Utilities stocks (NYSEARCA:XLU) have been on a tear in 2016, catching and reeling in several investors chasing yield. And this behavior may be blowing a Utilities stocks bubble.

The likely impetus for this behavior is tied to monetary policy and ZIRP implemented by Central Banks. How this ends no one knows.

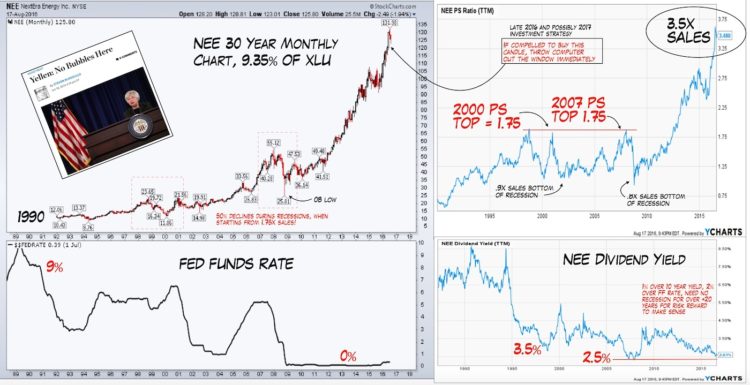

The price action and fundamentals point to a Utilities stocks bubble. Here’s a recap of recent events and the chart below.

- The “chase for yield” began with 7 years of zero interest rate policy and has gone parabolic.

- NextEra (NYSE:NEE), which is 9% of S&P Utility ETF (XLU) is trading at 3.5x sales, double its 1.75x peaks in 2000 and 2007.

- Remarkably, its 2.5% yield is just 1% over risk free 10-year Treasury and 2% over Fed Funds Rate.

Despite protestations, the Fed and other major CBs have created a bubble in yield. Let’s see if it blows.

Recently, I have partnered with Arun Chopra, an experienced investor/analyst and good friend who holds a CFA and CMT. Together, we have been blending longer-term fundamental indicators with technical indicators to do historical studies. The content above was also shared on our newly created non-public site. Note that we will be launching a premium service soon – details to follow.

Thanks for reading and have a great weekend.

Twitter: @JBL73

The author does not have a position in mentioned securities by the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.