Composite, Dow Jones Industrial Average, and S&P 500.

So our first question is an easy one… Does Apple’s stock price affect its peers and the major market indices. The answer is yes. And the larger Apple gets the more involved it becomes. In full disclosure, I do not own Apple’s stock, but I keep tabs on it as a Tech ‘bellwether’. Apple blew the doors off their earnings, but it appears that investors had priced much of that in. That said, Apple is also an “over-owned” stock, so when major players need capital, it’s a likely target to trim and raise cash.

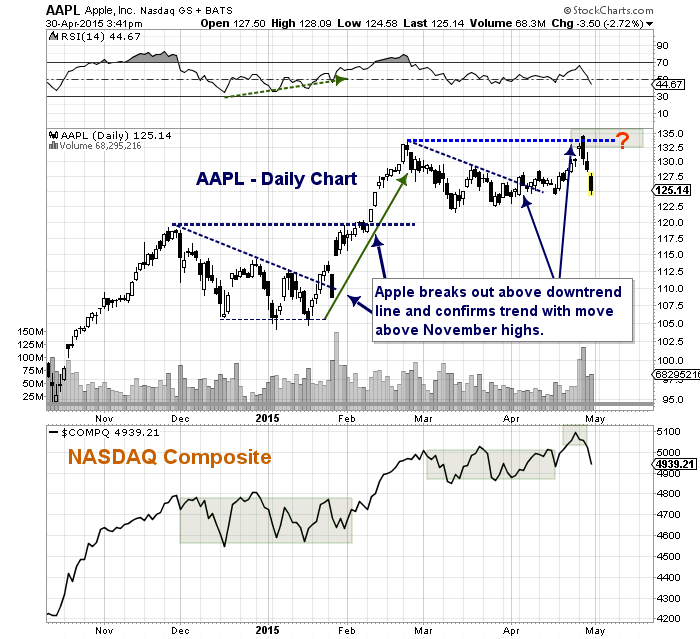

I bring this up in light of Apple’s recent sell-off (which has now trimmed almost $10 off the stock price). I shared Apple’s stock setup into earnings and it was true to form… with a twist. The stock popped but sold off right away (i.e. it didn’t see follow through buying). It still may, but we need to monitor it’s move lower because it has larger implications.

In the chart below, you can see that the December-January and March-April setups are similar. The only difference is that the stock couldn’t hold the breakout. This is a near-term concern. Why? Look at how the NASDAQ has tracked with Apple over the past several months. So goes Apple, goes the broader tech sector. And now that Apple is a part of the Dow Jones and S&P 500, we need to be on the lookout for weakness in the prized jewel.

Apple (AAPL) Stock Chart

This isn’t a long-term call, just a near-term observation (and leading indicator) that bears watching. Thanks for reading.

Twitter: @andrewnyquist

Author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.