It’s Volatility season. All of a sudden the Dow Jones Industrials are below the 200 day moving average. Instability and uncertainty is emerging across the globe. More and more charts are breaking down and this seems like early stage correction stuff.

On the flip side, hopefully you’re having a wonderful long weekend! Happy Birthday America!

Here’s this week’s Top Trading Links.

MARKET INSIGHTS

@RyanDetrick shows us that for whatever reason, volatility tends to spike in July.

@michaelbatnick notes volatility spikes tend to occur when the Dow Industrials are below the 200 day moving average.

@VIXandMore shares what to expect after Monday’s monstrous VIX spike.

As you can see, we currently have a ‘perfect storm’ for increased market volatility that extends beyond Greece or other news events.

@Snyder_Karl notes S&P 500 support levels.

@andrewnyquist analyzes the China correction.

The high yield bond market has shown relative weakness for about a year now. Does it finally matter? @KimbleCharting takes a look.

@IPOtweet’s quarterly review of the IPO market:

“Fueled by a continued wave of biotechs, the health care sector has accounted for over one in three IPOs for four quarters in a row”

“Globally, buyout firms conducted 97 stock offerings in the second quarter, more than any other 3 month period” -bloomberg

— Charlie Bilello, CMT (@MktOutperform) July 1, 2015

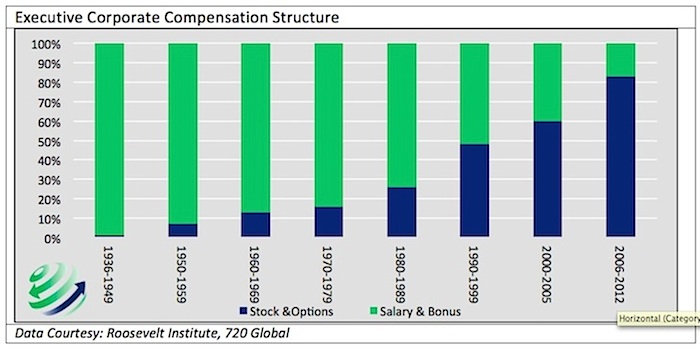

The key, under-appreciated driver of the stock buyback trend via @michaellebowitz

@TMFHousel on innovation:

“Some of the most meaningful inventions took decades for people to notice”

MARKET OPERATOR INSIGHTS

“To succeed as traders we have to accept losses on individual trades as well as drawdown periods but also must have a way of controlling and minimizing them.” – @NoanetTrader

@harmongreg on support and resistance:

“The key distinction between how the professional uses support and resistance is this concept of a brick wall. Pro’s see support and resistance more like a state border. It is a line demarcating a border, but it does not stop you from walking right through it.”

Here’s some timeless advice…

If the market is not offering up the tape that works for your system you sit. Period end of story. — Sunrise Trader (@SunriseTrader) Jul. 1 at 04:18 PM

Warren Buffet’s greatest advice compliments of @SirMarket:

NEWS & HAPPENINGS

- “with less than 5% of the world’s population, the United States holds roughly a quarter of its prisoners” – The Economist

- Guggenheim boots China’s Hanergy from its funds.

- China is allowing its pension fund to buy stocks.

- …and brokers are now allowed to accept real estate as collateral for investors to leverage bets on stocks.

- Another reason why water is becoming more scarce all the time.

- The wildest view of the future of wearable tech.

- The currency hedged ETF trend is getting long in the tooth.

Thanks for reading! Be sure to check out our Top Trading Links archives for a goldmine of investing research and trading education.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.