Stock buybacks have become extremely popular over the last ten years. In our article Corporate Buybacks; Connecting Dots to the F-word we explained the fundamentals behind a traditional share buyback as well as the negative attributes of stock buybacks that are largely being ignored. Investors should be aware that all is not that meets the eye in regards to buybacks.

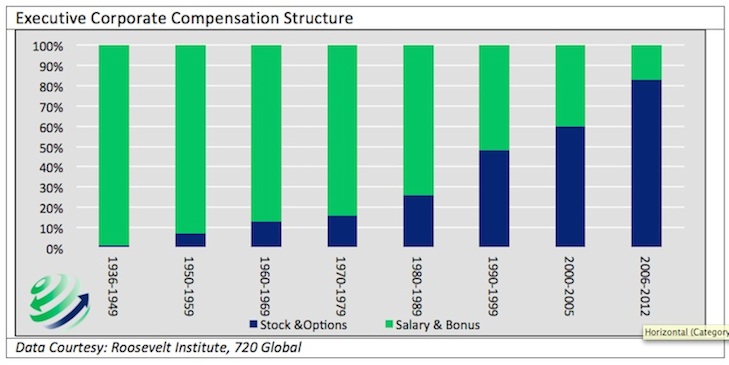

In our opinion, the main driver of stock buybacks resides in the chart below (you can read more in depth about this in the article referenced above).

Compensation of executives at major public companies is predominately based on the value of their stock. The implications are not fully appreciated. On the positive side an investor and management are aligned in desiring a higher price for the stock. However executives, unlike long term investors, make financial and investment decisions on behalf of the company. Costly investments that require time before benefits are reaped, may not be in the best interest of an executive with a 5 year stock price goal. Instead of a valuable long term investment, the executive may opt for cost saving innovations that pay dividends today. In the long run it is more likely that an executive with a heavily laden stock compensation plan may likely provide investors with what is best for today, as investing for the future comes with a significant up front cost. As the graph below suggests, the motives for stock buybacks appear to be seriously influenced by executive compensation and this may conflict with the best interests of the company.

We leave you with a quote from Warren Buffett:

“Now, repurchases are all the rage, but are all too often made for an unstated and, in our view, ignoble reason: to pump or support the stock price”.

Thanks for reading.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.