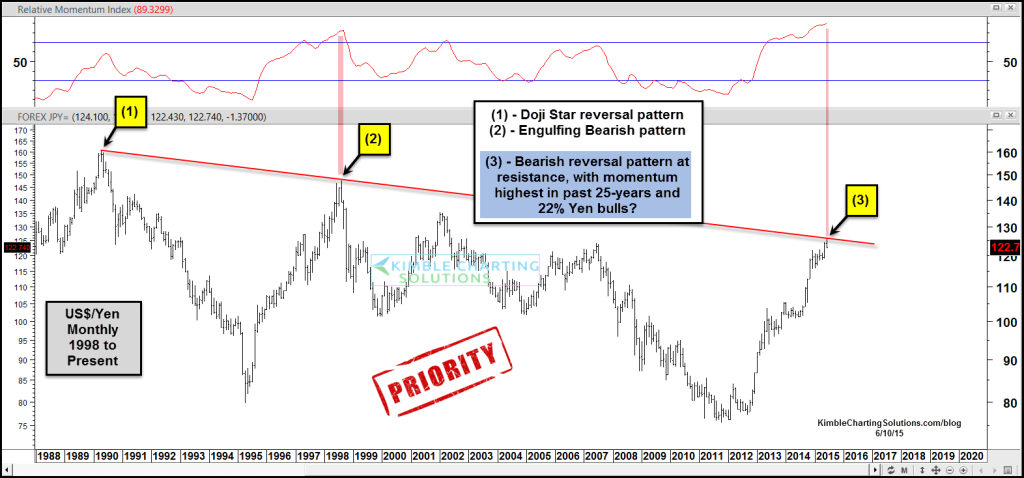

It has been a long time since we’ve seen the US Dollar/Yen currency pair at a major crossroads, with implications for the broader market. Don’t get me wrong, there have been plenty of “trades” to be had and inter-market trends to be followed. But how this one plays out could be a game changer for investors.

As you can see in the chart below, the US Dollar/Yen trade has touched a major resistance line, last seen in 1998 – point [2] on the chart below. Several factors have lead to the recent rise in the US Dollar and fall in the Yen, the most important being global central banks uptick in stimulus action just as the U.S. was winding down their stimulus. Over in Japan, huge stimulus packages (aka “Abenomics”) have lead to a weaker Japanese Yen and BIG stock market gains for the Nikkei 225.

So what are the implications? Well let’s look at the bearish side of things first. If this resistance holds, it would imply that the US Dollar will start to weaken relative to the Japanese Yen. This would be good news for select commodities, which have remained weak since this pair began to strengthen back in 2012. Similar to points [1] and [2] on the chart, point [3] highlights a bearish reversal pattern that is in the works this month. Back in 1990 we saw a Doji Star reversal pattern and in 1998 we had an engulfing bearish pattern. Both saw follow through to the downside so a bearish reversal could lead the pair lower. As well, momentum is at its highest point in 25 years!

On the flip side, should the US Dollar/Yen breakout above resistance, it would likely indicate a big move higher is underway for the US Dollar. This could coincide with rate hikes and would likely be bearish for commodities.

US Dollar/Yen Currency Pair Chart – 1988 to 2015

Stay tuned and thanks for reading.

Twitter: @KimbleCharting

Author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.